-Hallo friends, Accounting Methods, in the article you read this time with the title Estimated Uncollectible Accounts Calculator, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Estimated Uncollectible Accounts Calculator

link : Estimated Uncollectible Accounts Calculator

Estimated Uncollectible Accounts Calculator

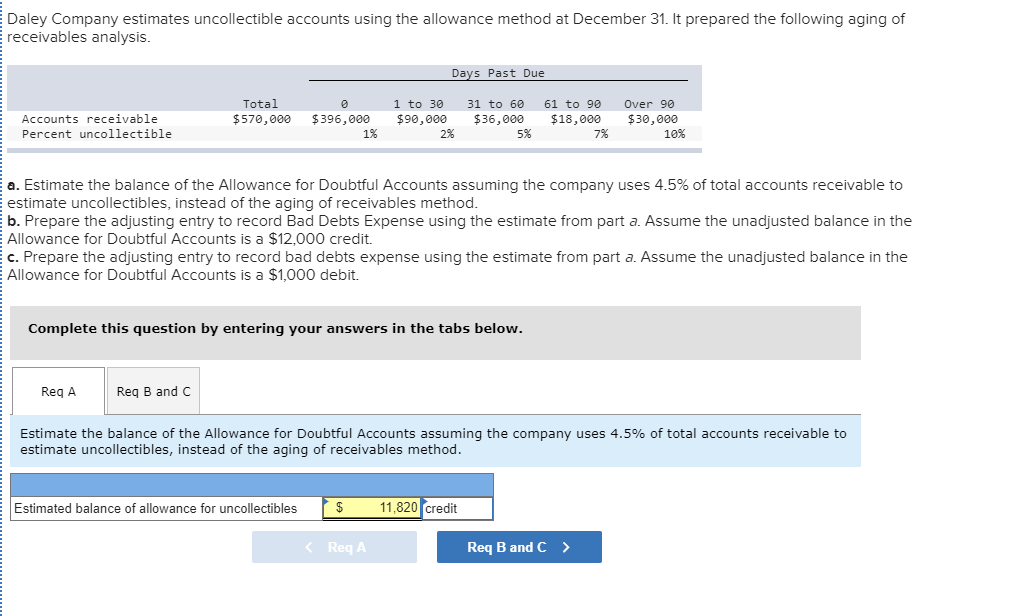

The percentage-of-sales method is commonly used to estimate the accounts receivable that a business expects will estimated uncollectible accounts calculator be uncollectible. when you use this method, use your small business’s past collection data to estimate what portion of the credit sales you generate each accounting period that will go unpaid. Multiply current credit sales from the percentage in step 4 to estimate current uncollectible accounts receivable. if current credit sales is $15,000, then the estimated uncollectible accounts receivable is $1,500, since $15,000 *. 10 = $1,500. The allowance for uncollectible accounts has a credit balance of $2,000. net sales for the year were $250,000. in the past, 3 percent of net sales have proved uncollectible. an aging of accounts receivable results in an estimate of $9,000 of uncollectible accounts receivable.

How To Calculate Uncollectible Accounts Expense Basic

When you put money in a savings account, the interest you earn builds on itself over time. the savings calculator below will help you understand how your money can grow. Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. for example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for. Prepare the adjusting journal entry to record the estimate for bad debts assuming: 1. 6. 0% of the accounts receivable balance is assumed to be uncollectible. 2. bad debts expense is estimated to be 1. 5% of credit sales. 3. show how accounts receivable and the allowance for doubtful accounts would appear on the balance sheet after adjustment. 4. For example, 10% of accounts receivable that are between 31 60 days outstanding are uncollectible. you are waiting on $2,000 worth of payments in this aging period. multiply your accounts receivable by the percentage ($2,000 x 10% = $200). and, 5% of accounts receivable under 30 days outstanding will be uncollectible.

