-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Expense Is Another Name For, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Expense Is Another Name For

link : Uncollectible Accounts Expense Is Another Name For

Uncollectible Accounts Expense Is Another Name For

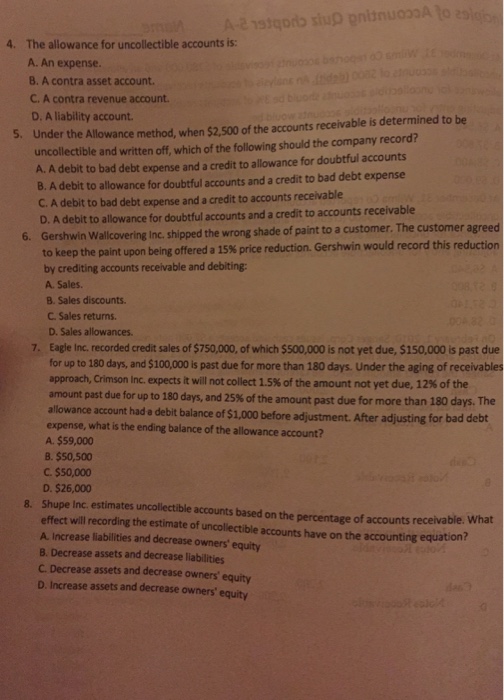

Accounting Chapter 9 Quiz Flashcards Quizlet

link:label >description of reason why sufficient information is not available to account for multi-employer or state plan as defined benefit The offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. in accounting, an item is deemed material if it is large enough to affect the judgment of an informed financial statement user. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts uncollectible accounts expense is another name for in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

Uncollectibleaccountsexpense Accountingtools

Accountsuncollectible definition investopedia.

Chapter 9 Acct Multiple Choice Flashcards Quizlet

The debit part of the adjusting entry is made to the uncollectible accounts expense account. another title for this account is bad debt expense, this account is closed to income summary and is generally shown as a selling expense on the income statement. however, some firms show this item as a deduction from gross sales in arriving at net sales. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Uncollectible accounts receivable is a loss of asset and decrease in revenue that is recognized by recording an expense known as uncollectible account expense. two methods are commonly used for recognizing uncollectible accounts expense in the books of seller. these are allowance method and direct write off method.

suppliers under amnesty program june 25 retail supplier has taken another step click for more puc raps utility's, " Another name for uncollectible accounts. recording uncollectible accounts expense only when an amount is actually known. wrote off a customer's past due account as uncollectible-direct write-off method. debit-uncollectible accounts expense credit-accounts receivable/customer name. information" means information relating to a person who is or can be identified directly from that information this includes your name, address, telephone number, email address, credit card or other account number 22 how we use the information Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; uncollectible accounts expense is another name for however.

Uncollectibleaccount Financial Definition Of

Accounts receivable and bad debts expense 17. accounts payable 18. inventory and cost of goods sold 19. depreciation 20. payroll accounting 21. bonds payable 22. stockholders' equity 23. present value of a single amount 24. present value of an ordinary annuity 25. future value of a single amount 26. nonprofit accounting 27. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Debit-uncollectible accounts expense credit-accounts receivable/customer name receive cash in full payment of a customer's account, previously written off as uncollectible-direct write-off method (the first step). Abc company uses the estimate of sales method of accounting for uncollectible accounts. abc estimates that 3% of all credit sales will be uncollectible. on january 1, 2005, the allowance for doubtful accounts had a credit balance of $2400. during 2005, abc wrote-off accounts receivable totaling $1,800 and made credit sales of $100,000. Another way to record bad debt expense or uncollectible accounts in the financial statements is by using the allowance method. this method adheres to the matching principle and the procedural standards of gaap. in the allowance method, a company estimates the amount of uncollectible accounts it will incur as a percentage of credit sales.

A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap.

Another name for uncollectible-account expense interest the borrower's cost of renting money from a lender. interest is revenue for the lender and expense for the borrower. Recording uncollectible accounts expense and bad debts. november 14, 2018 november 3, 2018 by rashidjaved. the risk of extending credit arises from the possibility that the customer will not pay. this risk impacts both the measurement of income and the description of the receivables held by the seller. the accountant’s task involves. Accounts written off as uncollectible during 2017 500 bad expense is estimated by the aging-of-receivables method. management estimates that $2,850 of accounts receivable will be uncollectible. calculate the amount of net accounts receivable after the adjustment for bad debts. a. $19,150 b. $20,150 c. $18,150 d. $17,650.

Alpha estimates uncollectible accounts expense to be 1% of receivables. based on this information, the amount of uncollectible accounts expense shown on the yr. 3 income statement is. $1,700. an aging schedule is used to improve the estimate used in the percent of revenue method of determining the uncollectible accounts expense. this statement. The allowance method follows gaap matching principle since we estimate uncollectible accounts at the end of the year. we use this estimate to record bad debt expense and to setup a reserve account called allowance for doubtful accounts (also called allowance for uncollectible accounts) based on previous experience with past due accounts. Uncollectibleaccountsexpense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches the expense to the related sale within the same reporting uncollectible accounts expense is another name for period.

After writing off the bad account on august 24, the net realizable value of the accounts receivable is still $230,000 ($238,600 debit balance in accounts receivable and $8,600 credit balance in allowance for doubtful accounts). the bad debts expense remains at $10,000; it is not directly affected by the journal entry write-off. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. The risk of extending credit arises from the possibility that the customer will not pay. this risk impacts both the measurement of income and the description of the receivables held by the seller. the accountant’s task involves consideration of these three issues: 1. what is the nature of the loss? 2. when does the loss read morerecording uncollectible accounts expense and bad debts.