-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Written Off, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Written Off

link : Uncollectible Accounts Written Off

Uncollectible Accounts Written Off

Journal entry to write off accounts receivable: in the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry: the above entry is recorded every time a receivable actually proves to be uncollectible. Apr 03, 2020 · accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Recovery Of Uncollectible Accountsbad Debts Allowance

Accounting For Uncollectible Receivables

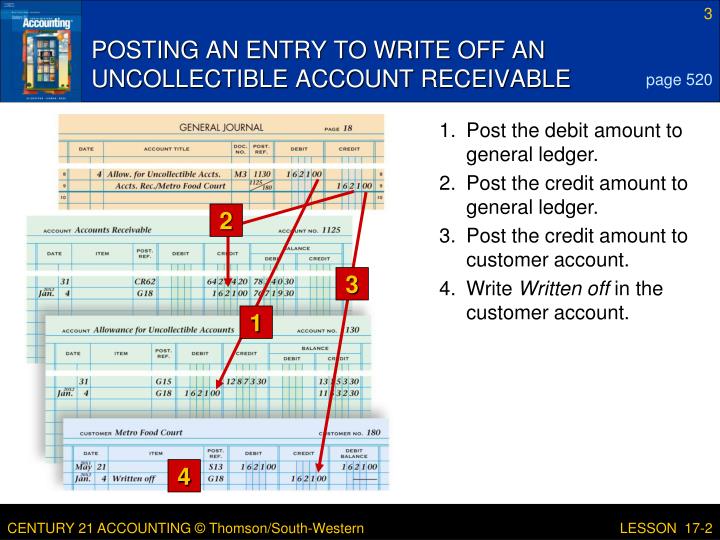

The entry to write off a bad account depends on whether the company is using the direct write-off method or the allowance method. examples of the write-off of a bad account. under the direct write-off method a company writes off a bad account receivable when a specific account is determined to be uncollectible. this usually occurs many months. Accounts uncollectible are loans, receivables or other uncollectible accounts written off debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. With the direct write-off method, many accounting periods may come and go before an account is finally determined to be uncollectible and written off. as a result, revenues from credit sales are recognized in one period, but the costs of uncollectible accounts related to those sales are not recognized until another subsequent period (producing.

Gaap Rules For Writing Off Accounts Receivable Your Business

If a company uses the allowance method to account for uncollectible accounts, the entry to write-off an uncollectible account only involves balance sheet accounts. t/f. true. voight company's account balances at december 31 for accounts receivable was $1,400,000 and for the allowance for doubtful accounts was $70,000 (credit). Direct-write off method; allowance method; direct write-off: in the direct write-off method, when after a few years of trying to recover the amount the invoice is declared as bad or uncollectible, it is directly written off or expensed out in the income statement by debiting bad debt expense and crediting accounts receivable. Under the allowance method, when an account becomes uncollectible and must be written off, a. sales should be debited b. bad debt expense should be credited c. allowance for doubtful accounts uncollectible accounts written off should be credited d. accounts receivable should be credited.

Gaap rules for writing off accounts receivable. at some point during the life of your business, you'll likely have to write off an invoice for a customer who never makes payment. if you maintain the business's books and records in accordance with generally accepted accounting principles, or gaap, there are two. Gaap rules for writing off accounts receivable. at some point during the life of your business, you'll likely have to write off an invoice for a customer who never makes payment. if you maintain the business's books and records in accordance with generally accepted accounting principles, or gaap, there are two. No previously written-off accounts receivable were reinstated during 2021. at 12/31/2021, gross accounts receivable totaled $166,700, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 18,300. required: 1. The journal entry used to write off an uncollectible account is the same, regardless of the method used to calculate the estimate uncollectible accounts written off of allowance for uncollectible accoutns. true. a company may continue its attempts to collect an account even after the account has been written off.

Recovery Of Uncollectible Accountsbad Debts Allowance

Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. With the direct write-off method, many accounting periods may come and go before an account is finally determined to be uncollectible and written off. as a result, revenues from credit sales are recognized in one period, but the costs of uncollectible accounts related to those sales are not recognized until another subsequent period (producing an unacceptable mismatch of revenues and expenses).

In accounting, bad debts are typically written off in two ways, though the proper way to write off the bad debt depends on how you account for the possible bad debts. you can either use an allowance method or a direct write-off method. uncollectible accounts written off however, the generally accepted accounting principles only allows for the use of the allowance method. When the allowanceethod is used to account for uncollectible accounts, bad debt expense is debited when _____ management estimates the amount of uncollectibles when an account becomes uncollectible and must be written off, accounts receivable should be_____. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable.