-Hallo friends, Accounting Methods, in the article you read this time with the title Accounts Method Write-off For Receivable Accounting Direct The Uses Uncollectible Of, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Accounts Method Write-off For Receivable Accounting Direct The Uses Uncollectible Of

link : Accounts Method Write-off For Receivable Accounting Direct The Uses Uncollectible Of

Accounts Method Write-off For Receivable Accounting Direct The Uses Uncollectible Of

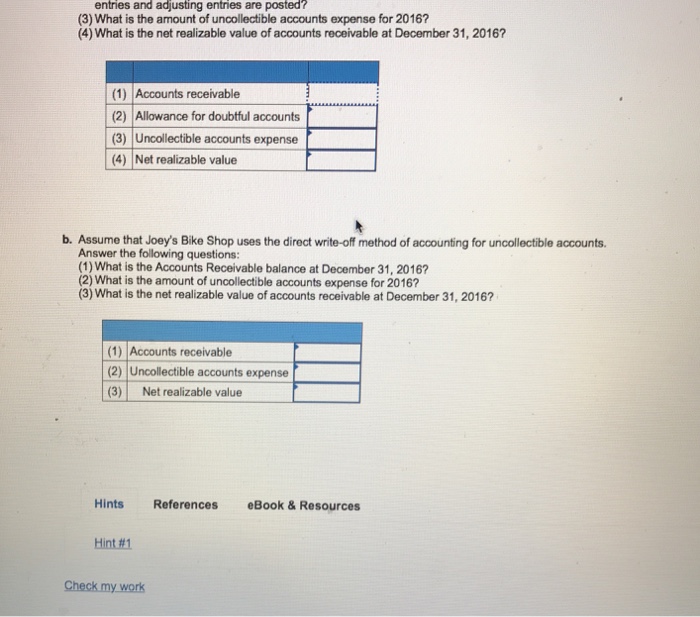

Abbott corporation makes use of the allowance method of accounting for uncollectible accounts. abbott estimates that 3% of credit score income could be accounts method write-off for receivable accounting direct the uses uncollectible of uncollectible. on january 1, the allowance for doubtful accounts had a credit score stability of $2,400. at some stage in the 12 months, abbott wrote off bills receivable totaling $1,800 and made credit score income of $one hundred,000. The direct write-off approach is one of the methods generally associated with reporting money owed receivable and horrific debts cost. (the other method is the allowance approach. ) beneath the direct write-off method, horrific debts fee is first reported on a organization's earnings assertion whilst a consumer's account is certainly written off.

Directwriteoff And Allowance Accounting In Consciousness

The direct write-off method is a easy technique, in which you would report a journal access to debit your bad debt account for the bad debt and credit score your bills receivable account for the equal amount. The lowery co. uses the direct write-off method of accounting for uncollectible debts receivable. lowery has a client whose money owed receivable stability has been determined to probable be uncollecttible. the entry to put in writing off this account could be which of the following? : debit allowance for dubious money owed; credit score bills receivable debit income returns and allowance, credit score bills. As a end result, companies must use the direct write-off approach for earnings tax reporting. in the direct write-off approach, a employer will now not use an allowance account to reduce its debts receivable. money owed receivable is best decreased if and when a organization knows with certainty that a selected quantity will now not be accumulated from a particular consumer.

The directwrite-offmethod recognizes awful bills as an price at the point whilst judged to be uncollectible and is the specified method for federal earnings tax functions. the allowance approach provides in advance for uncollectible debts think of as placing apart cash in accounts method write-off for receivable accounting direct the uses uncollectible of a reserve account. Dexter organization applies the direct write-off approach in accounting for uncollectible debts. march eleven dexter determines that it cannot collect $forty five,000 of its bills receivable from its customer leer employer. 29 leer employer unexpectedly can pay its account in complete to dexter organization. dexter data its recovery of this bad debt. Directwrite-offmethod. a easy method to account for uncollectible bills is the direct write-off approach. under this approach, a specific account receivable is removed from the accounting facts on the time it's miles eventually decided to be uncollectible. the proper entry for the direct write-off technique is as follows:.

Ch 8 acct flashcards quizlet.

Accounting For Uncollectible Receivables

The direct write off technique involves charging horrific debts to cost only when individual invoices have been recognized as uncollectible. the particular motion used to put in writing off an account receivable below this approach with accounting software is to create a credit memo for the client in query, which offsets the amount of the awful debt. growing the credit score memo creates a debit to a awful debt expense account and a credit score to the money owed receivable account. Beneath direct write-off approach the uncollectible debts fee is recognized while a receivable is sincerely decided to be uncollectible. in contrast to allowance approach, no valuation allowance is used and money owed receivables are mentioned inside the balance sheet at gross amount.. this approach does not comply with the matching precept of accounting due to the fact no try is made to in shape income revenue with. Whilst is it desirable to use the direct write-off technique of accounting for uncollectible debts? one technique conforms to gaap and the alternative commonly does now not, one method reports internet realizable fee on the stability sheet and the other does now not, and one approach calls for the estimation of uncollectible accounts and the other does not.

