-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Expense Debit Or Credit, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Expense Debit Or Credit

link : Uncollectible Accounts Expense Debit Or Credit

Uncollectible Accounts Expense Debit Or Credit

How To Calculate Uncollectible Accounts Expense Basic

Normal Balance Of Accounts Debits Credits Examples

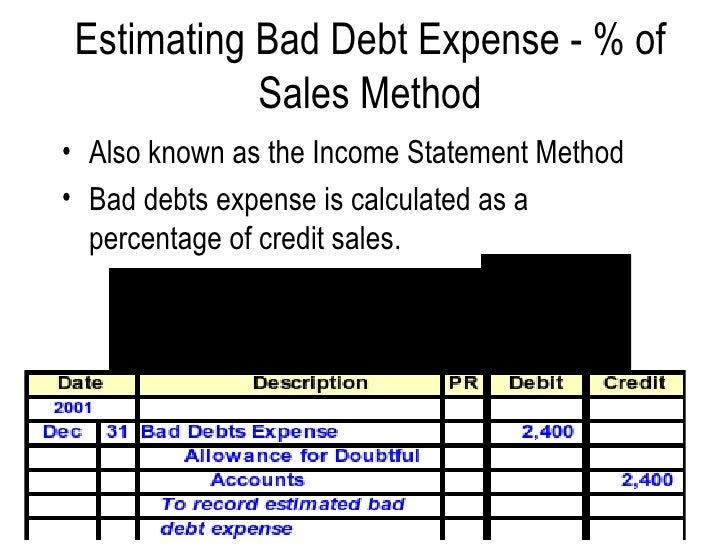

A20. to recognize the portion of accounts receivable that may be uncollectible, bad debts expense is recorded on the debit side and the allowance for doubtful accounts is recorded on the credit side. to increase the balance of the allowance for doubtful accounts to $4,500:. 2. using the results of part 1, calculate the christopher corporation’s january uncollectible accounts expense if january’s credit sales are $4,000,000. uncollectible accounts expense = credit sales x percentage of credit sales not collected. uncollectible accounts expense = $4,000,000 x. 035 = $140,000. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. 1,000 (debit) net credit sales for 2017 92,000 accounts written off as uncollectible during 2017 500 bad expense is estimated by the aging-of-receivables method. management estimates that $2,850 of accounts receivable will be uncollectible. calculate the amount of net accounts receivable after the adjustment for bad debts. a. $19,150 b. $20,150.

Provision For Credit Losses Pcl Definition Example

Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 $1,200) in the allowance for doubtful accounts. First, let’s determine what the term bad debt means. sometimes, at the end of the fiscal period, when a company goes to prepare its financial statements, it needs to determine what portion of its receivables is collectible. the portion that a company believes is uncollectible is what is called “bad debt expense. ” the. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. The first journal entries under the allowance method include a debit to bad debt expense and a credit to allowance for doubtful accounts. when the company considers an account to be completely uncollectible, it makes a debit to allowance for doubtful accounts and a credit to accounts receivable.

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful uncollectible accounts expense debit or credit accounts). Increases to the account are also recorded in the income statement account uncollectible accounts expense. example of provision for credit losses company a’s ar has a debit balance of $100,000.

Accounting Chapter 9 Quiz Flashcards Quizlet

How to calculate uncollectible accounts expense basic.

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Allowance for uncollectible accounts 1600 if, however, there had been a debit balance of $200 then a credit to allowance for uncollectible accounts of $2,000 would be necessary to bring the closing balance to $1,800. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries:.

Debit: uncollectibleaccountsexpensecredit: allowance for uncollectibleaccounts. wrote of sanderson company's past-due account as uncollectible. journal: uncollectible accounts expense debit: allowance for uncollectible accounts credit: accounts receivable/notes receivable. 45. allowance for doubtful accounts has a debit uncollectible accounts expense debit or credit balance of $1,200 at the end of the year (before adjustment). the company prepares an analysis of customers' accounts and estimates the amount of uncollectible accounts to be $13,900. which of the following adjusting entries is needed to record the bad debt expense for the year? a. After writing off the bad account on august 24, the net realizable value of the accounts receivable is still $230,000 ($238,600 debit balance in accounts receivable and $8,600 credit balance in allowance for doubtful accounts). the bad debts expense remains at $10,000; it is not directly affected by the journal entry write-off.

Answer to entries for uncollectible debts, using direct write-off technique obj. 3journalize the following transactions within the. more co. uses the direct write-off approach of accounting for uncollectible debts receivable. the access to put in writing off an account that has been decided to be uncollectible might be as follows: a. debit income returns and allowances; credit accounts receivable. Debit bad debts expense, and; credit allowance for doubtful accounts. when a specific customer's account is identified as uncollectible, the journal entry to write off the account is: a credit to accounts receivable (to remove the amount that will not be collected) a debit to allowance for doubtful accounts (to reduce the allowance balance that. The debit to bad debts expense would report credit losses of $50,000 on the company’s june income statement. above, we assumed that the allowance for doubtful accounts began with a balance of zero. if instead, the allowance for uncollectible accounts began with a balance of $10,000 in june, we would make the following adjusting entry instead:. certain actions in the event that a check, credit card, debit card or account, deducting the uncollectible amount directly from the accounts

Question: raintree cosmetic company sells its products to customers on a credit basis. an adjusting entry for bad debt expense is recorded only at december 31, the company's fiscal year-end. the 2020 balance sheet disclosed the following: current assets: receivables, net of allowance for uncollectible uncollectible accounts expense debit or credit accounts of $46,000 $ 512,000 book erences during 2021, credit. Since expenses are usually increasing, think "debit" when expenses are incurred. (we credit expenses only to reduce them, adjust them, or to close the expense accounts. ) examples of expense accounts include salaries expense, wages expense, rent expense, supplies expense, and interest expense. in a t-account, their balances will be on the left side. Bad debt expense = (accounts receivable ending balance x percentage estimated as uncollectible) existing credit balance in allowance for doubtful accounts or + existing debit balance in allowance for doubtful accounts. using the same information as before, rankin makes an estimate of uncollectible accounts at the end of the year.

Debit: credit: uncollectibleaccountsexpense: 1600: allowance for uncollectibleaccounts: 1600. if, however, there had been a debit balance of $200 then a credit to allowance for uncollectible accounts of $2,000 would be necessary to bring the closing balance to $1,800. journal: date: description: post ref. debit:. Debit: accounts receivable/notes receivable credit: allowance for uncollectible accounts received cash in full payment of sanderson company's account, previously written off as uncollectible (second entry). Exercise 5-21 complete the accounting cycle using receivable transactions (l05-1,5-4,5-5, 5-7,5-8) (gl) on january 1, 2021, uncollectible accounts expense debit or credit the general ledger of 3d family fireworks includes the following account balances: credit debit $ 26,300 14,800 $ 3,200 accounts cash accounts receivable allowance for uncollectible accounts supplies notes receivable (6%, due in 2 years) land accounts payable common stock.