-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Receivable Balance Sheet, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Receivable Balance Sheet

link : Uncollectible Accounts Receivable Balance Sheet

Uncollectible Accounts Receivable Balance Sheet

Account For Uncollectible Accounts Using The Balance Sheet

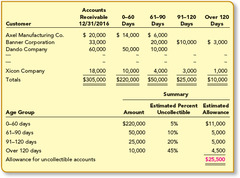

The balance-sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable. the difference between the current balance of allowance for doubtful accounts and the amount calculated using the balance sheet approach is the amount of bad debt expense for the period. The journal entry to record uncollectible accounts receivable balance sheet this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries: following is the balance sheet presentation. this figure assumes gross accounts receivable is $75,500.

Aging Method Of Accounts Receivableuncollectible Accounts

Accounts uncollectible are receivables, loans, or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy,. Uncollectible accounts receivable definition. the term uncollectible accounts receivable is used to describe the portion of credit sales in accounts receivable the company does not expect to collect from a customer. uncollectible accounts is used in the valuation of accounts receivable, which appears on a company's balance uncollectible accounts receivable balance sheet sheet. explanation.

The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Definition. the term uncollectible accounts receivable is used to describe the portion of credit sales in accounts receivable the company does not expect to collect from a customer. uncollectible accounts is used in the valuation of accounts receivable, which appears on a company's balance sheet. Under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows: notice that the preceding entry reduces the receivables balance for the item that is uncollectible. Allowance for uncollectible accounts definition allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

The nature of a company's accounts receivable balance depends on the sector and industry in which it operates, as well as the particular credit policies the corporate management has in place. a company documents its a/r as a current asset on what's called a balance sheet which shows how much money a company has (the assets) and how much it. initiative on ballot comed files updated purchase of receivables tariff sheet commonwealth edison filed with the illinois commerce commission an updated informational sheet setting forth discount factors under its purchase of receivables (por) program click for more texas qse to With an allowance for uncollectible accounts, the company determines the average number of accounts that enter default and records it on the balance sheet as a “contra asset” to offset the accounts receivable. this allows companies to anticipate write-downs of bad debt by accounting for them as early as uncollectible accounts receivable balance sheet possible.

An allowance for doubtful accounts is a contra-asset account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to be paid. A balance sheet approach, since it focuses on accounts receivable. an income statement approach, since it focuses uncollectible accounts receivable balance sheet on the amount of expense to be reported on the income statement. is required to be used by all companies because it focuses on what should be the most relevant and faithful representation of accounts receivable on the balance sheet.

The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable. The debit part of this entry is to the account uncollectible uncollectible accounts receivable balance sheet accounts expense. the aging method is often referred to as the balance sheet approach because the accountant attempts to measure, as accurately as possible, the net realizable value of accounts receivable, a balance sheet figure. Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

Walmart inc. annual balancesheet by marketwatch. view all wmt assets, cash, debt, liabilities, shareholder equity and investments. In this case, the business doesn't record an account receivable, but instead enters a liability on its balance sheet to an account known as unearned revenue or prepaid revenue. as the money is earned, either by shipping promised products, using the "percentage of completion" method, or simply as time passes, it gets transferred from unearned revenue on the balance sheet to sales revenue on the income statement. Writing off an account under the allowance method. under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts:.

The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. the method looks at the balance of accounts receivable at the end of the period and assumes that a certain amount will not be collected. Which method of accounting for uncollectible accounts receivable uses an estimate based on a percentage of sales $20. 25 the interest on a $5,400, 3%, 45-day note is. Costco wholesale corp. annual balancesheet by marketwatch. view all cost assets, cash, debt, liabilities, shareholder equity and investments. This figure assumes gross accounts receivable is $75,500. when you determine that a particular customer’s account is uncollectible (maybe the customer died and left no estate or closed up shop), your next step is to remove the balance from both allowance for uncollectible accounts and the customer accounts receivable balance.

The allowance for uncollectible accounts or allowance for doubtful accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is more likely be collected. the income statement account bad debts expense is part of the adjusting entry that increases the balance in the allowance for uncollectible accounts. The reason for the preference is because the method involves a contra asset account that goes against accounts receivables. a contra asset account is basically an account with an opposite balance to accounts receivables and is recorded on the balance sheet balance sheet the balance sheet is one of the three fundamental financial statements. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:.

Accounts uncollectible definition investopedia.