-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Allowance Method, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Allowance Method

link : Uncollectible Accounts Allowance Method

Uncollectible Accounts Allowance Method

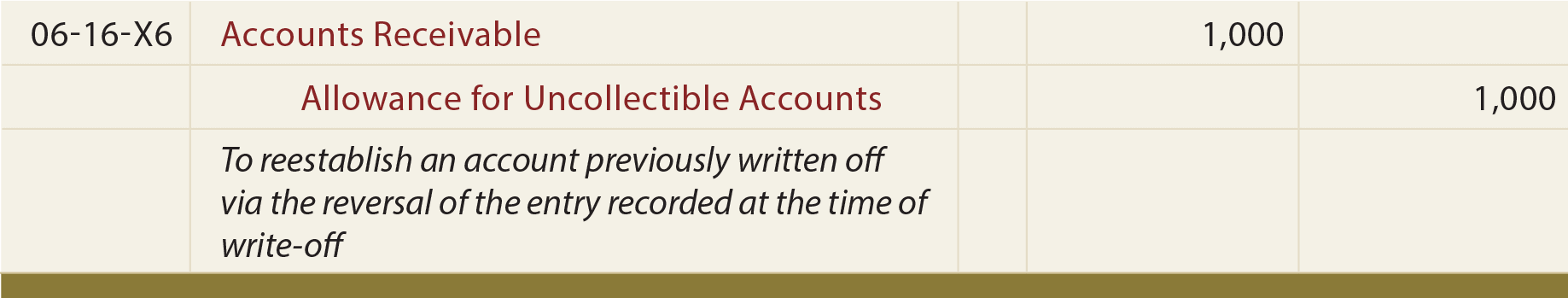

To record estimated uncollectible accounts using the allowance method, the adjusting entry would be a debit to bad debts expense and a credit to allowance for doubtful accounts an aging of a company's accounts receivable indicates that $4,000 are estimated to be uncollectible. When a written of account is recovered, the first step is to reinstate it in the accounting record. the following journal entry is made for this purpose: notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. see uncollectible accounts expense allowance method. (2). This is the simplest way to record uncollectible accounts or bad debt. allowance method. another way to record bad debt expense or uncollectible accounts in the financial statements is by using the allowance method. this method adheres to the matching principle and the procedural standards of gaap.

The Allowance Method Of Recording Uncollectible Accounts

The allowance method of recognizing uncollectible accounts expense follows uncollectible accounts allowance method the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. What is the aging method? explanation. the aging method is based on determining the desired balance in the account allowance for uncollectible accounts. the accountant attempts to estimate what percentage of outstanding receivables at year-end will ultimately not be collected; ‘this amount becomes the desired ending balance in the allowance for uncollectible accounts, and a credit entry. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. The allowance method is preferred over the direct write-off method because: the income statement will report the bad debts expense closer to the time of the sale or service, and the balance sheet will report a more realistic net amount of accounts receivable that will actually be turning to cash. The allowance method is a technique for estimating and uncollectible accounts allowance method recording of uncollectible amounts when a customer fails to pay, and is the preferred alternative to the direct write-off method.. accounts receivable represent amounts due from customers as a result of credit sales.

Direct Writeoff And Allowance Methods Financial Accounting

Intro to the allowance method and uncollectible accounts (financial accounting tutorial 41) receivables method in later videos as they are 2 ways in which we can account for the allowance method!. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. In that example, we calculated the expected amount of uncollectible accounts in the second quarter of year one of operation, based on the allowance method, to be $168.

A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. The allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. the allowance method represents the accrual basis of accounting and is the accepted method to record uncollectible accounts for financial accounting purposes.

13. a business uncollectible accounts allowance method having a $400. 00 debit balance in allowance for uncollectible accounts and estimating its uncollectible accounts using accounts receivable aging to be $5,000. 00 would record a $5,400. 00 credit to allowance for uncollectible accounts.

Accounting For Uncollectible Receivables

The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable. the allowance method is preferred over the. The allowance method of recognizing uncollectible accounts expense follows the matching uncollectible accounts allowance method principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first. The allowance method is meant to be used so that we have smooth earnings and to record the correct value for receivables within our company. its basically a method that provides conservative. The first journal entries under the allowance method include a debit to bad debt expense and a credit to allowance for doubtful accounts. when the company considers an account to be completely uncollectible, it makes a debit to allowance for doubtful accounts and a credit to accounts receivable.

Allowance for doubtful accounts is the running total of the business' past-due accounts receivable, and bad debt expense is the amount of uncollectible accounts allowance method past-due accounts receivable for a particular accounting period. if you had $750 in uncollectible accounts, the adjusting entry is a debit to bad debt expense for $750 and a credit to allowance for doubtful. Using the allowance method, the uncollectible accounts for the year are estimated to be $40,000. if the balance for the allowance for doubtful accounts is a $9,000 credit before adjustment, what is the amount of bad debt expense for the period?. To compensate for this problem, accountants have developed “allowance methods” to account for uncollectible accounts. importantly, an allowance method must be used except in those cases where bad debts are not material (and for tax purposes where tax rules often stipulate that a direct write-off approach is to be used). Having established that an allowance method for uncollectibles is preferable (indeed, required in many cases), it is time to focus on the details. begin with a consideration of the balance sheet. suppose that ito company has total accounts receivable of $425,000 at the end of the year, and is in the process or preparing a balance sheet.

Unlike the direct write-off method, the allowance method records an expense to bad debt using an estimate of accounts that are unlikely to be collected before specific customer accounts are identified as being uncollectible. the estimate is determined by management and is based on a percentage of accounts receivable or sales. Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible account a has no effect on the allowance for uncollectible accounts. b increases the allowance for uncollectible accounts. c has no effect on net income. d decreases net income.