-Hallo friends, Accounting Methods, in the article you read this time with the title K-1 Accounting Method, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts K-1 Accounting Method, article posts Method, which we write this you can understand. Alright, happy reading.

Title : K-1 Accounting Method

link : K-1 Accounting Method

K-1 Accounting Method

Opting Out Of Filing Form 1041 For Grantor Trust The Daily Cpa

Tax basis, in general, reports all transactions that affect the tax situation of the partnership. if gaap is checked, this means the k-1s are prepared in accordance with generally accepted accounting principles. if 704(b) is checked, the k-1 discloses the “substantial economic effect of the allocations amount the partners”. Beginning with the 2018 partnership taxable year, if a partner’s tax basis capital was negative at the beginning or end of a partnership’s taxable year, a partnership or other person is required to report on line 20 of a partner’s schedule k-1, using code ah, such partner’s beginning and ending tax basis capital. Cash-basis accounting. in cash-basis accounting, companies record expenses in financial accounts when the cash k-1 accounting method is actually laid out, and they book revenue when they actually hold the cash in their hot little hands or, more likely, in a bank account. for example, if a painter completed a project on december 30, 2003, but doesn’t get paid for it until the owner inspects it on january 10, 2004.

No reporting of partner tax basis capital accounts 2019.

Where do i enter partners' capital for schedule l when schedule l does not k-1 accounting method use the same capital account accounting method as schedules k-1 and m-2? answer. use the following fields in screen l in the balance sheet folder if the beginning or ending capital accounts reported on schedule l differ from amounts reported on schedule m-2. Most tax practitioners would agree that filing a 1041 return for a grantor trust is redundant and is a waste of tax resources. this is especially true for a grantor trust owned by one person. after all, the income will ultimately flow down to the individual's income tax return so what is the point of filling….

Form 1065 Accounting Methods Support

Can someone please clearly explain (line l) at the bottom? choices are tax basis gaap section 704(b) book other example: partner a contributed 13,000 cash and a vehicle valued at 2,402. 00. partner b contributed 3,047. 00 cash. profits and losses are 50% each. capital: 80. 22% partner a 19. 78% for partner b i don't know which box to check. thank you. k-1 accounting method If a partnership reports other than tax basis capital accounts to its partners on schedule k-1 in item l (that is, gaap, 704(b) book, or other), and tax basis capital, if reported on any partner's schedule k-1 at the beginning or end of the tax year would be negative, the partnership must report on line 20 of schedule k-1, using code ah, such. If a partnership reports other than tax basis capital accounts to its partners on schedule k-1 in item l (that is, gaap, 704(b) book, or other), and tax basis capital, if reported on any partner's schedule k-1 at the beginning or end of the tax year would be negative, the partnership must report on line 20 of schedule k-1, using code ah, such. “what is the difference between the tax basis and gaap basis on a k-1 1065? ”----->as you can see,there are two choices when selecting an accounting method for your business: gaap, generally accepted accounting principles, and tax accounting; each has benefits that may be ideally suited to the needs of your business financial reporting, and each method has drawbacks that may make it an.

The schedule k-1 is the form that reports the amounts that are passed through to each party that has an interest in the entity. k-1 forms for business partnerships for businesses that operate as partnerships, it’s the partners who are responsible for paying taxes on the business’ income, not the business. Why method matters. the accounting method a business uses can have a major impact on the total revenue the business reports as well as on the expenses that it subtracts from the revenue to get the bottom line. here’s how: cash-basis accounting: expenses and revenues aren’t carefully matched on a month-to-month basis. expenses aren’t. Enter the accounting method used to report capital on schedule k-1 in the capital account accounting method field or the other (specify) field in screen k1misc in the partner info, basis folder. the selection does not change how ultratax cs calculates the partners' capital accounts on schedule k-1. The method of accounting is important to know, and you should discuss how it affects income and net assets with the accountant or financial expert you are working with. page 3. schedule k reports shareholders’ aggregate share of income, deductions, credits, and so on (and mirrors the individual shareholder’s form k-1, which is discussed below).

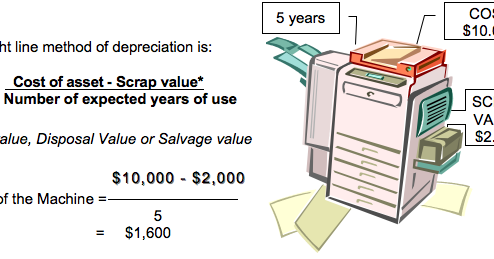

Schedulek-1 is a tax document used to report the incomes losses and dividends of a partnership. the schedule k-1 document is prepared for each individual partner and is included with the. The straight line depreciation method used for gaap accounting, which decreases the value of a property to $700. now the value of property contributed by b will have the following basis: $700 for gaap, $400 for tax purposes, and $1,000 for section 704 (b). To change the basis method for all partners: go to interview form 5 schedule k-1 print, partner percentages, calculation and pro forma options. in box 43 basis method, enter an appropriate code. if you select "other basis", in box 44 other basis description, enter a description. calculate the return. to change the basis for selected partners:.

Mar 28, 2012 · can someone please clearly explain (line l) at the bottom? choices are tax basis gaap section 704(b) book other example: partner a contributed 13,000 cash and a vehicle valued at 2,402. 00. partner b contributed 3,047. 00 cash. profits and losses are 50% each. capital: 80. 22% partner a 19. 78% for partner b i don't know which box to check. thank you. Key takeaways business partners or s corporation shareholders use schedule k-1 to report their incomes, losses, and dividends. the schedule k-1 requires the partnership to track each partner’s basis in the partnership. a partner can earn several types of income on schedule k-1.

Accordingly, today’s notice provides that partnerships and others required to furnish and file form 1065, schedule k-1 or form 8865, schedule k-1 will not be required to report partner capital accounts for 2019 using the tax basis method. The tcja's small business exceptions one of the tcja's aims was to reduce complexity for small businesses. the legislation allows most businesses with average annual gross receipts, or aagr, no greater than $25 million to use the cash method of accounting. 2 it also exempts these businesses from some of the more onerous recordkeeping. Crop method: this method of accounting is available for farmers who do not harvest and sell their crops in the same year that they planted and grew them. the crop method allows the farmer to. May 21, 2019 · the first alternative reporting method allows the trustee of the trust to file forms 1099 in lieu of a form 1041. in this case, the ownership of the assets themselves will be listed in the name of the trust and the trust will subsequently issue a 1099 in the name of the grantor.

For example, debt-financed real estate or certain debt-financed distributions may result in negative tax basis capital. it is likely that the partnership will have to provide a reconciliation between tax capital provided on schedule k-1 and whatever accounting method is used (e. g. gaap) on the schedule l balance sheet on form 1065. Officially, there are two types of accounting methods, which dictate how the company’s transactions are recorded in the company’s financial books: cash-basis accounting and accrual accounting. the key difference between the two types is how the company records cash coming into and going out of the business. Form 1065 accounting methods the accounting method is a set of rules used to determine how income and expenditures are reported. figure ordinary business income using the method of accounting regularly used in keeping the partnership's books and records.