-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Expense On Income Statement, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Expense On Income Statement

link : Uncollectible Accounts Expense On Income Statement

Uncollectible Accounts Expense On Income Statement

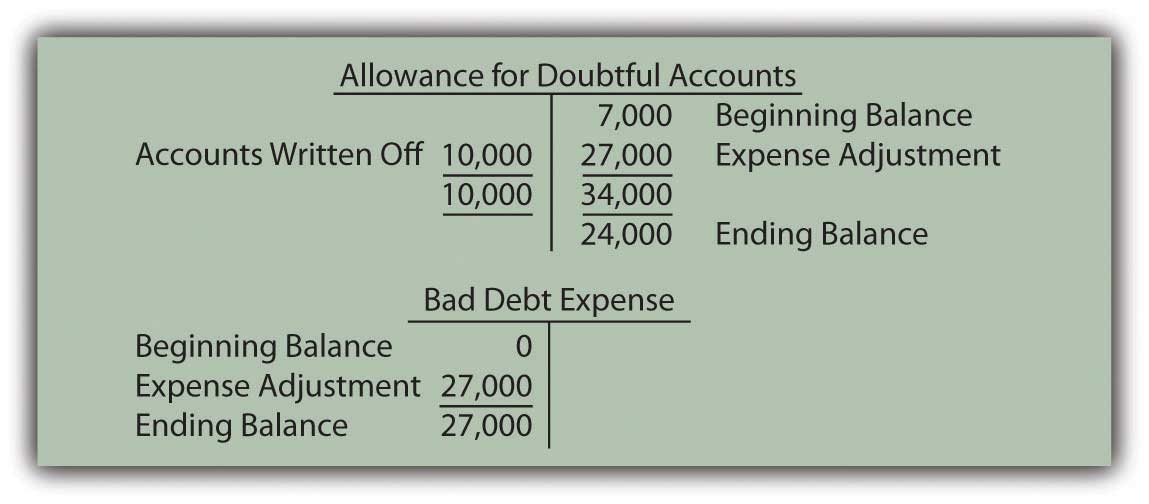

Question: departmental income statement the following information was obtained from the ledger of woodfield candies, inc. at the end of 2016 woodfield candies, inc. trial balance december 31, 2016 debit credit cash $45,000 accounts receivable (net) 156,000 inventory, december 31, 2016 180,000 equipment and fixtures (net) 540,000 accounts payable $108,000 common. The contra-asset account associated with accounts receivable will have the account title allowance for doubtful accounts. the current period expense pertaining to accounts receivable (and its contra account) is recorded in the account bad debts expense which is reported on the income statement as part of the operating expenses. telemarketing sales calls, encourages continual review of bill statements and online account activity • new ! -senior natural gas energy trader -.

Allowance For Doubtful Accounts Sales Method

However, receivables often become uncollectible because a customer cannot or will not pay. when using the allowance for doubtful accounts method, a expense entry is recognized on the income statement, at regular intervals. bad debt write-offs are recorded using the direct write-off method. calculating uncollectible accounts expense. During year 2, grande provided $104,000 of service on account. the company collected $97,000 cash from accounts receivable. uncollectible accounts are estimated to be 2% of sales on account. the amount of uncollectible accounts expense recognized on the year uncollectible accounts expense on income statement 2 income statement is: a) $320. b) $1,000. c) $2,080. d) $1,940.

How To Calculate Uncollectible Accounts Expense Basic

Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Based on this information, the amount of uncollectible accounts expense shown on the year 3 income statement is 1700 assuming alpha company uses the percent of receivables method to determine the amount of uncollectible expense, which of the following shows how the recognition of the expense will affect alpha's financial statements?. During 2016, grande provided $104,000 of service on account. the company collected $97,000 cash from accounts uncollectible accounts expense on income statement receivable. uncollectible accounts are estimated to be 2% of sales on account. the amount of uncollectible accounts expense recognized on the 2016 income statement is: a. $320. b. $1,000. c. $2,080. d. $1,940. 53 account for uncollectible accounts using the balance sheet and income statement approaches. you lend a friend $500 with the agreement that you will be repaid in two months. at the end of two months, your friend has not repaid the money.

Calculate allowance for doubtful accounts using sales method or income statement approach. prepare adjusting entry to recognize uncollectible accounts expense and to update the allowance for doubtful accounts account at the end of the year 2015. solution: (1). allowance for doubtful accounts: $175,000 × 0. 01 = $1,750 (2).

Is The Provision For Doubtful Debts An Operating Expense

Alpha estimates uncollectible accounts expense to be 1% of receivables. based on this information, the amount of uncollectible accounts expense shown on the year 3 income statement is. 1700. assuming alpha company uses the percent of receivables method to determine the amount of uncollectible expense, which of the following shows how the. Estimating uncollectible accounts accountants use two basic methods to estimate uncollectible accounts for a period. the first method—percentage-of-sales method—focuses on the income statement and the relationship of uncollectible accounts to sales. on the income statement, bad debt expense would still be 1%of total net sales, or $5,000. 53 account for uncollectible accounts using the balance sheet and income statement approaches you lend a friend $500 with the agreement that you will be repaid in two months. at the end of two months, your friend has not repaid the money. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense.

Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. The balance sheet will now report accounts receivable of $120,500 less the allowance for doubtful accounts of $10,000, for a net amount of $110,500. the income statement for the accounting period will report bad debts expense of $10,000. aging of accounts receivable form and template. balance sheet: retail/wholesale corporation. link:label> The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable. Based on this information, the amount of uncollectible accounts expense shown on the yr. 3 income statement is $1,700 an aging schedule uncollectible accounts expense on income statement is used to improve the estimate used in the percent of revenue method of determining the uncollectible accounts expense. The allowance for uncollectible accounts or allowance for doubtful accounts is a contra asset account that reduces the amount of accounts receivable to the amount that is more likely be collected. the income statement account bad debts expense is part of the adjusting entry that increases the balance in the allowance for uncollectible accounts. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. The percentage of credit sales approach focuses on the income statement and the matching principle. sales revenues of $500,000 are immediately matched with $1,500 of bad debts expense. the balance in the account allowance for doubtful accounts is ignored at the time of the weekly entries. Alpha estimates uncollectible accounts expense to be 1% of receivables. based on this information, the amount of uncollectible accounts expense shown on the year 3 income statement is. 1700. corazon company purchased an asset with a list price of $14,000. corazon paid $500 of transportation in cost, $800 to train an employee to operate the. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. A percentage of accounts receivable will become uncollectible for a myriad of reasons, requiring a periodic write-off of receivables. whether the allowance for doubtful accounts or the direct write off method are used, an uncollectible accounts expense must be recorded to remain compliant with u. s. gaap. below are details regarding this expense, and how it impacts the balance sheet and income. The accounts receivable balance is $1 million, so the allowance for doubtful accounts should be $50,000. the allowance for doubtful accounts still has $9,000 left over from it last year, so the company debits bad debt expense for $41,000 and credits allowance for uncollectible accounts for $41,000.

Accounting final flashcards quizlet.