-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Receivable Formula, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Receivable Formula

link : Uncollectible Accounts Receivable Formula

Uncollectible Accounts Receivable Formula

Accounts Receivable Turnover Ratio Formula Analysis

The average accounts receivable is the total of the beginning and ending accounts receivable divided by two. for example, last year, a company had $800,000 in net credit sales. at the beginning of the year, its accounts receivable was $40,000. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. (2). writing off accounts receivable at january 12, 2015: (3). recognition of accounts receivable expense at december 31, 2015: * 4,800 (4,500 1,200) notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already.

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how efficiently a company is collecting revenue and by extension, how efficiently it is using its assets. the accounts receivable turnover ratio measures the number of times over a given period formula for. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts. Percentage of sales method for calculating doubtful accounts. the percentage-of-sales method is commonly used to estimate the accounts receivable that a business expects will be uncollectible. when you use this method, use your small business’s past collection data to estimate what portion of the credit sales you.

Accounts Uncollectible Definition Investopedia

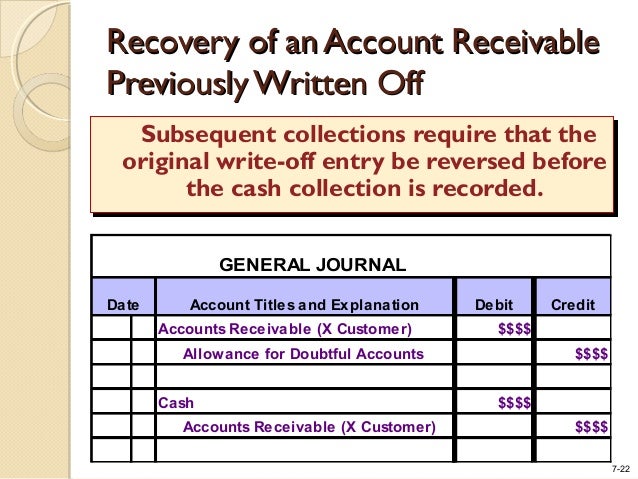

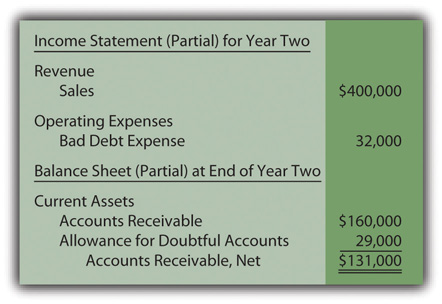

The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable. Accountsreceivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. in other words, the accounts receivable turnover ratio measures how many times uncollectible accounts receivable formula a business can collect its average accounts receivable during the year. The percentage of receivables method is used to derive the bad debt percentage that a business expects to experience. the technique is used to populate the allowance for doubtful accounts, which is a contra account that offsets the accounts receivable asset. at the most basic level, the percentage of receivables method requires the following steps:. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

This figure assumes gross accounts receivable is $75,500. when you determine that a particular customer’s account is uncollectible (maybe the customer died and left no estate or closed up shop), your next step is to remove the balance from both allowance for uncollectible accounts and the customer accounts receivable balance. Accountsreceivable is uncollectible accounts receivable formula known as a control account. this means the total of all individual accounts found in the subsidiary ledger must equal the total balance in accounts receivable. the allowance method uses an estimate of uncollectible expense, also known as bad debts expense, and does not predict which individual accounts will be written off. An allowance for doubtful accounts is your best guess of the bills your customers won't pay or will pay only partially. you can calculate the allowance subjectively, based on your knowledge of a customer's payment habits or ability to pay, or you can use an allowance for doubtful accounts formula based on the past experience of actual bad debt expense. Allowance for doubtful accounts is shown as a deduction from accounts receivable on the balance sheet. valente company received a $10,000, 12%, 1-year note from andrea foley on june 1st, as full payment on her account.

Acc 211 Chapter 8 Flashcards Quizlet

Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. for example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for doubtful accounts. The allowance for doubtful accounts is a contra-asset account that records the amount of receivables expected to be uncollectible. the allowance is established in the same accounting period as the. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries:. Accounts receivable is known as a control account. this means the total of all individual accounts found in the subsidiary ledger must equal the total balance in accounts receivable. the allowance method uses an estimate of uncollectible expense, also known as bad debts expense, and does not predict which individual accounts will be written off.

Accounting For Uncollectible Receivables

Prepare an aging of accounts receivable and compute bad debt expense. all answers must be entered as a formula 1 xercise cycles company sells exercise equipment to gyms on account. at year end, the following accounts receivable were uncollected 3 required: 4 1) calculate the number of days unpaid, using the excel days function (fx). 5 number of. One way to estimate the amount of uncollectible accounts receivable is to prepare an aging. an aging of accounts receivable lists every customer's balance and then sorts each customer's balance according to the amount of time since the date of the sale. for example, assume that all sales are made.

Accounts Uncollectible Definition Investopedia

The percent-of-sales method for computing uncollectible accounts: computes uncollectible-account expense as a percent of accounts receivable. takes a balance sheet approach. employs the expense recognition (matching) concept. will result in the same amount of estimated uncollectible-accounts expense as the aging-of-receivables method. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. The percentage of accounts receivable method formula is as follows: the bad debt expense is then the difference between the calculated allowance for doubtful accounts at the end of the account period and the current allowance for doubtful accounts before adjustment.

Face value of accounts receivable uncollectible accounts receivable formula allowance for doubtful accounts = net realizable value of accounts receivable journal entry to write off accounts receivable: in the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry:.

How to estimate uncollectible accounts dummies.