-Hallo friends, Accounting Methods, in the article you read this time with the title Estimated Uncollectible Accounts Meaning, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Estimated Uncollectible Accounts Meaning

link : Estimated Uncollectible Accounts Meaning

Estimated Uncollectible Accounts Meaning

How To Estimate Uncollectible Accounts Dummies

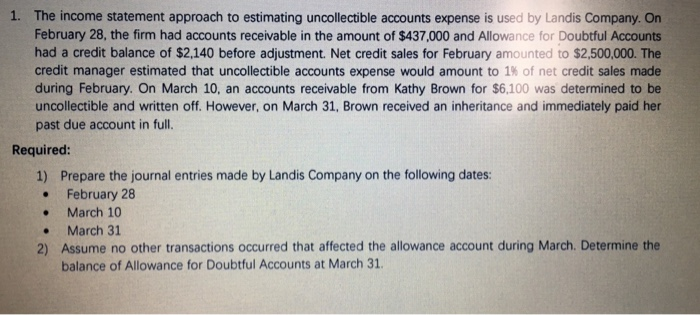

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Multiply current credit sales from the percentage in step 4 to estimate current uncollectible accounts receivable. if current credit sales is $15,000, then the estimated uncollectible accounts receivable is $1,500, since $15,000 *. 10 = $1,500. If uncollectible accounts are expected to be 8 percent of that amount, the expense is reported as $32,000 ($400,000 × 8 percent). bad debt expense (the figure estimated) must be raised from its present zero balance to estimated uncollectible accounts meaning $32,000.

How Do I Calculate Uncollectible Accounts Bizfluent

Definition: the estimated amount of uncollectible accounts receivable. increase the account by the amount estimated to be uncollectible each accounting period. decrease the account by the actual amount subsequently written off. the amount should consider outstanding advances. this account does not close at yearend. account title:. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense.

For each age category, the firm multiplies the accounts receivable by the percentage estimated as uncollectible to find the estimated amount uncollectible. the sum of the estimated amounts for all categories yields the total estimated amount uncollectible and is the desired credit balance (the target) in the allowance for uncollectible accounts. Definition: allowance for doubtful accounts, also called the allowance for uncollectibleaccounts, is a contra asset account that records an estimate of the accounts receivable that will not be collected. in other words, it’s an account used to discount the accounts receivablea ccount and keep track of the customers who will probably not pay their current balances. The uncollectible percentages and the accounts receivable breakdown are shown here. for each of the individual categories, the accountant multiplies the uncollectible percentage by the accounts receivable total for that category to get the total balance of estimated accounts that will prove to be uncollectible for that category. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

Account For Uncollectible Accounts Using The Balance Sheet

If 6. 67% sounds like a reasonable estimate for future uncollectible accounts, you would then create an allowance for bad debts equal to 6. 67% of this year’s projected credit sales. if you have $50,000 of credit sales in january, on january 30th you might record an adjusting entry to your allowance for bad debts account for $3,335. In other words, this method reports the accounts receivable balance at estimated amount of cash that is expected to be collected. as opposed to the direct write off method the allowance-method removes receivables only after specific accounts have been identified as uncollectible. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be.

Uncollectible Account Financial Definition Of Uncollectible

Allowance method for uncollectible accounts double entry.

Allowance for uncollectible accounts definition. the reserve is a contra-asset, or an asset listed on the balance sheet with a negative value meant to offset the value of accounts receivable. to record the reserve, you debit uncollectible accounts expense and credit allowance for uncollectible accounts. One way to estimate the amount of uncollectible accounts receivable is to prepare an aging. an aging of accounts receivable lists every customer's balance and then sorts each customer's balance according to the amount of time since the date of the sale. for example, assume that all sales are made. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each.

Uncollectibledefinition, that cannot be collected: an uncollectible debt. see more. Uncollectibleaccounts. imagine that you're a business owner. in your store, you have two ways to pay for merchandise. a customer can pay cash or he can open a credit account and make monthly.

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible estimated uncollectible accounts meaning for many reasons, including the debtor's bankruptcy. The balance of allowance for doubtful accounts prior to making the adjusting entry to record estimated uncollectible accounts _____ relevant when using the percentage of receivables basis. is the entry to recognize the bad debt expense ________ when the allowance method is used. Go through your uncollectible accounts from the past three years and tell me how many of those accounts passed the gut check. eight things you can do right now to avoid past due accounts 1. 166-1(e. thus, for cash-basis taxpayers, a bad debt deduction is generally not allowed for uncollectible accounts receivable since these items are normally.

A method used to estimate uncollectible accounts receivable that assumes a percent of credit sales will become uncollectible. (p. 413) percent of sales method. 7. a method used to estimate uncollectible accounts receivable that uses an analysis of accounts receivable to estimate the amount that will be uncollectible. What is the allowance for doubtful accounts? the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable accounts receivable accounts receivable (ar) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet. companies allow their clients to pay at a reasonable, extended period of. A percentage of accounts estimated uncollectible accounts meaning receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. For example, a category might consist of accounts receivable that is 0–30 days past due and is assigned an uncollectible percentage of 6%. another category might be 31–60 days past due and is assigned an uncollectible percentage of 15%. all categories of estimated uncollectible amounts are summed to get a total estimated uncollectible balance.

How do i calculate uncollectible accounts? bizfluent.

Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; however. Calculate the sum of the amounts of each portion you expect will be uncollectible to calculate the total amount of uncollectible accounts. for example, calculate the sum of $750, $200, $1,050, $1,500 and $1,350. this equals $4,850 in uncollectible accounts. Companies must estimate the amount of uncollectible accounts based on historic data. then companies must apply a certain percentage of accounts receivable to the uncollectible accounts account using the percentage rate determined by analyzing the historical data. estimated uncollectible accounts meaning direct charge-off method: meaning. one way to record the affects of uncollectible.