-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Normal Balance, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Normal Balance

link : Uncollectible Accounts Normal Balance

Uncollectible Accounts Normal Balance

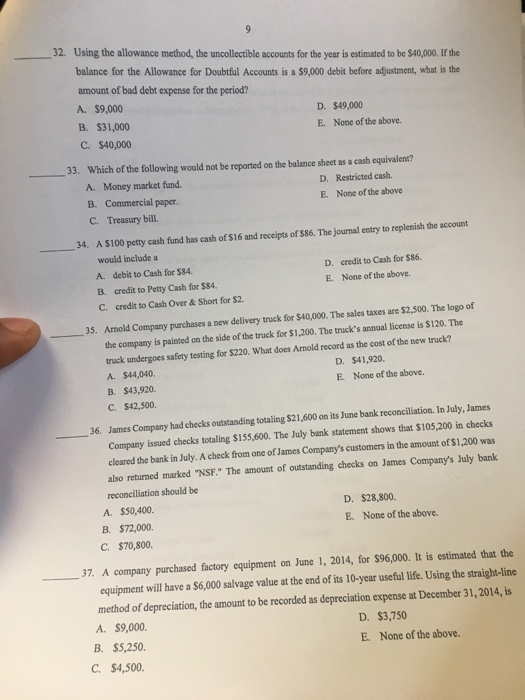

Uncollectible Accounts Expense Allowance Method

4 account(s) with a normal credit balance include: (select all that apply. ) part 3 of 4 check all that apply 0. 45 points accounts receivable ebook print references allowance for uncollectible accounts bad debt expense cash sales revenue. The allowance for uncollectible accounts has a normal balance because it is an asset account. false. accounts receivable represents a form of extending credit which requires customers to sign a promise to pay the business a definite sum at the maturity date, plus interest. false. 2. the normal balance of the account "allowance for uncollectible accounts" is a because a. debit; it is a contra revenue account to sales revenue b. credit; it is a contra asset account to accounts receivable c. debit; it is an expense in the income statement d. credit; it is a contra expense account to bad debt expense. The expense of an uncollectible account should be recorded in the accounting period that the account becomes uncollectible. (p. 412) t. 2. the account allowance for uncollectible accounts has a normal credit balance. (p. 412) f. 3. a business usually knows at the end of the fiscal year which customer accounts will become uncollectible. (p. 412.

U S Government Standard General Ledger Accounts And

Above, we assumed that the allowance for doubtful accounts began with a balance of zero. if instead, the allowance for uncollectible accounts began with a balance of $10,000 in june, we would make the following adjusting entry instead: $50,000 $10,000 = $40,000 (adjusting entry). The allowance for doubtful accounts account is listed on the asset side of the balance sheet, but it has a normal credit balance because it is a contra asset account, not a normal asset account. for more ways to add value to your company, download your free a/r checklist to see how simple changes in your a/r process can free up a significant. A contra account contains a normal balance that is the reverse of the normal balance for that class of account. the contra accounts noted in the preceding table are usually set up as reserve accounts against declines in the usual balance in the accounts with which they are paired. for example, a contra asset account such as the allowance for doubtful accounts contains a credit balance that is.

Chapter 8 Accounting Flashcards Quizlet

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Those bad debts are simply subtracted out of accounts receivable. it isn't normal to have a credit balance on an asset account. this is another reason allowance for doubtful accounts is referred to as a contra asset account. the contra account's credit balance keeps it from violating the cost principle. Normal balance: debit uncollectible accounts normal balance definition: the amount of cash authorized to be placed on u. s. federal government debit cards by federal agencies and held at personal risk by a federal agency representative. this account does not close at yearend. account title: funds held by the public account number: 1130 normal balance: debit.

Allowance For Doubtful Accounts Definition And Meaning

Allowance For Doubtful Accounts Is A Contra Asset Account

Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown as a contra asset account that reduces the gross receivables on the balance sheet to reflect the net amount that is expected to be paid. A contra account has an opposite normal balance to its paired account, thereby reducing or increasing the balance in the paired account at the end of a period; the adjustment can be an addition or a subtraction from a controlling account. in the case of the allowance for doubtful accounts, it is a contra account that is used to reduce the. Allowance for doubtful accounts has a credit balance of $500 at the end of the year (before adjustment), and uncollectible accounts expense is estimated at 3% of net sales. if net sales are $600,000, the amount of the adjusting entry to record the provision for doubtful accounts is. Allowance for doubtful accounts is classified as a(n) _____ and has a normal _____ balance. contra asset, credit. a company uses the allowance method to account for uncollectible accounts receivables. when the firm writes off a specific customer's account receivable.

On the balance sheet (exhibit 2), a write off adds to the balance of allowance for doubtful accounts. and this, in turn, is subtracted from the balance sheet asset category "accounts receivable. " the result appears as "net accounts receivable. " the write off thus ensures that net accounts receivable is lower than accounts receivable. Account title: imprest funds account numbe r: 1120 normal balance: debit definition: the amount of cash authorized to be held by agency cashiers at personal risk. this account does not close at yearend. account title: u. s. debit card funds account number: 1125 normal balance: debit definition: the amount of cash authorized to be placed on u. s. federal government debit cards.

Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 uncollectible accounts normal balance $1,200) in the allowance for doubtful accounts. Allowance for doubtful accounts is classified as a(n) _____ and has a normal _____ balance. contra asset, credit a company uses the allowance method to account for uncollectible accounts receivables. Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 $1,200) in the allowance for doubtful accounts.

Allowance for doubtful accounts: normal balance. the allowance for uncollectible accounts shows the company expects its customers to be unable to pay $750 of the $50,000 they owe. based on accounts receivable and the allowance for uncollectible accounts, the company would predict it could collect $49,250 ($50,000 $750) from its credit. Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible.

The normal balance of the account "allowance for uncollectible accounts" is a _____ because _____. a debit to allowance for uncollectible accounts and a credit to accounts receivable. when $2,500 of accounts receivable are determined to be uncollectible, which of the following should the company record to write off the accounts using the. Allowance for doubtful accounts is a contra asset account therefore its normal balance is a credit. however; a debit in the allowance represents accounts receivable written-off using the allowance. The most important part of the aging schedule is the number highlighted in yellow. it represents the amount that is required to be in the allowance of doubtful accounts. however, if there is already a credit balance existing in the allowance of doubtful accounts, then we only need to adjust it.

Allowance for doubtful accounts definition. allowance for doubtful accounts is a contra current asset account associated with accounts receivable. when the credit balance of the allowance for doubtful accounts is subtracted from the uncollectible accounts normal balance debit balance in accounts receivable the result is known as the net realizable value of the accounts receivable. Note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts).