-Hallo friends, Accounting Methods, in the article you read this time with the title Allowance Method Uncollectible Accounts Journal Entries, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Allowance Method Uncollectible Accounts Journal Entries

link : Allowance Method Uncollectible Accounts Journal Entries

Allowance Method Uncollectible Accounts Journal Entries

Direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method uncollectible accounts journal entries allowance method as follows:. Cairo co. uses the allowance method of accounting for uncollectible accounts. cairo co. accepted a $5,000, 12%, 90-day note dated may 16, from alexandria co. as in exchange for its past-due account re. Allowance method is a better alternative to the direct write-off method because it is according to the matching principle of accounting. in allowance method, the doubtful debts are estimated and bad debts expense is recognized before the debts actually become uncollectible.

Uncollectibleaccounts Expense Allowance Method

Determining account balances and preparing journal entries: percent of revenue allowance method of accounting for uncollectible accounts lo 7-1 during the first year of operation, 2016, direct service co. recognized $290,000 of service revenue on account. at the end of 2016, the accounts receivable balance was $46,000. The three primary components of the allowance method are as follows: estimate uncollectible receivables. record the journal entry by debiting bad debt expense and crediting allowance for doubtful allowance method uncollectible accounts journal entries accounts.

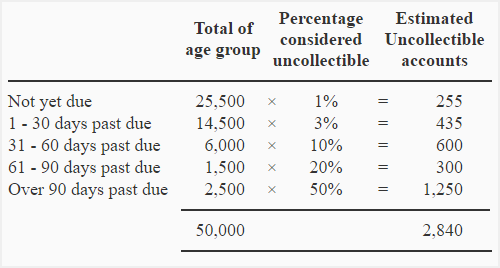

2 allowance method. charge the reverse value of accounts receivables for doubtful customers to a contra account called allowance for doubtful account. this keeps the p&l account unaffected from bad debts and reporting of the direct loss against revenues can be avoided. however writing-off the account at a future date is possible. for example:-. Once the estimated amount for the allowance account is determined, a journal entry will be needed to bring the ledger into agreement. assume that ito’s ledger revealed an allowance for uncollectible accounts credit balance of $10,000 (prior to performing the above analysis). Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown as a contra asset account that reduces the gross receivables on the balance sheet to reflect the net amount that is expected to be paid.

In the accounting cycle, the process of recording uncollectible accounts is called the allowance method. several accounts are used to separate the unpaid accounts receivables from the paying accounts, and specific journal entries are included on the financial statements. The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable. the allowance method is preferred over the.

The allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. the allowance method represents the accrual basis of accounting and is the accepted method to record uncollectible accounts allowance method uncollectible accounts journal entries for financial accounting purposes. Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected.

The Allowance Method Of Recording Uncollectible Accounts

See uncollectible accounts expense allowance method. (2). when cash is received from recovered account: the following journal entry is made when cash is received from recovered or reinstated account: for more clarification of the procedure, consider the three journal entries included in the following example:. See uncollectible accounts expense allowance method. (2). when cash is received from recovered account: the following journal entry is made allowance method uncollectible accounts journal entries when cash is received from recovered or reinstated account: for more clarification of the procedure, consider the three journal entries included in the following example:.

In this entry, we are debiting allowance for doubtful debts because by this amount the counter-asset has been reduced and we’re crediting accounts receivables to reduce the outstanding accounts receivables by $120,000. journal entries 3. now let’s say that the company has asked a collection agency to try out to recover the bad debts. Direct write off method vs allowance method if a customer defaults the payment, this will be called a ‘bad debt’. when an account is deemed to be uncollectible, the company must remove the receivable from the accounts and record an expense. The allowance method. the _____ records bad debt expense only when an account is determined to be worthless. direct write-off method. under the allowance method for uncollectible accounts, the journal entry to record the estimate of uncollectible accounts would include a credit to.

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries:. If the allowance for bad debts account had a $300 credit balance instead of a $200 debit balance, a $4,700 adjusting entry would be needed to give the account a credit balance of $5,000. aging method. in general, the longer an account balance is overdue, the less likely the debt is to be paid. The allowance method is one of the two common techniques of accounting for bad debts, the other being the direct write-off method. allowance method is a better alternative to allowance method uncollectible accounts journal entries the direct write-off method because it is according to the matching principle of accounting. in allowance method, the doubtful debts are estimated and bad debts expense is recognized before the debts actually become. The allowance method is preferred over the direct write-off method because: the income statement will report the bad debts expense closer to the time of the sale or service, and the balance sheet will report a more realistic net amount of accounts receivable that will actually be turning to cash.

The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. For the year ended december 31, 2012, dent co. estimated its allowance for uncollectible accounts using the year-end aging of accounts receivable. the following data are available: allowance for uncollectible accounts, 1/1/12 $84,000 provision for uncollectible accounts during 2012 (2% on credit sales of $3,000,000) $60,000.