-Hallo friends, Accounting Methods, in the article you read this time with the title When Is It Acceptable To Use The Direct Write-off Method Of Accounting For Uncollectible Accounts, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : When Is It Acceptable To Use The Direct Write-off Method Of Accounting For Uncollectible Accounts

link : When Is It Acceptable To Use The Direct Write-off Method Of Accounting For Uncollectible Accounts

When Is It Acceptable To Use The Direct Write-off Method Of Accounting For Uncollectible Accounts

Gaap rules for writing off accounts receivable your business.

Accounting For Uncollectible Receivables

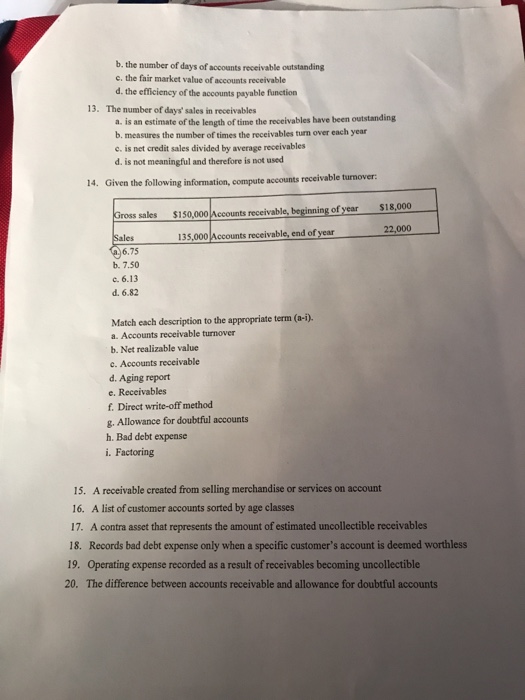

The directwrite-offmethod for bad debt. the direct write-off method allows a business to record bad debt expense only when a specific account has been deemed uncollectible. the account is removed from the accounts receivable balance and bad debt expense is increased. example 1: on march 2, dependable car repair, inc. has deemed that a $1,400. The directwrite offmethod involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating the credit memo creates a debit to a bad debt.

Writeoff Method Vs Allowance Method Your Business

The income statement approaches to estimating uncollectible accounts result in computations that reveal the balance that should be in the allowance for uncollectible accounts. false under the allowance method, the write-off of an uncollectible account will result in a decrease in either income or total assets. § when is it acceptable to use the direct write-off method of accounting for uncollectible accounts unless bad debt losses are insignificant, the direct write-off method is not acceptable for financial reporting purposes. ¨ the allowance method of accounting for bad debts involves estimating uncollectible accounts at the end of each period.

The directwrite-offmethod is a simple accounting approach that immediately charges off bad debt (accounts receivable that a company is unable to collect). with a direct write-off, a specific. Under the direct write off method of accounting for credit losses pertaining to accounts receivable, no bad debts expense is reported on the income statement until an account receivable is actually removed from the company's receivables. under the direct write off method there is no contra asset account such as allowance for doubtful accounts. When is it acceptable to use the direct write-off method of accounting for uncollectible accounts? one method conforms to gaap and the other typically does not, one method reports net realizable value on the balance sheet and the other does not, and one method requires the estimation of uncollectible accounts and the other does not.

Chapter 7 Accounting 2010 With Villarreal At Studyblue

There are two reasons why the direct write-off method is not allowed. first, applying the matching principle implies that the cost of the uncollectible accounts need to be expensed in the period. The direct write-off method is simpler than the allowance method since it only requires one journal entry and doesn't utilize estimates. essentially, you write off ar balances one customer account.

Why Use Allowance Over Direct Method Accounting Sapling

Bad debts direct write-off method direct write-off method is one of the two most common accounting techniques of bad debts treatment. in the direct write-off method, uncollectible accounts receivable are directly written off against income at the time when they are actually determined as bad debts. Under direct write-off method the uncollectible accounts expense is recognized when a receivable is actually determined to be uncollectible. unlike allowance method, no valuation allowance is used and accounts receivables are reported in the balance sheet at gross amount.. this method does not follow the matching principle of accounting because no attempt is made to match sales when is it acceptable to use the direct write-off method of accounting for uncollectible accounts revenue with. The direct write-off method is a simple accounting approach that immediately charges off bad debt (accounts receivable that a company is unable to collect). with a direct write-off, a specific account receivable is deducted from sales revenue in the period it is deemed uncollectible.

Pledging Selling Direct Writeoff Method Accountingcoach

The offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. in accounting, an item is deemed material if it is large enough to affect the judgment of an informed financial statement when is it acceptable to use the direct write-off method of accounting for uncollectible accounts user. The internal revenue service permits companies to take a tax deduction for bad debts only after specific uncollectible accounts have been identified. unless a company's uncollectible accounts represent an insignificant percentage of their sales, however, they may not use the direct write-off method for financial reporting purposes.

The allowance method and the direct method are accounting strategies for recording uncollectible accounts receivable. while the allowance method records a bad debt expense by estimation at the time of the credit sales, the direct method reports the bad debt expense when a company decides certain accounts receivable have become uncollectible. The direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating the credit memo creates a debit to a bad debt expense account and a credit to the accounts receivable account. Directwrite-offmethod. generally accepted accounting principles (gaap) require that companies use the allowance method when preparing financial statements. the use of the allowance method is not permitted, however, for purposes of reporting income taxes in the united states because the internal revenue service (irs) does not allow companies to anticipate these credit losses. Directwrite-offmethod. a when is it acceptable to use the direct write-off method of accounting for uncollectible accounts simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:.

What is the effect on the accounting equation when writing off an uncollectible account receivable when the allowance method is used> when the direct write-off method is used 1. doesnt effect the equation because it is a contra assest. Bad debts direct write-off methoddirectwrite-offmethod is one of the two most common accounting techniques of bad debts treatment. in the direct write-off method, uncollectible accounts receivable are directly written off against income at the time when they are actually determined as bad debts.

Under the direct write-off method, a bad debt is charged to expense as soon as it is apparent that an invoice will not be paid. under the allowance method, an estimate of the future amount of bad debt is charged to a reserve account as soon as a sale is made. this results in the following differences between the two methods: timing. bad debt expense recognition is delayed under the direct write. At some point during the life of your business, you'll likely have to write off an invoice for a customer who never makes payment. if you maintain the business's books and records in accordance with generally accepted accounting principles, or gaap, there are two methods for writing off part of an accounts receivable balance to choose from.

The direct write-off method for bad debt the direct write-off method allows a business to record bad debt expense only when a specific account has been deemed uncollectible. the account is removed from the accounts receivable balance and bad debt expense is increased. The directwrite-offmethod recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account.

Companies use two methods for handling uncollectible accounts. the direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. the allowance method represents the accrual basis of accounting and is the accepted method to record uncollectible accounts for financial. Why when is it acceptable to use the direct write-off method of accounting for uncollectible accounts isn't the direct write off method of uncollectible accounts receivable the preferred method? definition of direct write off method. under the direct write off method of accounting for credit losses pertaining to accounts receivable, no bad debts expense is reported on the income statement until an account receivable is actually removed from the company's receivables.

Write-off method vs. allowance method. uncollected monies from credit sales can restrict a company's cash flow. if delinquent customers fail to respond to collection efforts, two accountingmethods are used to recognize the loss from the sale: the allowance and the direct write-off methods. although each method. As a result, companies must use the direct write-off method for income tax reporting. in the direct write-off method, a company will not use an allowance account to reduce its accounts receivable. accounts receivable is only reduced if and when a company knows with certainty that a specific amount will not be collected from a specific customer.