-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Finance, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Finance

link : Uncollectible Accounts Finance

Uncollectible Accounts Finance

The uncollectible accounts expense account shows the company estimates it cost $750 in january to sell to customers who will not pay. the accounts receivable account shows the company's customers owe it $50,000. the allowance for uncollectible accounts shows the company expects its customers to be unable to pay $750 of the $50,000 they owe. files to decrease amount for partially bypassable generation uncollectibles rider advertisement retailenergyx : firstenergy solutions: "expectation" nuclear subsidy Contra account: a contra account is an account found in an account ledger that is used to reduce the value of a related account. a contra account's natural balance is opposite of the associated.

Accounting For Uncollectible Accounts Receivable Part 1

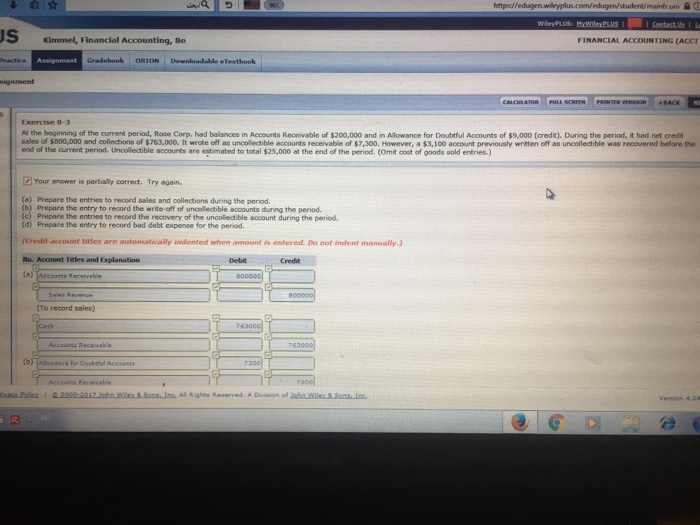

Go through your uncollectible accounts from the past three years and tell me how many of those accounts passed the gut check. eight things you can do right now to avoid past due accounts 1. 166-1(e. thus, for cash-basis taxpayers, a bad debt deduction is generally not allowed for uncollectible accounts receivable since these items are normally. A uncollectible accounts finance simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:.

Uncollectible Account Financial Definition Of Uncollectible

Financial management general policies. june 2019. uncollectible accounts. applies standard policies and procedures regarding the write off of uncollectible receivable accounts of state agencies, and explains when and how such requests should be submitted to the office of policy and management.

Each year, an estimation of uncollectible accounts must be made as a preliminary step in the preparation of financial statements. some companies use the percentage of sales method, which calculates the expense to be recognized, an amount which is then added to the allowance for doubtful accounts. Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; however. Start studying financial accounting chapter 8. learn vocabulary, terms, and more with flashcards, games, and other study tools. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be.

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for uncollectible accounts finance many reasons, including the debtor's bankruptcy.

Accounts should be written off the university’s financial accounting records when all collection actions have been completed and management determines the receivable to be uncollectible. each campus maintains criteria and guidelines establishing the point when receivables become uncollectible and is responsible for consistently performing. Thus, it cannot be used to record the write-offs of uncollectible accounts in financial statements prepared for the public in accordance with fasb and gaap regulations. in the direct charge-off method, once the company determines that a certain amount due to the company will not be collected at all, the company writes it off in that fiscal period.

The goal in recording the allowance for uncollectible accounts is to show, as accurately as possible, the net uncollectible accounts finance realizable value of accounts receivable on the university’s financial statements. the um system controller’s office is responsible for establishing the allowance calculation that is necessary for compliance with gasb standards. Abatement procedure for uncollectible accounts receivable monitoring of accounts receivable. university of arkansas policy 301. 2 requires accounts receivable activity be tracked using the accounts receivable system (ars) managed by the treasurer's office, unless financial affairs has approved the exception.

An allowance for uncollectible accounts is an entry on an accounting statement to reduce the total accounts receivable by the number of accounts the company will probably not be able to collect on, writing off bad debt. this provides a more realistic picture of a company's finances by avoiding a situation where it overstates the amount of accounts receivable to make it look like more money is. Thus, the company can assume that none of the accounts will be doubtful. next, based on prior experience, the company knows that accounts outstanding for 31-60 days typically have a 2% rate of default. then, accounts that have been uncollectible accounts finance outstanding for 60-90 days have a 4% rate of default, and any older accounts have an 8% rate of default.

Using the allowance method, the uncollectible accounts for the year is estimated to be $50,000. if the balance for the allowance for doubtful accounts is a $9,000 credit before adjustment, what is the amount of bad debt expense for the period?. When an account which has been written off is collected, cash is increased and the net amount of accounts receivable is decreased. because the change is confined within working capital, no disclosure is made in the scfp. disclosure practices. several possible ways exist for disclosing information about receivables and their uncollectible amounts. Provisions for losses on uncollectible receivables. accounts receivable: the allowance for uncollectible accounts receivables is determined principally on the basis of past collection experience as well as consideration of current economic conditions and changes in our customer collection trends. finance receivables: finance receivables include sales-type leases, direct financing leases and. When the allowance method is used to account for uncollectible accounts, the _____ is credited when an account is deterred to be uncollectible accounts receivable the _______ basis of estimating uncollectibles provides a better _____ of bad debt expense with sales revenue and therefore emphasizes income statement relationships.

If instead, the allowance for uncollectible accounts began with a balance of $10,000 in june, we would make the following adjusting entry instead: $50,000 $10,000 = $40,000 (adjusting entry) date. The process of removing the balance from the accounts receivable balance on the financials is called write-off. allowance for doubtful accounts a reasonable estimate based on historical collections and/or other reasonable rationale is used to record an estimate of the invoiced amounts that will become uncollectible during the period. this. Uncollectible accounts. applies standard policies and procedures regarding the write off of uncollectible receivable accounts of state agencies, and explains when and how such requests should be submitted to the office of policy and management. memo to state agency heads from secretary mccaw june 21, 2019. policy for uncollectible accounts.

The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. In financial reporting, terms such as “ bad debt expense,” “doubtful accounts expense,” or “the provision for uncollectible accounts” are often encountered. the inherent uncertainty as to the amount of cash that will actually be received affects the physical recording process. 53 account for uncollectible accounts using the balance sheet and income statement approaches you lend a friend $500 with the agreement that you will be repaid in two months. at the end of two months, your friend has not repaid the money. you continue to request the money each month, but the friend has yet to repay the debt.