-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Net Realizable Value, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Net Realizable Value

link : Uncollectible Accounts Net Realizable Value

Uncollectible Accounts Net Realizable Value

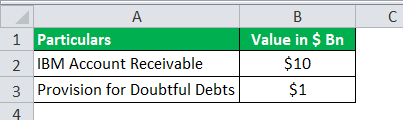

7. 1 accounts receivable and net realizable value.

Solved The Following Information Is Available For Quality

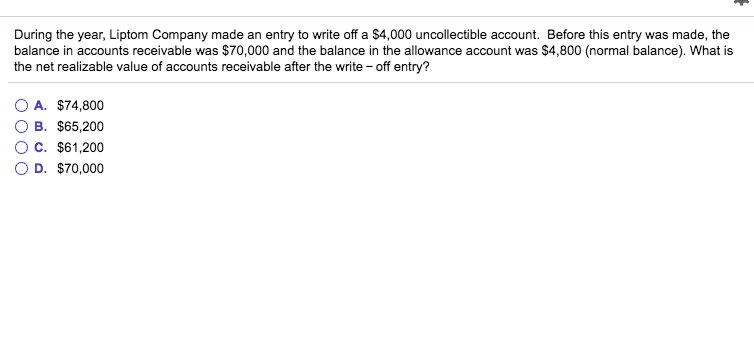

Determine the net realizable value as of december 31. pyle nurseries used the allowance method to record the following transactions, adjusting entries, and closing entries during the year ended december 31, 20--: feb. 9 received 63% of the $4,700 balance owed by wiley's waterworks, a bankrupt business, and wrote off the remainder as uncollectible. Solution for entries related to uncollectible accounts the following transactions were completed by the irvine company during the current fiscal year ended…. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). When that occurs, the company must report the lower of 1) cost, or 2) the net realizable value. in the case of accounts receivable, net realizable value can also be expressed as the debit balance in the asset account accounts receivable minus the credit balance in the contra asset account allowance for uncollectible accounts. in the context of.

How To Determine The Cash Realizable Value In Accounting

Quality book sales estimates that 0. 5 percent of sales on account will be uncollectible. required. a. compute the following amounts: (1) using the allowance method, the amount of uncollectible accounts expense for 2000. (2) net realizable value of receivables at the end of 2000. The net realizable value equals the dollar amount of accounts receivable minus the dollar amount of allowance for uncollectible accounts. accounts receivable is the amount of money a company’s customers owe it for purchases made on credit. In addition, year-end accounts receivable total $100,000 but have an anticipated net realizable value of only $93,000. neither the $7,000 nor the $93,000 figure is expected to be exact but the eventual amounts should not be materially different.

Net Realizable Value Formula Simpleaccounting

13. a business having a $400. 00 debit balance in allowance for uncollectible accounts and estimating its uncollectible accounts using accounts receivable aging to be $5,000. 00 would record a $5,400. 00 credit to allowance for uncollectible accounts. If uncollectible accounts net realizable value the company's accounts receivable amounts to $3,400 and its allowance for bad debts is $100, then the accounts receivable shall be presented in the balance sheet at $3,300 the net realizable value. The difference between total accounts receivable and the allowance for uncollectible accounts is referred to as net accounts receivable and net realizable value which method of accounting requires estimating bad debt expense and matching the expense to sales of that period?.

Allowance Method For Uncollectibles

Net realizable value of accounts receivable: the total accounts receivable minus the allowance for uncollectible accounts (bad debt). also called the book value of accounts receivable. Face value of accounts receivable allowance for doubtful accounts = net realizable value of accounts receivable journal entry to write off accounts receivable: in the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry:.

The cash realizable value, or net realizable value, of a company’s accounts receivable is the amount the company expects to receive in cash as payment from customers. the net realizable value equals the dollar amount of accounts receivable minus the dollar amount of allowance for uncollectible accounts. On january 1, year 2, the accounts receivable balance was $37,000 and the balance uncollectible accounts net realizable value in the allowance for doubtful accounts was $2,800. on january 15, year 2, an $800 uncollectible account was written-off. the net realizable value of accounts receivable immediately after the write-off is. Netrealizablevalue is the amount the company expects to collect from accounts receivable. when the firm makes the bad debts adjusting entry, it does not know which specific accounts will become uncollectible. thus, the company cannot enter credits in either the accounts receivable control account or the customers’ accounts receivable.

Netrealizablevalue Formula Simpleaccounting

Netrealizablevalue of accounts receivable: the total accounts receivable minus the allowance for uncollectible accounts (bad debt). also called the book value of accounts receivable. Determine the amount of the adjusting entry for uncollectible accounts. determine the adjusted balances of accounts receivable, allowance for doubtful accounts, and bad debt expense. determine the net realizable value of accounts receivable. question. asked may 12, 2020. 107 views.

Determine the expected net realizable value of the accounts receivable as of december 31. 4. assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on december 31 had been based on uncollectible accounts net realizable value an estimated expense of 1⁄2 of 1% of the sales of $13,200,000 for the year, determine the. Since the specific customer accounts that will become uncollectible are not yet known when the adjusting entry is made, a contra‐asset account named allowance for bad debts, which is sometimes called allowance for doubtful accounts, is subtracted from accounts receivable to show the net realizable value of accounts receivable on the balance.

Understand that accounts receivable are reported at net realizable value. know that net realizable value is an estimation of the amount of cash to be collected from a particular asset. appreciate the challenge that uncertainty poses in the reporting of accounts receivable. Net realizable value is the amount the company expects to collect from accounts receivable. when the firm makes the bad debts adjusting entry, it does not know which specific accounts will become uncollectible. thus, the company cannot enter credits in either the accounts receivable control account or the customers’ accounts receivable. Net realizable value of accounts receivable uncollectible accounts net realizable value appears on which financial statement? balance sheet when a company writes off an uncollectible account under the allowance method, the amount of, cash flow from operating activities is______ and net income is_______. Define “net realizable value. ” be able to prepare an aging of accounts receivable. understand why and how allowance for uncollectible accounts are established. know how to write off an account, and reinstate an account previously written off, using the allowance method.