How To Calculate Uncollectible Accounts Expense Basic

Uncollectible Accounts Expense Allowance Method

Solved V Calculate Zuo Software Categorizes Its Accounts

A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Accounts 31-90 days past due $40,000; estimated uncollectible 30% 4 accounts more than 90 days past due $30,000; estimated uncollectible 50%. e 7-14 uncollectible accounts using the aging method; record adjustments at 12/31/2021, before recording any adjustments, zuo has a credit balance of $22,000 in its allowance for uncollectible accounts.

The estimated uncollectible percentage of each age group is applied to the total dollar amount of accounts receivable in that group to obtain an estimated uncollectible amount of the group. the estimated uncollectible amounts for all age groups are separately calculated and added together to find the total or overall estimated uncollectible amount. Using the same information as before, rankin makes an estimate of uncollectible accounts at the end of the year. the balance of accounts receivable is $100,000, and the allowance account has no balance. if rankin estimates that 6% of the receivables will be uncollectible, the adjusting entry would be: dec. 31. Accounting q&a library estimating uncollectible accounts and reporting accounts receivablecollins company analyzes its accounts receivable at december 31, and arrives at the aged categories below along with estimated uncollectible accounts calculator the percentages that are estimated as uncollectible. age group accounts receivable estimated loss % 0-30 days past due $110,000 1% 31-60 days past due 40,000 2 61-120 days past due 27,000 5.

Brief exercise 5-11 calculate uncollectible accounts using the aging estimated uncollectible accounts calculator method (lo5-5) spade agency separates its accounts receivable into three age groups for purposes of estimating the percentage of uncollectible accounts. in addition, the balance of allowance for uncollectible accounts before adjustment is $12,500 (credin). 1. Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 $1,200) in the allowance for doubtful accounts. Under this approach, businesses find the estimated value of bad debts by calculating bad debts as a percentage of the accounts receivable balance. for example, at the end of the accounting period, your business has $50,000 in accounts receivable. the historical records indicate an average 5% of total accounts receivable become uncollectible. By the end of 2018, cash collections on these accounts total $99,000. pave estimates that 20% of the uncollected accounts will be bad debts. record the adjustment for uncollectible accounts on december 31, 2018. calculate the net realizable value of accounts receivable.

An aging of accounts receivable results in an estimate of $9,000 of uncollectible accounts receivable. calculate: (1) uncollectible accounts expense (2) the ending balance of the allowance for uncollectible accounts using (a) the percentage of net sales method and (b) the accounts receivable aging method. The estimated uncollectible accounts expense using the percentage of accounts receivable method is $530. after the adjusting entry has been recorded, the balance in allowance for uncollectible accounts will be a. 5. 5. beginning book value of accounts receivable $52,000. Aged accounts receivable : estimated percentage uncollectible. estimated amount uncollected. not yet due. $115,000. x. 2% = $2,300. up to 90 days past due. $69,000. x. 10% = $6,900. over 90 days past due. $46,000. x. 30% = $13,800. estimated ending balance in allowance for doubtful accounts = $23,000. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts.

If your unit uses banner ar, university bursar business operations calculates each unit's allowance for uncollectible accounts and records it in your unit's fund in the banner general ledger. if your unit does not use banner ar, calculate an allowance for uncollectible accounts and record it in the banner general ledger annually at fiscal year end. Now that you have your estimated allowance for doubtful accounts amount, record a journal entry to establish the allowance for uncollectible accounts. debit uncollectible account expense and credit the allowance for uncollectible accounts for the estimated amount. the allowance for uncollectible accounts is a cushion for bad debt that protects. Calculating uncollectible accounts expense. when using the allowance for doubtful accounts method, an estimate is calculated to record uncollectible accounts expense. historical data typically forms the basis for the estimate. however, industry averages can form the basis, if the business doesn’t have a history of uncollectible accounts. The. 014 is the average percentage of uncollectible accounts receivable during year 1 through year 3. on the other hand, since that data suggest uncollectible accounts are increasing, from 1. 25% in year 1 to 1. 55% in year 3, the company could estimate its uncollectible accounts receivable to be $255 ($15,000 x. 017).