-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts On The Balance Sheet, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts On The Balance Sheet

link : Uncollectible Accounts On The Balance Sheet

Uncollectible Accounts On The Balance Sheet

How To Estimate Uncollectible Accounts Dummies

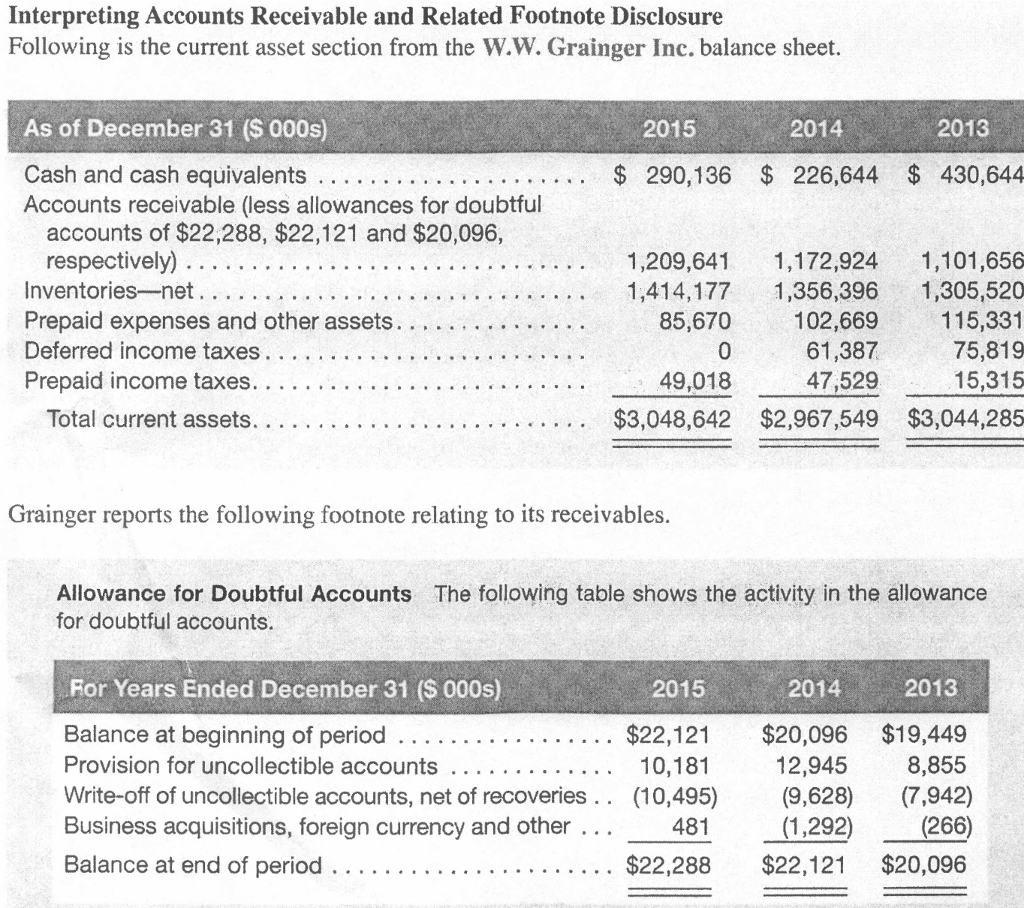

A contra asset account is basically an account with an opposite balance to accounts receivables and is recorded on the balance sheet balance sheet the balance sheet is one of the three fundamental financial statements. these statements are key to both financial modeling and accounting. This product computed will be the adjusted balance of the allowance for doubtful accounts. bad debts to be recognized is determined by deducting from the adjusted allowance its beginning balance.

The debit part of this entry is to the account uncollectible accounts expense. the aging method is often referred to as the balance sheet approach because the accountant attempts to measure, as accurately as possible, the net realizable value of accounts receivable, a balance sheet figure. Allowance for doubtful accounts has a debit balance of $500 at the end of uncollectible accounts on the balance sheet the year (before adjustments), and the uncollectible accounts expense is estimated at 3% of net sales. if net sales are $600,000, the amount of the adjusting entry to record the provision for doubtful accounts is.

On the balancesheet, the amount shown for the allowance for doubtful accounts is equal to the total estimated uncollectible accounts as of the end of the year under the direct write-off method of accounting for uncollectible accounts, bad debt expense is debited. The percent-of-sales method for computing uncollectible accounts: computes uncollectible-account expense as a percent of accounts receivable. takes a balance sheet approach. employs the expense recognition (matching) concept. will result in the same amount of estimated uncollectible-accounts expense as the aging-of-receivables method. Which method of accounting for uncollectible accounts receivable uses an estimate based on a percentage of sales $20. 25 the interest on a $5,400, 3%, 45-day note is.

Energychoicematters Com News On Retail Energy Choice Electric And Natural Gas Markets

Allowance for uncollectible accounts definition. allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. legal brief opposing inclusion uncollectible accounts on the balance sheet of electric choice initiative on ballot comed files updated purchase of receivables tariff sheet commonwealth edison filed with the illinois commerce commission an updated informational sheet setting The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable. The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected.

This account is a contra asset account the value of which is subtracted from the value of the accounts receivable account on the balance sheet. companies must estimate the amount of uncollectible accounts based on historic data. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to uncollectible accounts on the balance sheet debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each.

Writing Off An Account Under The Allowance Method

The balance-sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable. the difference between the current balance of allowance for doubtful accounts and the amount calculated using the balance sheet approach is the amount of bad debt expense for the period. The allowance for uncollectible accounts or allowance for doubtful accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is more likely be collected. the income statement account bad debts expense is part of the adjusting entry that increases the balance in the allowance for uncollectible accounts. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Uncollectible accounts receivable definition. the term uncollectible accounts receivable is used to describe the portion of credit sales in accounts receivable the company does not expect to collect from a customer. uncollectible accounts is used in the valuation of accounts receivable, which appears on a company's balance sheet. explanation. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. Overview of the allowance for doubtful accounts. the allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet, and is listed as a deduction immediately below the accounts receivable line item. this deduction is classified as a contra asset account. the allowance represents management’s best estimate of the amount of.

The allowance for doubtful accounts is reported as a(n) _____ on the balance sheet. deduction from accounts receivable all receivables that are expected to be realized in cash within a year are reported in the __________ section uncollectible accounts on the balance sheet of the balance sheet.

Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. Overview of the allowance for doubtful accounts. the allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet, and is listed as a deduction immediately below the accounts receivable line item. On the balancesheet after adjusting entries are uncollectible accounts on the balance sheet made, the amount shown for the allowance for doubtful accounts is equal to the. total estimated uncollectible accounts as of the end of the year. when the allowance method is used to account for uncollectible accounts, bad debts expense is debited when.