-Hallo friends, Accounting Methods, in the article you read this time with the title Estimated Uncollectible Accounts Per Aging, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Estimated Uncollectible Accounts Per Aging

link : Estimated Uncollectible Accounts Per Aging

Estimated Uncollectible Accounts Per Aging

Intermediate Acc I Final Exam 2 Ch7 Cash And Receivable

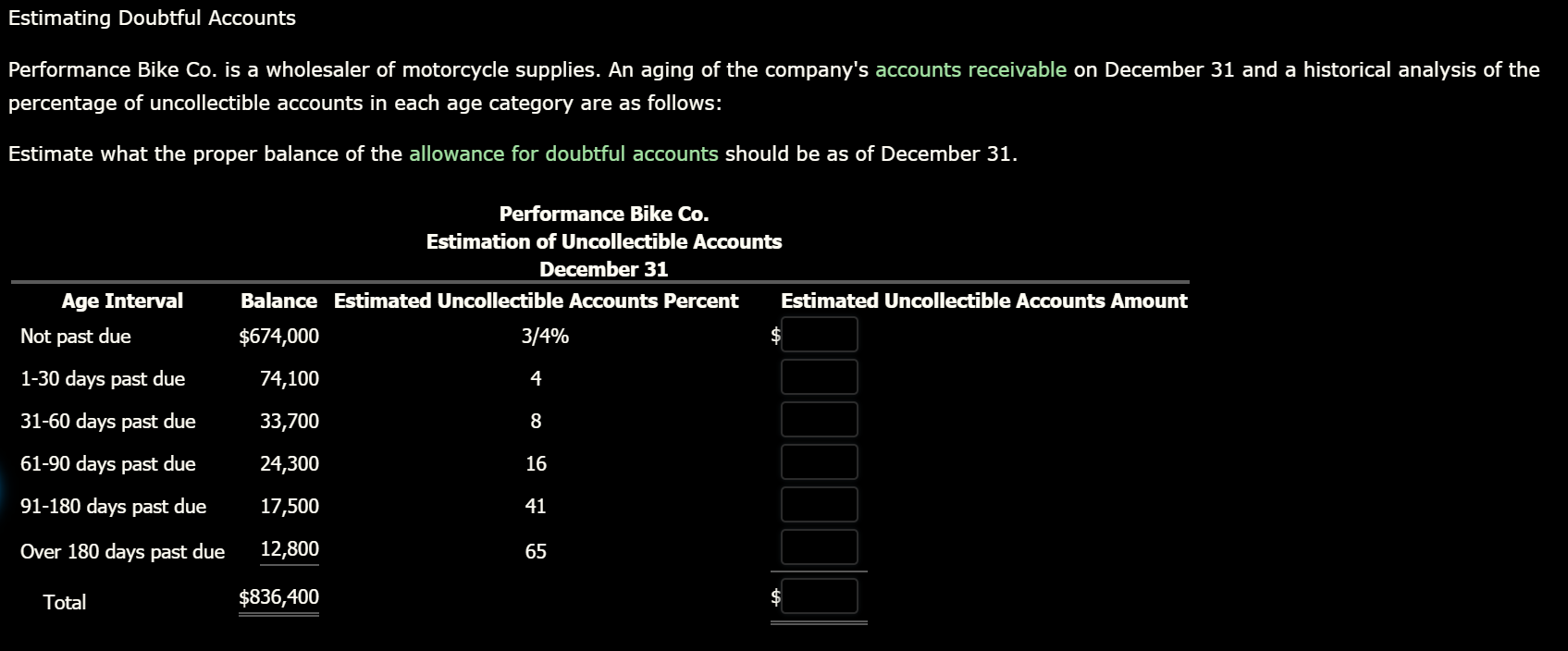

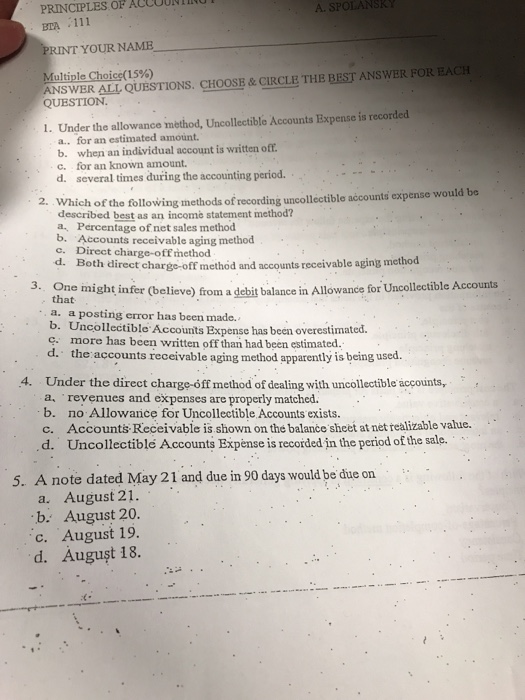

An aging of a company's accounts receivable indicates $10600 is estimated to be uncollectible. the company has a $1500 debit balance in its allowance for doccounts. the sent to record estimated credit losses for the period will require an) o $9100 debit to bad debt expense. For example, the estimate of uncollectible accounts receivable less than 30 days old is 0. 5% and equals $12,500 (i. e. $2,5000,000 x 0. 5%). you can see that the estimated uncollectible percentage increases with the accounts receivable age.

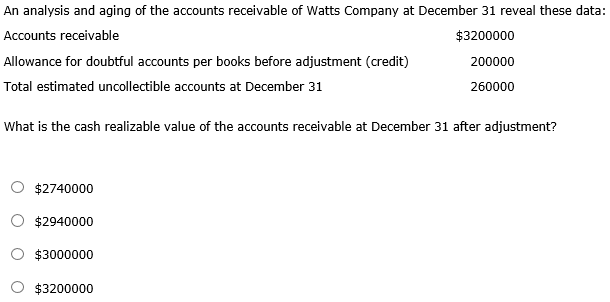

Answer: the percentage of receivables method (or the aging method if that variation is used) views the estimated figure of $24,000 as the proper total for the allowance for doubtful accounts. thus, the accountant must turn the $3,000 debit balance residing in that contra asset account into the proper $24,000 credit. The accounts receivable aging schedule shown below includes five categories for classifying the age of unpaid credit purchases. in this example, estimated bad debts are $5,000. if the account has an existing credit balance of $400, the adjusting entry includes a $4,600 debit to bad debts expense and a $4,600 credit to allowance for bad debts. 