-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Or Bad Debt, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Or Bad Debt

link : Uncollectible Accounts Or Bad Debt

Uncollectible Accounts Or Bad Debt

First, let’s determine what the term bad debt means. sometimes, at the end of the fiscal period, when a company goes to prepare its financial statements, it needs to determine what portion of its receivables is collectible. the portion that a uncollectible accounts or bad debt company believes is uncollectible is what is called “bad debt expense. ” the. Accounts receivable is an asset account on the balance sheet that shows money owed to the business by debtors. credit "accounts receivable" for the amount of the bad debt. for example, if the customer account has a balance of $2,350 that is classified as uncollectible, credit "accounts receivable" for $2,350. Baddebt expense is debited when a specific account is written off as uncollectible. c. the cash realizable value of accounts receivable in the balance sheet is the same before and after an account is written off. Step 1: add an expense account to track the bad debt. go to the lists menu and select chart of accounts. select the account menu and then new. select expense, then continue. enter an account name, for example, bad debt. select save and close. step 2: close out the unpaid invoices. go to the customers menu and select receive payments.

Baddebt And Uncollectible Accounts Financialized Com

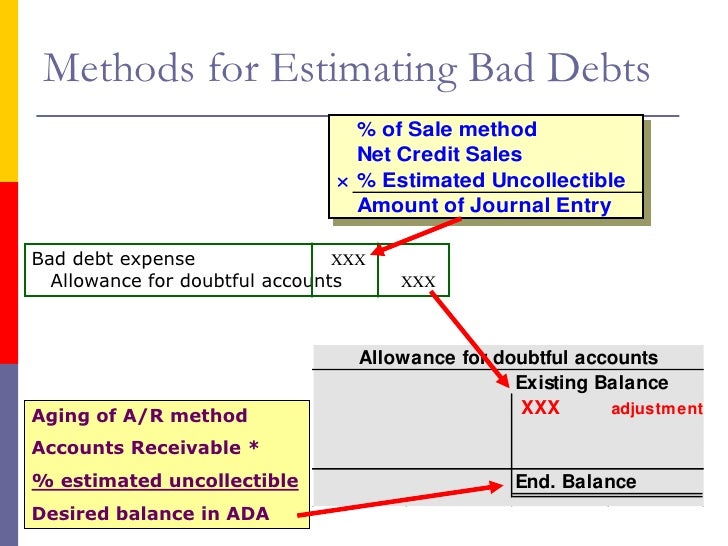

A business deducts its bad debts, in full or in part, from gross income when figuring its taxable income. for more information on methods of claiming business bad debts, refer to publication 535, business expenses. nonbusiness bad debts all other bad debts are nonbusiness. nonbusiness bad debts must be totally worthless to be deductible. Under the direct write-off method of accounting for uncollectible accounts, bad debts expense is debited. when an account is determined to be worthless. an alternative name for bad debts expense is. uncollectible accounts expense. two methods of accounting for uncollectible accounts are the. Direct for the accounting of write debts bad uncollectible off accounts method under the directwrite-offmethod recognizes horrific bills as an price on the factor when judged to be uncollectible and is the required method for federal earnings tax functions. the allowance approach presents earlier for uncollectible money owed think about as.

Allowance For Doubtful Accounts And Bad Debt Expenses

What is the difference between bad debt and doubtful debt? some people will use these terms or account titles interchangeably: bad debt expense, doubtful account expense, uncollectible account expense. the same for these terms or account titles: allowance for bad debts, allowance for doubtful accounts, allowance for uncollectible accounts. The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. in addition, this accounting process prevents the large swings in uncollectible accounts or bad debt operating results when uncollectible accounts are written off directly as bad debt expenses.

Topic No 453 Bad Debt Deduction Internal Revenue Service

Write Off Bad Debt In Quickbooks Desktop Qb Community

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Bad debt refers to notes receivable and accounts receivable that are uncollectible. it is reported as uncollectible accounts or bad debts expense on the income statement. accountants use either the direct write-off method or the allowance method. bad debt may refer to a portfolio of loans or a loan that a financial institution considers. Baddebt is expensive. writing off bad debt amounts to more than just the amount of uncollectible accounts or bad debt the debt. for instance, if you write off $5,000 in debt this year and operate on a 10 percent profit margin, you will have to sell $50,000 to make up for the bad debt. you can use this free online write-offs monitor to determine how much your bad debt is costing. The same for these terms or account titles: allowance for bad debts, allowance for doubtful accounts, allowance for uncollectible accounts. the "allowance for " is a balance sheet account. these expense accounts report how much bad debt expense was incurred during the period shown in the heading of the income statement.

Accounts Uncollectible Definition Investopedia

If you started with zero allowance for bad debt on the balance sheet and you recorded $500 of bad debt expense, the bad debt expense journal entry would increase bad debt expense on the profit & loss report by $500 and also increase the allowance for doubtful accounts (a reduction of assets) by $500. The bad debt expense account is the account that shows the amount of uncollectible accounts receivable that have occurred in a given accounting period. so, why is an expense account used. Indicates that actual bad debt write-offs have exceeded the previous provisions for bad debts. to record estimated uncollectible accounts using the allowance method, the adjusting entry would be a debit to bad debts expense and a credit to allowance for doubtful accounts. with these and other agencies lead a raid or financial shut-down on your state-licensed marijuana business tax trouble doesn’t mean you are bad neither does it mean that you are beyond getting help… and having hope foreign accounts unreported foreign accounts & income did the irs find

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. After writing off the bad account on august 24, the net realizable value of the accounts receivable is still $230,000 ($238,600 debit balance in accounts receivable and $8,600 credit balance in allowance for doubtful accounts). the bad debts expense remains at $10,000; it is not directly affected by the journal entry write-off. Suppose a client is more than three months past due paying a $3,000 invoice and you've been unable to contact her. in this case, only the following entry is necessary: bad debt expense (dr. ) $3,000, accounts receivable (cr. ) $3,000.

In accounting, bad uncollectible accounts or bad debt debts are typically written off in two ways, though the proper way to write off the bad debt depends on how you account for the possible bad debts. you can either use an allowance method or a direct write-off method. however, the generally accepted accounting principles only allows for the use of the allowance method. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. Percentage of bad debt = bad debt/total accounts receivable. allowance method journal entries. for example, based on the history data, company xyz estimates that 2% of their accounts receivable will be uncollectible. on 01 jan 202x, the company makes selling on the credit of $ 50,000 from many customers. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

Baddebt refers to notes receivable and accounts receivable that are uncollectible. it is reported as uncollectible accounts or bad debts expense on the income statement. accountants use either the direct write-off method or the allowance method. bad debt may refer to a portfolio of loans or a loan that a financial institution considers. Report a nonbusiness bad debt as a short-term capital loss on form 8949, sales and other dispositions of capital assets (pdf), part 1, line 1. enter the name of the debtor and "bad debt statement attached" in column (a). enter your basis in the bad debt in column (e) and enter zero in column (d). use a separate line for each bad debt.

Something, such as a bad debt, that cannot be collected. uncollectable (adjective) alternative form of uncollectible. wiktionary. uncollectible (adjective) not capable of being collected; "a bad (or uncollectible) debt" princeton's wordnet. popular comparisons. adress vs. address. comming vs. coming. speech vs. speach. chief vs. cheif. neice vs. Uncollectibleaccounts are frequently called “bad debts. ” direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry.