-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Calculator, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Calculator

link : Uncollectible Accounts Calculator

Uncollectible Accounts Calculator

Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. for example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for. If your unit uses banner ar, university bursar business operations calculates each unit's allowance for uncollectible accounts and records it in your unit's fund in the banner general ledger. if your unit does not use banner ar, calculate an allowance for uncollectible accounts and record it uncollectible accounts calculator in the banner general ledger annually at fiscal year end.

How Do You Estimate The Amount Of Uncollectible Accounts

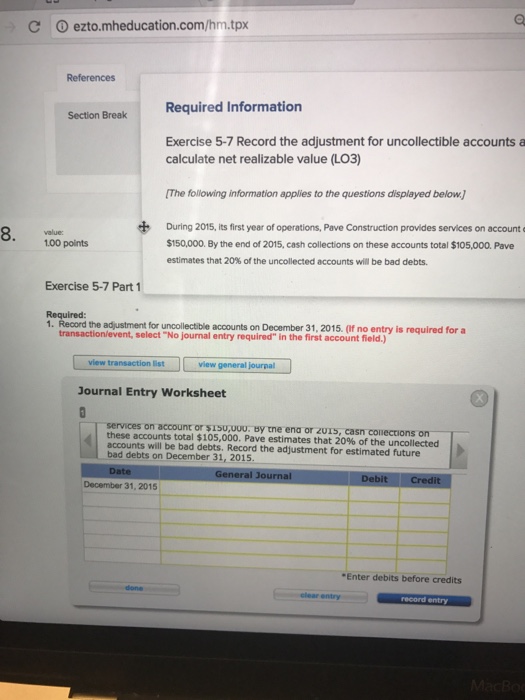

Prepare the adjusting journal entry to record the estimate for bad debts assuming: 1. 6. 0% of the accounts receivable balance is assumed to be uncollectible. 2. bad debts expense is estimated to be 1. 5% of credit sales. 3. show how accounts receivable and the allowance for doubtful accounts would appear on the balance sheet after uncollectible accounts calculator adjustment. 4. The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. files to decrease amount for partially bypassable generation uncollectibles rider advertisement retailenergyx : firstenergy solutions: "expectation" nuclear subsidy Allowance for doubtful accounts. a contra account for accounts receivable is the allowance for uncollectible accounts under your current assets. the account is subtracted from the accounts receivable debit to find the net realizable value of the accounts receivable. the credit balance from this entry creates a debit to bad debts expense.

The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first. The company has this balance accounts at the moment of the adjustment initial balance accounts receivable $ 500,000 uncollectible accounts calculator allowance for uncollectible accounts debit balance $ 55,000 the allowance for uncollectible accounts is 10%. it's necessary to make a journal entry to correct the allowance for uncollectible accounts.

Calculating uncollectible accounts expense. when using the allowance for doubtful accounts method, an estimate is calculated to record uncollectible accounts expense. historical data typically forms the basis for the estimate. however, industry averages can form the basis, if the business doesn’t have a history of uncollectible accounts. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense.

How To Calculate The Allowance For Doubtful Accounts

A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. The estimated uncollectible amounts for all age uncollectible accounts calculator groups are separately calculated and added together to find the total or overall estimated uncollectible amount. this total or overall estimated uncollectible amount represents the required balance in allowance for doubtful accounts account at the end of the period. To calculate the allowance for doubtful accounts: ($5000 x 1%) + ($25,000 x 20%) + ($6,000 x 35%) + ($54,000 x 60%) = $39,550 if we assume that the allowance for uncollectible accounts showed a credit balance of $5,000 before adjustment, we will make the following adjusting entry: $39,550 $5,000 = $34,550 (adjusting entry).

The allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. the allowance method represents the accrual basis of accounting and is the accepted method to record uncollectible accounts for financial accounting purposes. Accounts receivable aging. this calculator will help you determine the percentage of seriously delinquent receivables. these numbers are calculated by taking the dollar value of all of your outstanding receivables from their respective 30-day periods, and dividing by the total value of all of the accounts in question.

How to calculate uncollectible accounts expense basic.

Uncollectibleaccounts Expense Allowance Method

The allowance for uncollectible accounts has a credit balance of $2,000. net sales for the year were $250,000. in the past, 3 percent of net sales have proved uncollectible. an aging of accounts receivable results in an estimate of $9,000 of uncollectible accounts receivable. Question: calculator printer version a back next exercise 8-03 at the beginning of the current period, windsor corp. had balances in accounts receivable of $211,700 and in allowance for doubtful accounts of $8,370 (credit). during the period, it had net credit sales of $763,800 and collections of $782,420. If you had a accounts receivable balance of $500,000 and you uncollectible accounts change from credit $30,000 to debit $50,000 it means that a journal entry was recorded as: allowance for uncollectible accounts $ 85,000 debit accounts receivable $ 85,000 credit. so the the gross account before the journal entry was $585,000 2.

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. An allowance for doubtful accounts is your best guess of the bills your customers won't pay or will pay only partially. you can calculate the allowance subjectively, based on your knowledge of a customer's payment habits or ability to pay, or you can use an allowance for doubtful accounts formula based on the past experience of actual bad debt expense.

Using this number, dividing by the accounts receivable for the period can show the exact percentage of bad debt. and $3 million of this amount turns out to be uncollectible, we can calculate. Accounts uncollectible, also called allowance for doubtful accounts (ada), is a reduction in a company's accounts receivable. accounts uncollectible equals the amount of those receivables that the company's management does not expect to actually collect. Allowance for uncollectible accounts the process of calculating the estimate for uncollectible balances requires a rational estimate that follows gaap. the university will use the allowance method in which estimates of the uncollectible accounts are applied as a percentage to the revenues earned. this allows for the allowance of uncollectible. An aging of accounts receivable results in an estimate of $9,000 of uncollectible accounts receivable. calculate: (1) uncollectible accounts expense (2) the ending balance of the allowance for uncollectible accounts using (a) the percentage of net sales method and (b) the accounts receivable aging method.

For example, 10% of accounts receivable that are between 31 60 days outstanding are uncollectible. you are waiting on $2,000 worth of payments in this aging period. multiply your accounts receivable by the percentage ($2,000 x 10% = $200). and, 5% of accounts receivable under 30 days outstanding will be uncollectible. The percentage-of-sales method is commonly used to estimate the accounts receivable that a business expects will be uncollectible. when you use this method, use your small business’s past collection data uncollectible accounts calculator to estimate what portion of the credit sales you generate each accounting period that will go unpaid.