143. for the year ended december 31, 2014, dent co. estimated its allowance for uncollectible accounts using the year-end aging of accounts receivable. the following data are available: allowance for uncollectible accounts, 1/1/14 $84,000 provision for uncollectible accounts during 2014 (2% on credit sales of $3,000,000) 60,000 uncollectible accounts written off, 11/30/14 69,000 estimated.

Gleim 0130 Flashcards Quizlet

Allowance for uncollectible accounts, 1/1/12 $84,000. provision for uncollectible accounts during 2012 (2% on credit sales of $3,000,000) 60,000. uncollectible accounts written off, 11/30/12 69,000. estimated uncollectible accounts per aging, 12/31/12 104,000. after year-end adjustment, the uncollectible accounts expense for 2012 should be. Uncollectibleaccounts written off, 11/30/17 104,000 estimated uncollectible accounts per aging, 12/31/17 156,000 after year-end adjustment, the bad debt expense for 2017 should be a. $104,000. b. $90,000. c. $156,000. d. $134,000. ans: d. 144. nenn co. 's allowance for uncollectible accounts was $190,000 at the end of 2017 and $180,000 at the. Allowance for uncollectible accounts, 1/1/12 $84,000 provision for uncollectible accounts during 2012 (2% on credit sales of $3,000,000) $60,000 uncollectible accounts written off, 11/30/12 $69,000 estimated uncollectible accounts per aging, 12/31/12 $104,000 after year-end adjustment, the uncollectible accounts expense for 2012 should be. Under aging method of estimating allowance for doubtful accounts, a percentage of accounts receivable in each age group is considered to be uncollectible. this percentage is usually different for each age group and is estimated on the basis of past experience and current economic conditions of the areas where company conducts its operations.

