-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Written Off Journal Entry, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Written Off Journal Entry

link : Uncollectible Accounts Written Off Journal Entry

Uncollectible Accounts Written Off Journal Entry

Accounting quiz flashcards quizlet.

The journal entry also credits the accounts receivable account for $100. in combination, these two entries zero out the allowance for the uncollectible a/r account and remove the uncollectible amount from the accounts receivable account. writing off an actual, specific uncollectible receivable for invoice should be done on a case-by-case basis. When a written of account is recovered, the first step is to reinstate it in the accounting record. the following journal entry is made for this purpose: notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. see uncollectible accounts expense allowance method. (2).

Accounting Quiz Flashcards Quizlet

Journal entry to write off accounts receivable: in the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry: the above entry is recorded every time a receivable actually proves to be uncollectible. As more and more debts are written off, the balance in the allowance account decreases. recovered bad debts. when any bad debt is recovered, two journal entries are passed. the first one reverses the write-off entry and the second one is a routine journal entry to record collection. thus:. Journalentry to write off accounts receivable: in the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry: the above entry is recorded every time a receivable actually proves to be uncollectible. Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected.

How To Write Off Uncollectible Accounts Bizfluent

During 2012, it wrote off $12,960 of accounts and collected $3,780 on accounts previously written off. the balance in accounts receivable was $360,000 at 1/1 and $432,000 at 12/31. at 12/31/12, black estimates that 5% of accounts receivable will prove to be uncollectible. In accounting, bad debts are typically written off in two ways, though the proper way to write off the bad debt depends on how you account for the possible bad debts. you can either use an allowance method or a direct write-off method. however, the generally accepted accounting uncollectible accounts written off journal entry principles only allows for the use of the allowance method.

Step 1: add an expense account to track the bad debt. go to the lists menu and select chart of accounts. select the account menu and then new. select expense, then continue. enter an account name, for example, bad debt. select save and close. step 2: close out the unpaid invoices. go to the customers menu and select receive payments. During the year, kiner company made an entry to write-off a $16,000 uncollectible account. before this entry was made, the balance in accounts receivable was $200,000 and the balance in the allowance account was $18,000. the net realizable value of accounts receivable after the write-off entry was.

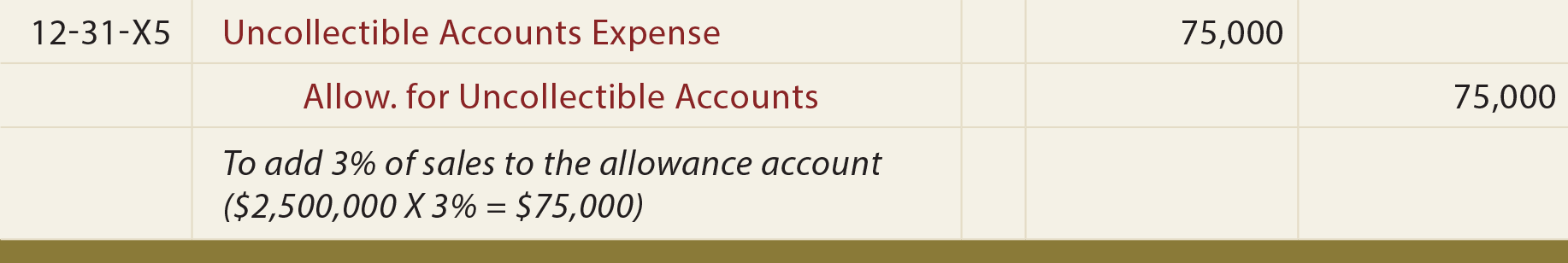

Direct write-offs. the direct write-off method is simpler than the allowance method since it only requires one journal entry and doesn't utilize estimates. essentially, you write off ar balances one customer account at a time when it's pretty clear that it's unlikely the customer will ever pay what is owed. With the direct write-off method, the journal entry to write-off an uncollectible account includes a debit to _____ and a credit to _____. bad debt expense; accounts receivable the direct write-off method is not normally an acceptable method under gaap because it fails to report _____. Credit: accounts receivable/notes receivable received cash in full payment of sanderson company's account, previously written off as uncollectible (first entry) journal: uncollectible accounts expense. The uncollectible accounts written off journal entry allowance account is established and adjusted with the following journal entry: debit bad debts expense, and; credit allowance for doubtful accounts. when a specific customer's account is identified as uncollectible, the journal entry to write off the account is: a credit to accounts receivable (to remove the amount that will not be collected).

Chapter 14 Journalizing Ar Nr Transactions Flashcards

Allowance Method For Uncollectibles

The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value uncollectible accounts written off journal entry of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable.

Direct write-off: in the direct write-off method, when after a few years of trying to recover the amount the invoice is declared as bad or uncollectible, it is directly written off or expensed out in the income statement by debiting bad debt expense and crediting accounts receivable. the following journal entry is passed:. Accounts receivable journal entry account receivable is the amount which the company owes from the customer for selling its goods or services and the journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the sales account.

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. Mr. unreal pays his billing amount on 8 jan 2019 and avails the discount. accounting for bad debts. while making sales on credit, the company is well aware that not all of its debtors will pay in full and the company has to encounter some losses called bad debts. bad debts expenses can be recorded using two methods viz. 1. ) direct write-off method and 2. ). Writing off accounts. when an allowance method is used, how are individual accounts written off? the following entry would be needed to write off a specific account that is finally deemed uncollectible: notice that the entry reduces both the allowance account and the related receivable, and has no impact on the income statement.

In the direct write-off method, uncollectible accounts receivable are directly written off against income at the time when they are actually determined as bad debts. when debt is determined as uncollectible, a journal entry is passed in which bad debts expense account is debited and accounts receivable account is credited as shown below. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

Direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the uncollectible accounts written off journal entry direct write-off approach is as follows:. The entry to write off a bad account depends on whether the company is using the direct write-off method or the allowance method. examples of the write-off of a bad account. under the direct write-off method a company writes off a bad account receivable when a specific account is determined to be uncollectible. this usually occurs many months. Journalentry for the direct write-off method. one method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts receivable and recording this as a bed debt expense in the income statement of the business.