-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Aging Method, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Aging Method

link : Uncollectible Accounts Aging Method

Uncollectible Accounts Aging Method

The aging method is based on determining the desired balance in the account allowance for uncollectible accounts. the accountant attempts to estimate what percentage of outstanding receivables at year-end uncollectible accounts aging method will ultimately not be collected; ‘this amount becomes the desired ending balance in the allowance for uncollectible accounts, and a credit. This video explains how to estimate bad debt expense using the aging of accounts receivable method. an example is provided to illustrate how an aging schedule can be used to estimate uncollectible. Under aging method of estimating allowance for doubtful accounts, a percentage of accounts receivable in each age group is considered to be uncollectible. this percentage is usually different for each age group and is estimated on the basis of past experience and current economic conditions of the areas where company conducts its operations. Matt fisher accounting accounts receivable aging methods. aging method for estimating uncollectible accounts duration: 7:37. edspira 97,496 views. 7:37.

Accounts Receivable Aging Definition

See more videos for uncollectible accounts aging method. The aging method is based on determining the desired balance in the account allowance for uncollectible accounts. the accountant attempts to estimate what percentage of outstanding receivables at year-end will ultimately not be collected; ‘this amount becomes the desired ending balance in the allowance for uncollectible accounts, and a credit entry to this account is made to adjust the previous balance to the new, desired balance. Setting up an accounts receivable aging schedule uncollectible accounts aging method is similar to the percentage of accounts receivable method in that the allowance account for uncollectible accounts is adjusted to some target value based on an ending balance sheet account.

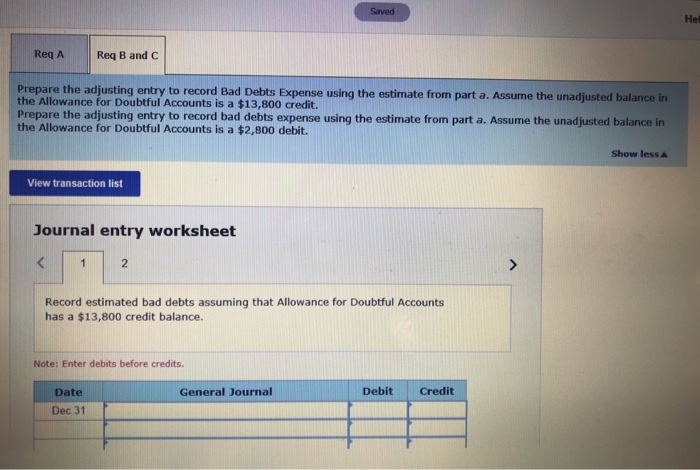

The allowance for bad debts account has a credit balance of $8,700 before the adjusting entry for bad debts expense. after analyzing the accounts in the accounts receivable subsidiary ledger using the aging-of-receivables method, the company's management estimates that uncollectible accounts will be $14,300. The aging of receivables method of estimating uncollectible accounts is: o a. not an acceptable method of estimating bad debts o b. is required to be used by all companies because it focuses on what should be the most relevant and faithful representation of accounts receivable on the balance sheet o c. an income statement approach, since it focuses on the amount of expense to be reported. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries:. Accounts that can't be collected because of the inability of a customer to pay the account or the lack of interest in paying the account are called uncollectible accounts. in order for accounting.

Aug 29, 2014 · this video explains how to estimate bad debt expense using the aging of accounts receivable method. an example is provided to illustrate how an aging schedule can be used to estimate uncollectible Accounts receivable aging is a technique to estimate bad debts expense by classifying accounts receivable of a business according to of length of time for which they have been outstanding and then estimating the probability of noncollection for each category. The aging method usually refers to the technique for estimating the amount of a company's accounts receivable that will not be collected. the estimated amount that will not be collected should be the credit balance in the contra asset account allowance for doubtful accounts

Using this method, which is also called aging of accounts receivable, you estimate the amount of your accounts receivable balance or money your customers owe, that will be uncollectible based on the amount of days certain accounts are past due. determine the total balance of your accounts receivable account from your uncollectible accounts aging method accounting records. One way to estimate the amount of uncollectible accounts receivable is to prepare an aging. an aging of accounts receivable lists every customer's balance and then sorts each customer's balance according to the amount of time since the date of the sale. for example, assume that all sales are made with terms of 30 days.

What Is The Allowance Method Accountingcoach

Accounting for uncollectible accounts using the allowance method (aging-of-receivables), and reporting receivable in the balance sheet. at september 30, 2014, the accounts of mountain terrace medical center (mtmc) include the following:. The aging method usually refers to the technique for uncollectible accounts aging method estimating the amount of a company's accounts receivable that will not be collected. the estimated amount that will not be collected should be the credit balance in the contra asset account allowance for doubtful accounts.

Uncollectible accounts expense allowance method.

Jan 04, 2020 · the aging method is based on determining the desired balance in the account allowance for uncollectible accounts. the accountant attempts to estimate what percentage of outstanding receivables at year-end will ultimately not be collected; ‘this amount becomes the desired ending balance in the allowance for uncollectible accounts, and a credit. Accounts receivable aging is a technique to estimate bad debts expense by classifying accounts receivable of a business according to of length of time for which they have been outstanding and then estimating the probability of noncollection for each category. the classification of accounts receivable in the accounts receivable aging schedule also helps the business to identify the customers.

Accounts Receivable Aging Method Bad Debts Estimation Example

An allowance for doubtful accounts is your best guess of the bills your customers won't pay or will pay only partially. you can calculate the allowance subjectively, based on your knowledge of a customer's payment habits or ability to pay, or you can use an allowance for doubtful accounts formula based on the past experience of actual bad debt expense. Jul 01, 2014 · setting up an accounts receivable aging schedule is similar to the percentage of accounts receivable method in that the allowance account for uncollectible accounts is adjusted to some target value based on an ending balance sheet account. Accounts receivable aging is the process of distinguishing open accounts receivables based on the length of time an invoice has been outstanding. accounts receivable aging is useful in determining.

The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected. Mar 23, 2012 · accounts receivable aging method accounts receivable aging is a technique to estimate bad debts expense by classifying accounts receivable of a business according to of length of time for which they have been outstanding and then estimating the probability of noncollection for each category.

Under this method, the uncollectible accounts expense uncollectible accounts aging method is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach. Using the aging method, carlton company calculates the estimated ending balance in the allowance for uncollectible accounts to be $12,000. prior to adjusting entries, the allowance for uncollectible accounts has a credit balance of $3,000. the year-end adjustment would include a: debit to bad debt expense for $12,000.