Estimating Bad Debtsallowance Method

Aging method for estimating uncollectible accounts youtube.

How Do You Estimate The Amount Of Uncollectible Accounts

Intermediate Acc I Final Exam 2 Ch7 Cash And Receivable

Cpanet forum: allowance for uncollectible accounts.

One way to estimate the amount of uncollectible accounts receivable is to prepare an aging. an aging of accounts receivable lists every customer's balance and then sorts each customer's balance according to the amount of time since the date of the sale. for example, assume that all sales are made with terms of 30 days. let's also assume that. For the year ended december 31, beal co. estimated its allowance for credit losses using the year-end aging of accounts receivable. the following data are available: allowance for credit losses, 1/1 $42,000 uncollectible accounts written off, 11/30 46,000 estimated uncollectible accounts per aging, 12/31 52,000. An example is provided to illustrate how an aging schedule can be used to estimate uncollectible accounts and bad debt expense. edspira is your source for business and financial education. Balance sheet presentation: accounts receivable $90,000. less: allowance for uncollectible accounts 2,000 $88,000. aging accounts receivable.

Allowance for uncollectible accounts 1600 if, however, there had been a debit balance of $200 then a credit to allowance for uncollectible accounts of $2,000 would be necessary to bring the closing balance to $1,800. Question: for the year ended december 31, beal co. estimated its allowance for uncollectible accounts using the estimated uncollectible accounts per aging year-end aging of accounts receivable. the following data are available: allowance for uncollectible accounts, 1/1 $42,000 uncollectible accounts written off, 11/30 46,000 estimated uncollectible accounts per aging, 12/31 52,000 after year-end adjustment,.

Allowance for uncollectible accounts, 1/1/17 $126,000 provision for uncollectible accounts during 2017 90,000 uncollectible accounts written off, estimated uncollectible accounts per aging 11/30/17 104,000 estimated uncollectible accounts per aging, 12/31/17 156,000 after year-end adjustment, the bad debt expense for 2017 should be a. $104,000. b. $90,000. c. $156,000. d. $134,000. The estimated uncollectible amounts for all age groups are separately calculated and added together to find the total or overall estimated uncollectible amount. this total or overall estimated uncollectible amount represents the required balance in allowance for doubtful accounts account at the end of the period. the aging method explained. Allowance for uncollectible accounts, 1/1/89 $42,000. provision for uncollectible accounts during 1989 (2% on credit sales of $2,000,000) 40,000. uncollectible accounts written off, 11/30/89, 46,000. estimated uncollectible accounts per aging, 12/31/89 52,000. after year-end adjustment, the uncollectible accounts expense for 1989 should be.

One way to estimate the amount of uncollectible accounts receivable is to prepare an aging. an aging of accounts receivable lists every customer's balance and then sorts each customer's balance estimated uncollectible accounts per aging according to the amount of time since the date of the sale. for example, assume that all sales are made. This video explains how to estimate bad debt expense using the aging of accounts receivable method. an example is provided to illustrate how an aging schedule can be used to estimate uncollectible.

Calculate the sum of the amounts of each portion you expect will be uncollectible to estimated uncollectible accounts per aging calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense.

A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. The aging method is based on determining the desired balance in the account allowance for uncollectible accounts. the accountant attempts to estimate what percentage of outstanding receivables at year-end will ultimately not be collected; ‘this amount becomes the desired ending balance in the allowance for uncollectible accounts, and a credit. The sum of the estimated amounts for all categories yields the total estimated amount uncollectible and is the desired credit balance (the target) in the allowance for uncollectible accounts. since the aging schedule approach is an alternative under the percentage-of-receivables method, the balance in the allowance account before adjustment.

The. 014 is the average percentage estimated uncollectible accounts per aging of uncollectible accounts receivable during year 1 through year 3. on the other hand, since that data suggest uncollectible accounts are increasing, from 1. 25% in year 1 to 1. 55% in year 3, the company could estimate its uncollectible accounts receivable to be $255 ($15,000 x. 017). Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each.