-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Receivable Write-off, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Receivable Write-off

link : Uncollectible Accounts Receivable Write-off

Uncollectible Accounts Receivable Write-off

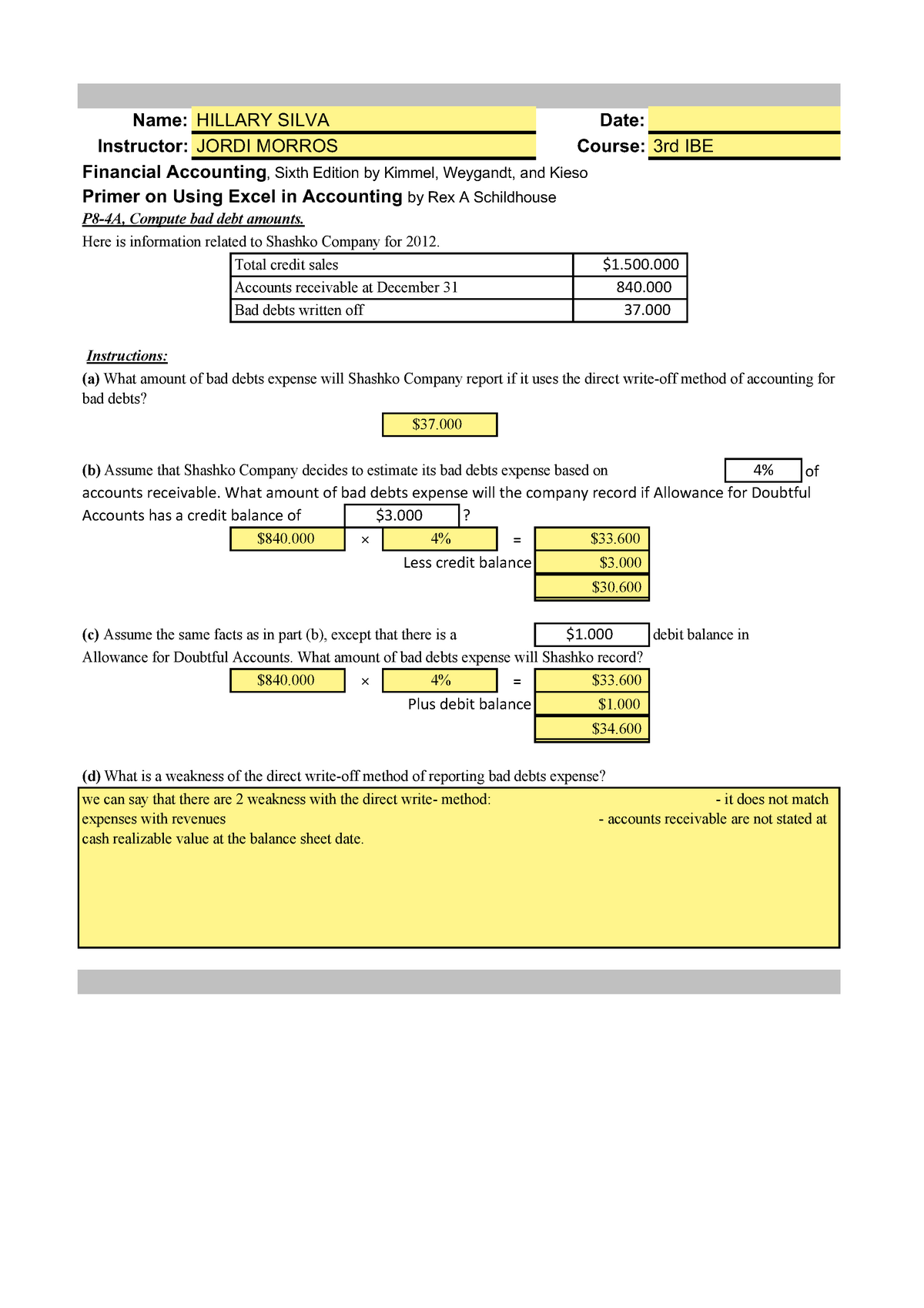

A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. An entry to write off uncollectible accounts receivable write-off accounts receivable at february 12, 2015. an adjusting entry to recognize uncollectible accounts expense at december 31, 2015. solution: (1). recognition of accounts receivable expense at december 31, 2014: (2). writing off accounts receivable at january 12, 2015: (3). recognition of accounts receivable expense at december. Reasons for accounts uncollectible relate to bankruptcy or a refusal to pay by the debtor. goods purchased on credit usually have a 30 to 90 day time period in which to be made whole. when.

