-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Expense Formula, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Expense Formula

link : Uncollectible Accounts Expense Formula

Uncollectible Accounts Expense Formula

Bad debt expense and allowance for doubtful account.

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. The debit to bad debts expense would uncollectible accounts expense formula report credit losses of $50,000 on the company’s june income statement. above, we assumed that the allowance for doubtful accounts began with a balance of zero. if instead, the allowance for uncollectible accounts began with a balance of $10,000 in june, we would make the following adjusting entry instead:.

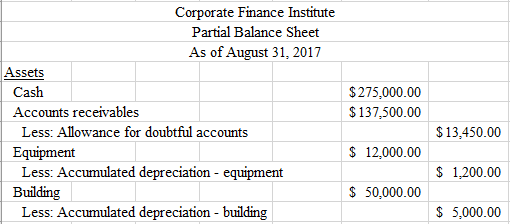

A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

Calculate Uncollectible Accounts Expense And Allowance

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. An aging of accounts receivable results in an estimate of $9,000 of uncollectible uncollectible accounts expense formula accounts receivable. calculate: (1) uncollectible accounts expense (2) the ending balance of the allowance for uncollectible accounts using (a) the percentage of net sales method and (b) the accounts receivable aging method. Uncollectible accounts expense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches.

Allowance For Doubtful Accounts Definition

What happens if the amount of uncollectible account expense is overstated at year end? net accounts receivable will be understated. if the allowance method is used to account for uncollectible accounts, when is bad debt expense debited formula for accounts uncollectible accounts expense formula receivable turnover. net credit sales (net sales cash sales) / average net accounts. Bad debt expense formula. percentage of bad debt: is the estimation by management which base on history data, accounts receivable aging report, company xyz estimates that 2% of their accounts receivable will be uncollectible. on 01 jan 202x, the company makes selling on the credit of $ 50,000 from many customers. Another way to estimate the amount of uncollectible accounts is to simply record a percentage of credit sales. for example, if your company and its industry has a long run experience of 0. 2% of credit sales being uncollectible, you might enter 0. 2% of each period's credit sales as a debit to bad debt expense and a credit to allowance for.

How Do You Estimate The Amount Of Uncollectible Accounts

Uncollectibleaccountsexpense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches the expense to the related sale within the same reporting period. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts. The bad debt expense account is debited, and the accounts receivable account is credited. under this method, there is no allowance account. there is a downside of using this method. while the direct write-off method records the exact amount of uncollectible debts and can be used to write off small amounts, it fails to uphold the gaap principles. The offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. in accounting, an item is deemed material if it is large enough to affect the judgment of an informed financial statement user.

How Do You Estimate The Amount Of Uncollectible Accounts

The percent-of-sales method for computing uncollectible accounts: computes uncollectible-account expense as a percent of accounts receivable. takes a balance sheet approach. employs the expense recognition (matching) concept. will result in the same amount of estimated uncollectible-accounts expense as the aging-of-receivables method. Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. the offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. Accounts receivable is the amount of money a company’s customers owe it for purchases made on credit. allowance for uncollectible accounts is an account a company uses to estimate the dollar amount of its accounts receivable balance that will be uncollectible. An allowance for doubtful accounts is your best guess of the bills your customers won't pay or will pay only partially. you can calculate the allowance subjectively, based on your knowledge of a customer's payment habits or ability to pay, or you can use an allowance for doubtful accounts formula based on the past experience of actual bad debt expense.

Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts uncollectible accounts expense formula receivable expected to be. The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable.

Allowance method for uncollectible accounts double entry.

The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. the first. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general uncollectible accounts expense formula approaches to estimate uncollectible accounts expense.

The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. in addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses. The percentage-of-sales method is commonly used to estimate the accounts receivable that a business expects will be uncollectible. when you use this method, use your small business’s past collection data to estimate what portion of the credit sales you generate each accounting period that will go unpaid.