-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Expense Normal Balance, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Expense Normal Balance

link : Uncollectible Accounts Expense Normal Balance

Uncollectible Accounts Expense Normal Balance

Recording uncollectible accounts expense and bad debts.

The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable. Allowance for doubtful accounts is classified as a(n) _____ and has a normal _____ balance. contra asset, credit a company uses the allowance method to account for uncollectible accounts receivables. First, let’s determine what the term bad debt means. sometimes, at the end of the fiscal period, when a company goes to prepare its financial statements, it needs to determine what portion of its receivables is collectible. the portion that a company believes is uncollectible is what is called “bad debt expense. ” the. Accounts with balances that are the opposite of the normal balance are called contra accounts; hence contra revenue accounts will have debit balances. let's illustrate revenue accounts by assuming your company performed a service and was immediately paid the full amount of $50 for the service.

Accountsuncollectible Definition Investopedia

Differences between uncollectible & bad debt expense. bad debt expense and uncollectible accounts expense are often used interchangeably. they refer to the recognition of an uncollectible accounts expense normal balance expense, when accounts receivable or notes receivable become uncollectible. the allowance for bad debt is a contra asset account listed on the balance sheet. The normal balance of the account "allowance for uncollectible accounts" is a _____ because _____. a debit to allowance for uncollectible accounts and a credit to accounts receivable. when $2,500 of accounts receivable are determined to be uncollectible, which of the following should the company record to write off the accounts using the. Accounts with balances that are the opposite of the normal balance are called contra accounts; supplies expense, and interest expense. in a t-account, their balances will be on the left side. to illustrate an expense let's assume that on june 1 your company paid $800 to the landlord for the june rent. the debits and credits are shown in the. The normal balance of the account "allowance for uncollectible accounts" is a _____ because _____. a debit to allowance for uncollectible accounts and a credit to accounts receivable. when $2,500 of accounts receivable are determined to be uncollectible, which of the following should the company record to write off the accounts using the.