How To Estimate Uncollectible Accounts Dummies

Direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Learn what to do if you can’t collect money from a customer and need to write it off as bad debt in quickbooks desktop. when invoices you send in quickbooks desktop become uncollectible, you need to record them as a bad debt and write them off. this ensures your accounts receivable and net income stay up-to-date. Allowance method for uncollectible accounts. the allowance method is a technique for estimating and recording of uncollectible amounts when a customer fails to pay, and is the preferred alternative to the direct write-off method. accounts receivable represent amounts due from customers as a result of credit sales. unfortunately for various.

In the direct write-off method, when after a few years of trying to recover the amount the invoice is declared as bad or uncollectible, it is directly written off uncollectible accounts receivable write-off or expensed out in the income statement by debiting bad debt expense and crediting accounts receivable. In the direct write-off method, when after a few years of trying to recover the amount the invoice is declared as bad or uncollectible, it is directly written off or expensed out in the income statement by debiting bad debt expense and crediting accounts receivable. the following journal entry is passed: bad debt expense d r account receivable c r. If you maintain the business's books and records in accordance with generally accepted accounting principles, or gaap, there are two methods for writing off part of an accounts receivable balance. Note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts).

Collections Writeoffs And Allowance Of Accounts Receivables

The entry to write off a bad account depends on whether the company is using the direct write-off method or the allowance method. examples of the write-off of a bad account. under the direct write-off method a company writes off a bad account receivable when a specific account is determined to be uncollectible. this usually occurs many months. A business can use the direct write-off method if accounts receivable are reported on the balance sheet as net realizable value false a disadvantage to the direct write-off method of recording uncollectible accounts expense is that the expense may not be recorded in the same fiscal period as the revenue for sale. Revenues and expenses can include non-cash-based transactions, such as sales made on credit. in contrast, cash flows are recorded -not surprisingly -on a cash basis. because the writing off of uncollectible accounts receivable does not change cash and cash equivalents, it does not impact the cash flow statement.

How To Write Off Accounts Receivable Wikiaccounting

Writing Off An Account Under The Allowance Method

See more videos for uncollectible accounts receivable write-off. The journal entry also credits the accounts receivable account for $100. in combination, these two entries zero out the allowance for the uncollectible a/r account and remove the uncollectible amount from the accounts receivable account. writing off an actual, specific uncollectible receivable for invoice should be done on a case-by-case basis. Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad uncollectible accounts receivable write-off account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. To write off an uncollectible account receivable, you record a credit memo and then apply the credit memo to the uncollectible account. the item shown on your credit memo should cause the allowance for uncollectible accounts to be debited.

Using this method, which is also called aging of accounts receivable, you estimate the amount of your accounts receivable balance or money your customers owe, that will be uncollectible based on the amount of days certain accounts are past due. determine the total balance of your accounts receivable account from your accounting records. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. When a specific customer's account is identified as uncollectible, the journal entry to write off the account is: a credit to accounts receivable (to remove uncollectible accounts receivable write-off the amount that will not be collected) a debit to allowance for doubtful accounts (to reduce the allowance balance that was previously established). Write-off of uncollectible accounts the process to remove an amount owed to the university from the receivable balance after a thorough collection process is followed and it is determined the balance will not be paid. the balance is no longer considered an asset and is not reflected in the financial statements.

Gaap rules for writing off accounts receivable. at some point during the life of your business, you'll likely have to write off an invoice for a customer who never makes payment. if you maintain the business's books and records in accordance with generally accepted accounting principles, or gaap, there are two. This figure assumes gross accounts receivable is $75,500. when you determine that a particular customer’s account is uncollectible (maybe the customer died and left no estate or closed up shop), your next step is to remove the balance from both allowance for uncollectible accounts and the customer accounts receivable balance.

6. 4 a write-off of uncollectible accounts receivable from the county's accounting records does not constitute forgiveness of the debt. the debt is owed to the county. 6. 5 county agencies shall maintain records of accounts written-off in accordance with federal and/or state records retention uncollectible accounts receivable write-off rules. Without crediting the accounts receivable control account, the allowance account lets the company show that some of its accounts receivable are probably uncollectible. when we decide a customer will not pay the amount owed, we use the allowance for doubtful accounts to offset this loss instead of bad debt expense. In the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry: the above entry is recorded every time a receivable actually proves to be uncollectible.

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. On dec. 31, yr. 3, alpha co. had an ending bal. of $200,000 in its accounts receivable account and an unadjusted (current) bal. in its allowance of doubt accounts account of $300. alpha estimates uncollectible accounts expense to be 1% of receivables. In accounting, bad debts are typically written off in two ways, though the proper way to write off the bad debt depends on how you account for the possible bad debts. you can either use an allowance method or a direct write-off method. however, the generally accepted accounting principles only allows for the use of.

Uncollectible accounts expense allowance method.