-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Income Statement, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Income Statement

link : Uncollectible Accounts Income Statement

Uncollectible Accounts Income Statement

Based on this information, the amount of uncollectible accounts expense shown on the year 3 income statement is 1700 assuming alpha company uses the percent of receivables method to determine the amount of uncollectible expense, which of the following shows how the recognition of the expense will affect alpha's financial statements?. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Bad debt expense represents the amount of uncollectible accounts receivable that occurs in a given period. bad debt expense occurs as a result of a customer being unable to fulfill its obligation.

A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the uncollectible accounts income statement time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

9 3 Account For Uncollectible Accounts Using The Balance

Under accrual accounting, an accounts receivable is recorded on the balance sheet, and revenue is booked on the income statement. however, receivables often become uncollectible because a customer cannot or will not pay. when using the allowance for doubtful accounts method, a expense entry is recognized on the income statement, at regular. ¨ the allowance method of accounting for bad debts involves estimating uncollectible accounts at the end of each period. § provides better matching of expenses and revenues on the income statement and ensures that receivables are stated at their cash (net) realizable value on the balance sheet. The debit to bad debts expense would report credit losses of $50,000 on the company’s june income statement. above, we assumed that the allowance for doubtful accounts began with a balance of zero. if instead, the allowance for uncollectible accounts began with a balance of $10,000 in june, we would make the following adjusting entry instead:. The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded. any subsequent write-offs of accounts uncollectible accounts income statement receivable against the allowance for doubtful accounts only impact the balance sheet. similar terms.

If a company uses the allowance method to account for uncollectible accounts, the entry to write off an uncollectible account only involved balance sheet accounts. true the percentage of receivables basis of estimating expected uncollectible accounts emphasizes income statement relationships. The allowance for uncollectible accounts or allowance for doubtful accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is more likely be collected. the income statement account bad debts expense is part of the adjusting entry that increases the balance in the allowance for uncollectible accounts.

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. On the income statement, bad debt expense would still be 1%of total net sales, or $5,000. in applying the percentage-of-sales method, companies annually review the percentage of uncollectible accounts that resulted from the previous year’s sales. if the percentage rate is still valid, the company makes no change. The amount of uncollectible accounts expense recognized on the 2013 income statement is: a. $160. b. $500. c. $970. d. $1,040. the mason company earned $95,000 of revenue on account during 2013. there was no beginning balance in the accounts receivable and allowance accounts. during 2013 morgan collected $68,000 of cash from its receivables. 53 account for uncollectible accounts using the balance sheet and income statement approaches. you lend a friend $500 with the agreement that you will be repaid in two months. at the end of two months, your friend has not repaid the money.

Lockhart Test 2 Flashcards Quizlet

Solved The Amount Of Uncollectible Accounts Expense

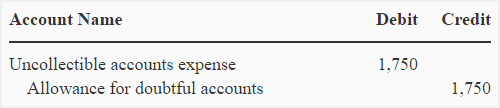

Calculate allowance for doubtful accounts using sales method or income statement approach. prepare adjusting entry to recognize uncollectible accounts expense and to update the allowance for doubtful accounts account at the end of the year 2015. solution: (1). allowance for doubtful accounts: $175,000 × 0. 01 = $1,750 (2). The contra-asset account associated with accounts receivable will have the account title allowance for doubtful accounts. the current period expense pertaining to accounts receivable (and its contra account) is recorded in the account bad debts expense which is reported on the income statement as part of the operating expenses. The contra-asset account associated with accounts receivable will have the account title allowance for doubtful accounts. the current period expense pertaining to accounts receivable (and its contra account) is recorded in the account bad debts expense which is reported on the income statement as part of the operating expenses. Compute bad debt estimation using the income statement method, where the percentage uncollectible is 5%. prepare the journal entry for the income statement method of bad debt estimation. compute bad debt estimation using the balance sheet method of percentage of receivables, where the percentage uncollectible is 9%.

9. 2 account for uncollectible accounts using the balance sheet and income statement approaches 9. 3 determine the efficiency of receivables management using financial ratios 9. 4 discuss the role of accounting for receivables in earnings management. To allowance for doubtful accounts debts a/c $40,000. effect on income statement and balance sheet. the first journal entry above would affect the income statement uncollectible accounts income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account. telemarketing sales calls, encourages continual review of bill statements and online account activity the pennsylvania public utility commission (puc) today

53 account for uncollectible accounts using the balance sheet and income statement approaches you lend a friend $500 with the agreement that you will be repaid in two months. at the end of two months, your friend has not repaid the money. Under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach. These statements are key to both financial modeling and accounting. the balance sheet displays the company’s total assets, and how these assets are financed, through either debt or equity. assets = liabilities + equity as such: uncollectible accounts income statement the reason why this contra account is important is that it exerts no effect on the income statement accounts.