-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts 1, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts 1

link : Uncollectible Accounts 1

Uncollectible Accounts 1

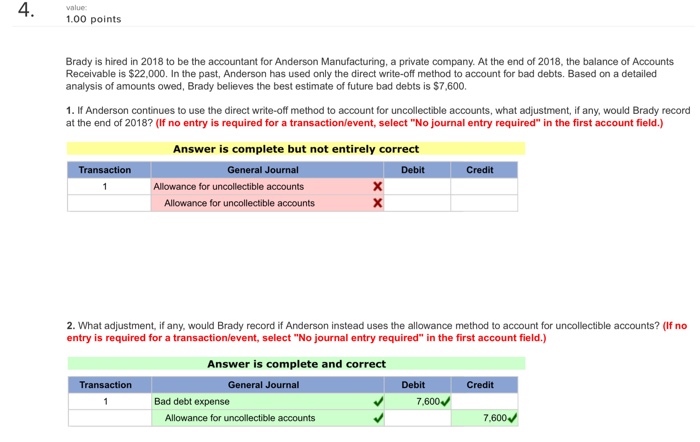

The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. 1) amount of uncollectible accounts expenses is $ 2,750 2) net realizable value of receivables at the end of year 2 is $65,040. explanation: accounts receivable balance, january 1, year 2 = $ 78,500 allowance for doubtful accounts, january 1, year 2 = $4,710 sales on account, year 2 = $550,000 collections of accounts receivable, year 2 = $556,000.

Solved: 1) when the allowance method is used to account fo.

Question: 1) when the allowance method is used to account for uncollectible accounts, bad debts expense is debited when * a) a customer's account becomes past-due. b) an account becomes bad and is written off. c) a sale is made. d) management estimates the amount of uncollectibles. 2) are company on july 15 sells merchandise on account to joe for $1,000, terms. The. 014 is the average percentage of uncollectible accounts receivable during year 1 through year 3. on the other hand, since that data suggest uncollectible accounts are increasing, from 1. 25% in year 1 to 1. 55% in year 3, the company could estimate its uncollectible accounts receivable to be $255 ($15,000 x. 017).

Currently uncollectible accounts can be removed uncollectible accounts 1 from active inventory after taking the necessary steps in the collection process. 5. 16. 1. 1. 3 (09-18-2018) responsibilities. the director, collection policy is responsible for overseeing policy and procedures regarding determinations to report accounts currently not collectible. 1. uncollectibleaccounts receivable are estimated and matched against sales in the same accounting period in which the sales occurred. 2. estimated uncollectibles are recorded as an increase to bad debts expense and an increase to allowance for doubtful accounts (a contra asset account) through an adjusting entry at the end of each period. 3.

advertisement retailenergyx : report: calif municipal aggregations returning some accounts to utility supply advertisement retailenergyx : report: nv energy paying nearly $1 million a year to keep henderson, lvcva as If the allowance account has a $5,000 credit balance before adjustment, the adjustment would be for $19,400 calculated as $24,400 estimated amount uncollectible from exhibit 1 5,000 existing credit balance in the allowance account. the entry would be:. labelarc /> Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. At the end of year 1, fulton corporation estimates uncollectible accounts to be $10,000. actual bad debts during year 2 totaled $12,000. this indicates that management's estimate of uncollectible accounts in year 1 was: too high. too low. fraudulent. Company xyz's balance sheet would then be adjusted to show $1 million of accounts receivable and $100,000 in an allowance for doubtful accounts, for a net accounts receivable of $900,000. note that accounts uncollectible is for amounts company xyz suspects will not be collected. Question: problem 7-1 uncollectible accounts; allowance method; income statement and balance sheet approach lo7-5, 7-6] swathmore clothing corporation grants its customers 30 days' credit. the company uses the allowance method for its uncollectible accounts receivable. during the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit. You plug it into the t-account, and solve for the ending balance of allowance for doubtful accounts. the second method is called the aging-of-accounts-receivable method. this method estimates the ending balance of the allowance for doubtful accounts directly. the way this method works is you multiply the accounts receivable on the balance sheet. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is uncollectible accounts 1 removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. 1) when the allowance method is used to account for uncollectible accounts, bad debts expense is debited when * a) a customer's account becomes past-due. b) an account becomes bad and is written off. c) a sale is made. d) management estimates the amount of uncollectibles. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. A company that estimates its uncollectible accounts receivable are $5,000 and a $200 credit balance in allowances for uncollectible accounts will increase the allowance account by $5,200. false. an aging of accounts receivable analyzes accounts receivable by age categories according to when payments are due. Sales on account are $250,000, so the uncollectible accounts 1 estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Businesses using the allowance method for the recognition of uncollectible accounts expense commonly experience four accounting events 1. recognition of uncollectible accounts expense through a year-end adjusting entry 2. write-off of uncollectible accounts 3. recognition of revenue on account. 4. directly from your designated bank account, deducting the uncollectible amount directly from the accounts funded by the transaction, and/or taking any 1. 166-1(e. thus, for cash-basis taxpayers, a bad debt deduction is generally not allowed for uncollectible accounts receivable since these items are normally not included in income until received. deducting business bad debts. the irs if you have undisclosed foreign bank accounts download free ebook what can you do if my situation irs enforcement action targeting: undisclosed foreign accounts / unreported income unreported crypto-currency / cannabis businesses it Also called uncollectible accounts. on august 1, harris co. determines that it cannot collect $200 from its customer, l. dash. harris co. uses the direct write-off method, so they will record the write-off of this account by debiting: bad debt expense. j. whitlock co. had $1,000 of credit cards sales. the net cash receipts were deposited. Accountsuncollectible are loans, receivables or other debts that uncollectible accounts 1 have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. A business having a $300. 00 credit balance in allowance for uncollectible accounts and estimating its uncollectible accounts to be $4,000. 00 would record a $4,300. 00 credit to allowance for uncollectible accounts.Accountsuncollectible Definition Example

Accounts Uncollectible Definition Investopedia