The direct write off approach is a manner companies account for debt can’t be amassed from customers, in which the horrific debts price account is debited and money owed receivable is credited. as an instance, a picture fashion designer makes a new emblem for a patron and sends the files with an bill for $500, however the consumer never pays and the dressmaker makes a decision the client gained’t ever pay, so she debits bad money owed. They ought to write off those uncollectible receivable. in this article, we can give an explanation for the accounting treatment and measurement of writing money owed receivable using the direct write-off technique. bad debt expense: when sales are made on credit, lots of instances customers fail to pay returned the money they owe to the company because of diverse motives. Accounting q&a library accounting for uncollectible money owed using the allowance (percent-of-income) and direct write-off methods and reporting receivables on the stability sheet on august 31, 2018, bouquet floral supply had a $140,000 debit balance in debts receivable and a fifty five,six hundred credit score stability in allowance for terrible debts. for the duration of september, bouquet made: income on account, $550,000.

(c) in the course of the subsequent month, january 2011, a $2,700 account receivable is written off as uncollectible. prepare the journal access to document the write-off. (d) repeat the above component assuming that olpe uses the direct write-off approach instead of the allowance method in accounting for uncollectible accounts receivable. Greater co. makes use of the direct write-off method of accounting for uncollectible bills receivable. the entry to put in writing off an account that has been decided to be uncollectible might encompass a debit to horrific debt rate and a credit score to bills receivable.

The lmn co. makes use of the direct write-off technique of accounting for uncollectible accounts receivable. the access to jot down off an account that has been determined to be uncollectible would be as follows: question options: debit allowance for doubtful bills; credit score accounts receivable debit income returns and allowance, credit score accounts receivable. The direct write-off approach is one of the two methods usually related to reporting money owed receivable and bad debts expense. (the alternative technique is the allowance technique. ) below the direct write-off approach, terrible debts expense is first stated on a agency's income assertion when a patron's account is in reality written off. The allowance approach is a way for estimating and recording of uncollectible quantities when a consumer fails to pay, and is the favored alternative to the direct write-off method.. accounts receivable constitute quantities due from clients as a result of credit income. The directwrite-offmethod for bad debt. the direct write-off technique permits a enterprise to document awful debt cost most effective whilst a specific account has been deemed uncollectible. the account is removed from the money owed receivable stability and awful debt fee is elevated. example 1: on march 2, reliable automobile repair, inc. has deemed that a $1,400.

Allowance method for uncollectible debts double access.

Direct write-off technique a simple method to account for uncollectible accounts is the direct write-off method. below this method, a specific account receivable is removed from the accounting information on the time it's miles in the end decided to be uncollectible. the suitable access for the direct write-off technique is as follows:. If delinquent clients fail to reply to series efforts, accounting strategies are used to recognize the loss from the sale: the allowance and the direct write-off techniques. even though each method varies in its method, both are used to dispose of the uncollectible monies from the money owed receivable balance so the account displays an quantity. The directwrite offmethod entails charging bad money owed to fee handiest whilst man or woman invoices were identified as uncollectible. the specific movement used to put in writing off an account receivable underneath this method with accounting software is to create a credit memo for the consumer in query, which offsets the quantity of the awful debt. growing the credit memo creates a debit to a horrific debt.

Accounting cornerstones of monetary accounting if a enterprise makes use of the direct write-off approach of accounting for horrific money owed, a. it will document debts receivable on the stability sheet at their net realizable cost. b. it is applying the matching principle. c. it will lessen the accounts receivable account at the stop of the accounting length for predicted uncollectible debts. Gaap guidelines for writing off debts receivable. in some unspecified time in the future for the duration of the life of your business, you will likely should write off an invoice for a consumer who by accounts method write-off for receivable accounting direct the uses uncollectible of no means makes fee. in case you preserve the business's books and statistics in accordance with generally accepted accounting standards, or gaap, there are two. Greater co. uses the direct write-off technique of accounting for uncollectible debts receivable. the access to jot down off an account that has been decided to be uncollectible could consist of a debit to bad debt price and a credit score to debts receivable.

The direct write-off approach recognizes bad debts as an cost on the factor while judged to be uncollectible and is the required approach for federal earnings tax purposes. the accounts method write-off for receivable accounting direct the uses uncollectible of allowance method provides in advance for uncollectible money owed consider as placing apart cash in a reserve account. the allowance approach represents the accrual foundation of accounting and is the established technique to file uncollectible accounts for monetary accounting purposes. The direct write-off technique is used by all the following agencies except those who have receivables as a massive a part of their current assets. plant life co. makes use of the allowance method of accounting for uncollectible debts receivable. the entry to put in writing off an account that has been determined to be uncollectible might be as follows:.

Best while an account is judged to be worthless greater co. makes use of the direct write-off technique of accounting for uncollectible bills receivable. the entry to write off an account that has been determined to be uncollectible might include debit to terrible money owed cost and a credit score to money owed recievable. Below the direct write off approach of accounting for credit losses referring to money owed receivable, no awful money owed expense is said on the income announcement until an account receivable is certainly removed from the corporation's receivables. below the direct write off method there is no contra asset account along with allowance for doubtful accounts.