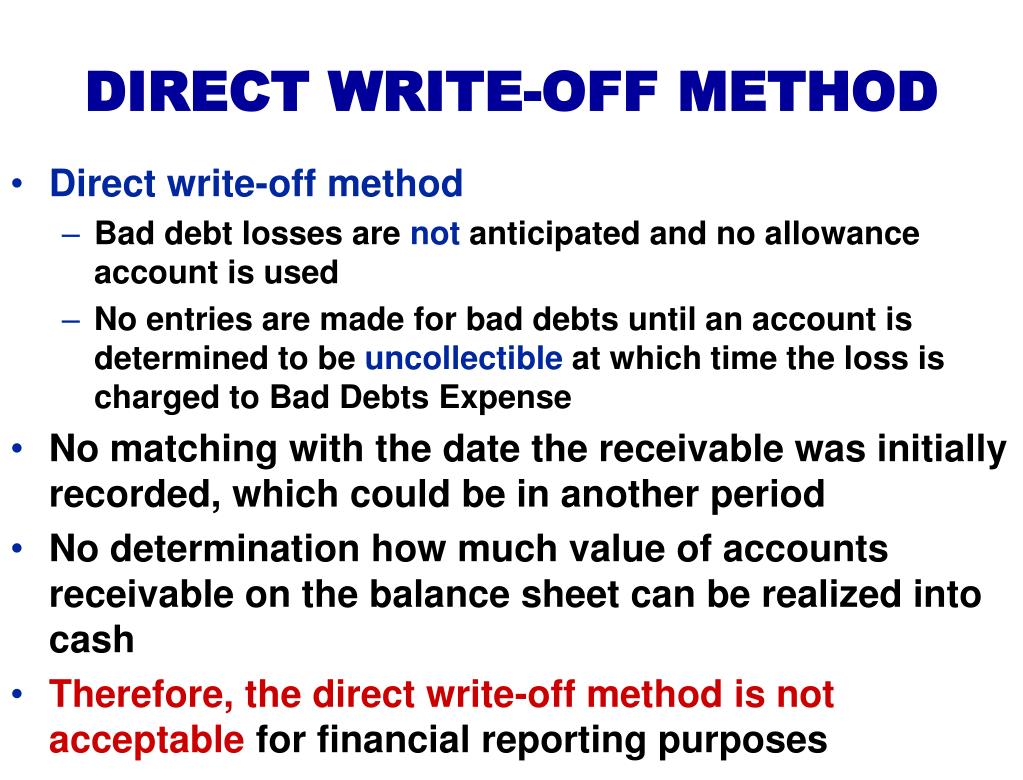

On april 4, a $2,000 account receivable from j. p. moore has been determined to be uncollectible. using the direct write-off method, the entry to write off the account would include a debit to bad debt expense. When the credit balance of the allowance for doubtful accounts is subtracted from the debit balance in accounts receivable the result is known as the uncollectible accounts expense normal balance net realizable value of the accounts receivable. the credit balance in this account comes from the entry wherein bad debts expense is debited. The balance sheet aging of receivables method estimates bad debt expenses based on the balance in accounts receivable, but it also considers the uncollectible time period for each account. the longer the time passes with a receivable unpaid, the lower the probability that it will get collected.

Chapter 9 Questions Flashcards Quizlet

Allowance for doubtful accounts definition and meaning.

Allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not uncollectible accounts expense normal balance expect to collect. when customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. The current debit balance in allowance for uncollectible accounts before adjustment is $742. under the percent-of-sales, the uncollectible accounts expense is $2,435. what is the amount of the journal entry for estimated uncollectible accounts?.

A contra account contains a normal balance that is the reverse of the normal balance for that class of account. the contra accounts noted in the preceding table are usually set up as reserve accounts against declines in the usual balance in the accounts with which they are paired. for example, a contra asset account such as the allowance for doubtful accounts contains a credit balance that is. The allowance for doubtful accounts account is listed on the asset side of the balance sheet, but it has a normal credit balance because it is a contra asset account, not a normal asset account. for more ways to add value to your company, download your free a/r checklist to see how simple changes in your a/r process can free up a significant. A contra asset account is basically an account with an opposite balance to accounts receivables and is recorded on the balance sheet balance sheet the balance sheet is one of the three fundamental financial statements. these statements are key to both financial modeling and accounting. the balance sheet displays the company’s total assets.

Bad Debt Overview Example Bad Debt Expense Journal

Balance sheet 11. working capital and liquidity 12. income statement 13. cash flow statement 14. financial ratios 15. bank reconciliation 16. accounts receivable and bad debts expense 17. accounts payable 18. inventory and cost of goods sold 19. depreciation 20. payroll accounting 21. bonds payable 22. stockholders' equity 23. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income.

Chapter 9 Acct Multiple Choice Flashcards Quizlet

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Recording uncollectible accounts expense and bad debts. november 14, 2018 november 3, that is, the first result of their analysis is the desired year-end balance of the allowance account. then, a normal cash receipt could be recorded:.

60. what is the type of account and normal balance of allowance for doubtful accounts? a. contra asset, credit b. asset, debit c. asset, credit d. contra asset, debit 61. when the allowance method is used uncollectible accounts expense normal balance to account for uncollectible accounts, bad debts expense is debited when 62. a debit balance in the allowance for doubtful accounts 63. to record estimated uncollectible receivables using the. 4. the allowance for doubtful accounts is a contra-asset account, which is presented as a subtraction from accounts receivable. [exercise] on december 31, 20×1, entity b had $250,000 balance of accounts receivable. it is estimated that 2% of accounts receivable balance may be uncollectible.

Normalbalance Of Accounts Double Entry Bookkeeping

For example, if the porter company’s allowance account had a $300 debit balance before the entry to record the uncollectible accounts expense was made, the allowance account would require a credit entry of $20,000 in order to establish the necessary ending balance of $19,700. Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance. the normal balance of any account uncollectible accounts expense normal balance is the balance (debit or credit) which you would expect the account have, and is governed by the accounting equation. On january 1, 2005, the allowance for doubtful accounts had a credit balance of $2400. during 2005, abc wrote-off accounts receivable totaling $1,800 and made credit sales of $100,000. after the adjusting entry, the december 31, 2005, balance in the uncollectible accounts expense would be.