-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Definition, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Definition

link : Uncollectible Accounts Definition

Uncollectible Accounts Definition

How To Estimate Uncollectible Accounts Dummies

The lender increased the client's line of credit, unaware that the accounts receivable balance included a number of aged and uncollectible accounts. minding the expectation gap in a cas engagement the risk management consists of the input item that is the output of operating performance output item (npls) and two output items including. Accounts uncollectible, also called allowance for doubtful accounts (ada), is a reduction in a company's accounts receivable. accounts uncollectible equals the amount of those receivables that the company's management does not expect to actually collect. Translation and definition "uncollectible account", dictionary english-english online. uncollectible account. example sentences with "uncollectible account", translation memory. un-2. for 2004, the allowance for exchange rate fluctuation and provision for uncollectible accounts amounted to $16. 0 million. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be.

Uncollectible definition is not capable of or suitable for being collected : not collectible. how to use uncollectible in a sentence. Allowance for uncollectible accounts definition. the reserve is a contra-asset, or an asset listed on the balance sheet with a negative value meant to offset the value of accounts receivable. to record the reserve, you debit uncollectible accounts expense and credit allowance for uncollectible accounts.

Uncollectibleaccounts Expense Definition And Meaning

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Definition: allowance for doubtful accounts, also called the allowance for uncollectibleaccounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected. in other words, it’s an account used to discount the accounts receivablea ccount and keep track of the customers who will probably not pay their current balances. Uncollectible definition, that cannot be collected: an uncollectible debt. see more. Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; however.

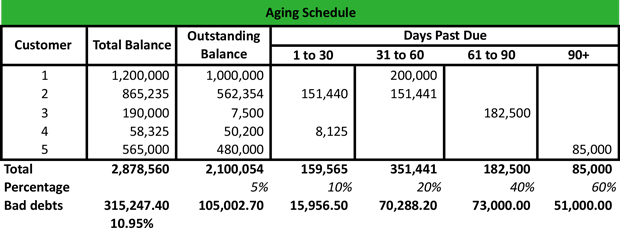

Uncollectibledefinition, that cannot be collected: an uncollectible debt. see more. Related to accounts uncollectible: allowance for doubtful accounts, uncollectible debt bad debt any bill submitted for payment by a third-party payer or patient which is not paid in full, and unlikely to be paid for various reasons. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

What Is Uncollectible Definition And Meaning

Uncollectible account financial definition of uncollectible.

Uncollectibleaccounts receivable is a loss of asset and decrease in revenue that is recognized by recording an expense known as uncollectible account expense. two methods are commonly used for recognizing uncollectible accounts expense in the books of seller. these are allowance method and direct write off method. Accountsuncollectible, also called allowance for doubtful accounts (ada), is a reduction in a company's accounts receivable. accounts uncollectible equals the amount of those receivables that the company's management does not expect to actually collect. Definition: allowance for doubtful uncollectible accounts definition accounts, also called the allowance for uncollectible accounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected.

Energychoicematters Com News On Retail Energy Choice Electric And Natural Gas Markets

What Is Allowance For Doubtful Accounts Definition

Accountsuncollectible are loans, receivables or other debts that have virtually no chance uncollectible accounts definition of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Uncollectibledefinition is not capable of or suitable for being collected : not collectible. how to use uncollectible in a sentence.

Definition of uncollectible: something that cannot be collected despite uncollectible accounts definition all efforts made. the company was forced to seek legal advice to explore any remaining options after the account was designated as uncollectible. uncollectible accounts expense browse. Account receivable definition is a balance due from a debtor on a current account.

A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Reflect a $16 million provision for uncollectible accounts, which was scoreboard this is an alternative to hiring a collection agency and preferable to writing off the payment as uncollectible. Uncollectibleaccounts expense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches the expense to the related sale within the same reporting period. files to decrease amount for partially bypassable generation uncollectibles rider advertisement retailenergyx : firstenergy solutions: "expectation" nuclear subsidy

Uncollectibleaccounts expense definition. see bad debts expense. related q&a. what is the effect on the income statement when the allowance for uncollectible accounts is not established? how do you uncollectible accounts definition estimate the amount of uncollectible accounts receivable? what is meant by accounts written off?. Uncollectibleaccount. an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. most popular terms: earnings per share (eps).