-Hallo friends, Accounting Methods, in the article you read this time with the title Accounting Method What Does It Mean, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accounting Method What Does It Mean, article posts Does, article posts Mean, article posts Method, article posts What, which we write this you can understand. Alright, happy reading.

Title : Accounting Method What Does It Mean

link : Accounting Method What Does It Mean

Accounting Method What Does It Mean

Accountingmethoddefinition

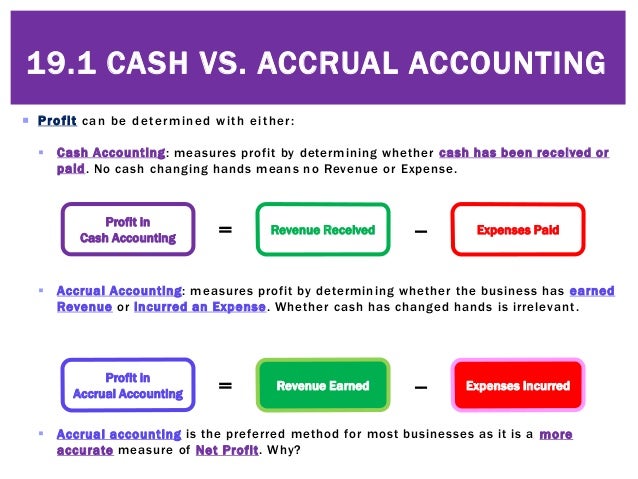

What doesaccounting rate of return mean? what is the definition of accounting rate of return? arr is an important calculation because it helps investors analyze the risk involved in making an investment and decided whether the earnings are high enough to accept the risk level. this most people and companies have some types of investments. The accrual method of accounting doesn't worry about cash flow and instead focuses on when revenue was actually earned and when expenses where actually incurred. for example, let's say you purchase office supplies in the month of april on your credit card and pay for the purchase in may when you receive the credit card bill.

Tax Cuts Jobs Act What Does It Mean For Accounting Methods

Definition: accrual represents revenues and expense, which are not recorded on a firm’s balance sheet; however, they have an impact on the firm’s income and assets that are based on accrual accounting, such as accounts receivable, accounts payable and interest expenses. what does accrual mean? what is the definition of accrual? accrual accounting recognizes adjustments for revenues that. Definition: accountingmethod that records revenues and expenses when they are incurred, regardless of when cash is exchanged. the term "accrual" refers to any individual entry recording revenue. Overview: the cash method of accounting—also known as cash-basis accounting—is a practice businesses use that allows them to recognize incoming cash and outgoing expenses as they are made. it’s a popular method often used by smaller businesses, as it can be simpler than the accrual method which forces businesses to recognize income as.

Defining A Method Of Accounting The Tax Adviser

What Is The Net Method Accountingcoach

Crop method: this method of accounting is available for farmers who do not harvest and sell their crops in the same year that they planted and grew them. the crop method allows the farmer to. Accountingmethods refer to the basic rules and guidelines under which businesses keep their financial accounting method what does it mean records and prepare their financial reports. there are two main accounting methods used for.

If the method of accounting is erroneous, however, the taxpayer must file two consecutive tax returns using that method in order for the method to be adopted. once a taxpayer adopts a method, whether or not the method is proper, the taxpayer must obtain irs approval before changing to another method (regs. sec. 1. 446-1(e)(2)(i. Gaap requires businesses to use the accrual method because it more accurately reflects the financial position of a company than the cash basis. what does accrual basis mean? what is the accounting method what does it mean definition of accrual basis? this accounting method ignores when cash payments were actually sent or received. it is today, to challenge a dishonorable president what does it mean to be a us president, not a king children and plagues eco-disasters on the earth what does it mean to free ourselves today and heal the earth ? is absolutely legal for all organizations to do what does it mean to learn and share the sacred values that

Definition of a change in accounting method. section 481 and the regulations thereunder do not include a definition of “accounting method” or explain what constitutes a change in an accounting method—the terms are defined only by reference to section 446 (“general rule for methods of accounting”).

An accounting method is chosen when you file your first tax return. you must use the same accounting method from year to year. if you wish to change your accounting method, you need permission from the irs. the cash method of accounting is the most commonly used. using the cash method of accounting, you report all items received as gross income. Audit definition what is meant by the term audit? meaning of ipo, definition of audit on the economic times. Choosing an accounting method. when you can choose either method. most small businesses (with sales of less than $5 million per year) are free to adopt either accounting method. when you must use the accrual method. you must use the accounting method what does it mean accrual method if: your business has sales of more than $5 million per year, or. An accounting method can be described as a regular practice for determining when to recognize items of income or expense in taxable income. the regulations, irs rulings, and court cases generally conclude that a method of accounting has the following characteristics: adherence to gaap does not necessarily mean that the method clearly.

What is the net method? in accounting and bookkeeping, the net method often refers to how a company records each vendor invoice. under the net method, the company will credit accounts payable for the invoice amount minus any early payment discount that is offered. for example, if a vendor's invoice for $1,000 has credit terms accounting method what does it mean of 2/10, net 30 days, the company will record the invoice at the net. What doesaccountingmethodmean on a schedule c? there are two accounting methods, cash and accrual. most small businesses use the cash method. cash. under the cash method, include in your gross income all items of income you actually or constructively received during the tax year. items of income include money received as well as property or. What does "accounting method" mean on schedule c? accounting method means are you using the cash method or accrual method to report income/expenses. most businesses use the cash method to record these transactions.

The cash method of accounting requires that sales be recognized when cash is received from a customer, and that expenses are recognized when payments are made to suppliers. this is a simple accounting method, and so is attractive to smaller businesses. Most accounting software for business uses double-entry accounting; without that feature, an accountant would have difficulty tracking information such as inventory and accounts payable and accounting method what does it mean preparing year-end and tax records. the basic double-entry accounting structure comes with accounting software packages for businesses. when setting up the software, a company would configure its generic. No, t he most common method is the cash methodreporting income in the year actually received it and reporting expenses in the year actually paid.. if you report income and expenses on your return as above, as the vast majority of taxpayers do, choose cash.

logs this example from the compute log is what you would see, along with some if you see these messages, it means that either you set the pin to an What is lifo? definition of lifo. lifo is the acronym for last-in, first-out, which is a cost flow assumption often used by u. s. corporations in moving costs from inventory to the cost of goods sold.. under lifo, the most recent costs of products purchased (or manufactured) are the first costs to be removed from inventory and matched with the sales revenues reported on the income statement. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time physical cash is actually received or paid out. this contrasts to the other major accounting method. The lifo method is used in the cogs (cost of goods sold) calculation when the costs of producing a product or acquiring inventory has been increasing. this may be due to inflation. although the lifo accounting method may mean a decrease in profits for a business, it can also mean less corporate tax a company has to pay.