-Hallo friends, Accounting Methods, in the article you read this time with the title Cash Accounting Method Vs Accrual, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accrual, article posts Cash, article posts Cash Accounting Method Vs Accrual, article posts Method, which we write this you can understand. Alright, happy reading.

Title : Cash Accounting Method Vs Accrual

link : Cash Accounting Method Vs Accrual

Cash Accounting Method Vs Accrual

Accountingmethods Canada Ca

The cash basis and accrual basis of accounting are two different methods used to record accounting transactions. the core underlying difference between the two methods is in the timing of transaction recordation. when aggregated over time, the results of the two methods are approximately the same. Using cash basis accounting, income is recorded when you receive it, whereas with the accrual method, income is recorded when you earn it. following the above example, using accrual accounting if you invoice a client for $5,000 in december of 2017, you would record that transaction as a part of your 2017 income (and thus pay taxes on it. Now, more small businesses can elect to use cash accounting. in the past, businesses that had inventory were required to use accrual accounting, but as of december 31, 2017, businesses with $25 million or less in revenue over the prior three years can use cash accounting. either roi or die let’s face it: accounting is boring as isht assets liabilities cost basis accrual gaap cost principle double entry system… finance is

Cash Method Vs Accrual Method Quickbooks Canada

Accrualaccountingvs. cash basis accounting example. let's say you own a business that sells machinery. if you sell $5,000 worth of machinery, under the cash method, that amount is not recorded. Both methods have restrictions, and larger public companies are required to use the accrual method of accounting. the accrual method is more difficult, timely, and expensive to incorporate into your records. while the cash method is easier, it provides potentially misleading financial statements. Both accrual and cash basis accounting methods have their advantages and disadvantages but neither shows the full picture about a company’s financial health. although, accrual method is the most commonly used by companies, especially publicly traded companies. a reason for the accrual basis method of accounting popularity is that it levels.

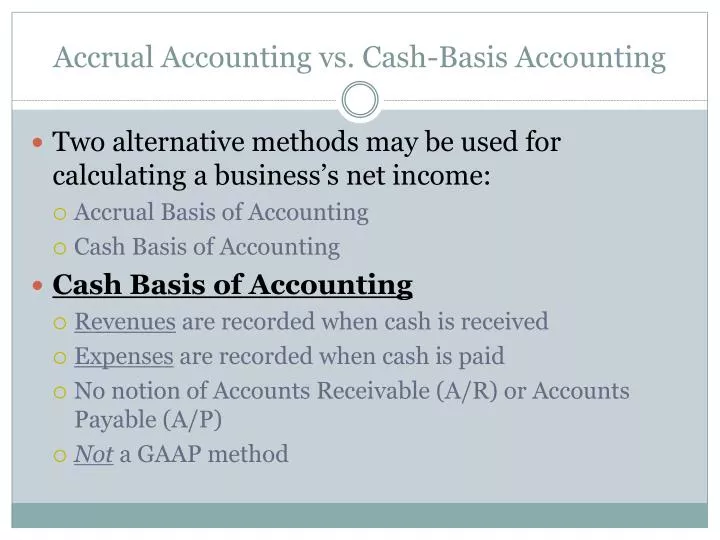

there are two accounting methods being referenced here: cash accounting, and an accrual accounting method called generally accepted accounting principles (gaap) the difference Cashvsaccrual (accounting) there are two methods used in accounting to record income and expenses which are known as cash basis accounting and accruals basis accounting. the method of accounting chosen will influence the manner in which transactions and business activities will be recorded in the books and will affect the final profit numbers. Accrualaccounting is more complicated than cash accounting so you'll need an in-depth understanding of bookkeeping methods or a professional to help you out. choosing a method to work out which method best suits your business, think about:.

Street Smart Product Manager Thriving In The Urban Jungle Of Product

Cash vs. accrual accounting nolo.

Cash Basis Vs Accrual Basis Whats The Difference

As per the accrual method of accounting, the accountant records the transaction when it occurs (not when the money would be received). but the cash accounting method is the complete opposite. in the cash accounting method, the transaction is recorded when the cash is received or expended. in this case, the accrual basis of accounting has a demerit. And prior to the tax cuts and jobs act pharmacies had to be on the accrual method in about 99% of the cases. pharmacies had to be under the accrual method. the tax cuts and jobs act has expanded the cash method of accounting now. so, pharmacies that are under $25 million in gross receipts can now use the cash method of accounting. The cash basis and accrual basis of accounting are two different methods used to record accounting transactions. the core underlying difference between the two methods is in the timing of transaction recordation. when aggregated over time, the results of the two methods are approximately the same. a brief description of each method cash accounting method vs accrual follows. Change your reporting method. if you decide to change your method of reporting income from the accrual method to the cash method, use the cash method when you file your next income tax return. make sure you include a statement that shows each adjustment made to your income and expenses because of the difference in methods.

Accrual accounting vs. cash basis accounting example. let's say you own a business that sells machinery. if you sell $5,000 worth of machinery, under the cash method, that amount is not recorded. Cash basis and accrual basis accounting methods both have advantages and disadvantages. discover more about these two accounting methods and find which one is better for your business.

Cashvsaccrual The Difference Between Cash Accrual

Cashvs. accrualaccounting. learn which accountingmethod is better for your business. by stephen fishman, j. d. the cash method and the accrual method (sometimes called cash basis and accrual basis) cash accounting method vs accrual are the two principal methods of keeping track of a business's income and expenses. in most cases, you can choose which method to use. Cashvs. accrualaccounting. while accounting might not be your favorite aspect of being your own boss, it’s still important to understand at least the basics and best practices of small business accounting. as long as your sales are less than $25 million per year, you’re free to use either the cash or accrual method of accounting.

If you decide to change your method of reporting income from the accrual method to the cash method, use the cash method when you file your next income tax return. make sure you include a statement that shows each adjustment made to your income and expenses because of the difference in methods. See more videos for cash accounting method vs accrual. The main difference between cash basis accounting vs. accrual accounting is when revenue and expenses are recorded in the accounting process. in cash accounting, revenue and expenses are recorded as cash is exchanged from hand to hand, while accrual recognizes these transactions when they’re billed and earned — whether or not the funds have been successfully transferred. Cash vs. accrual accounting. while accounting might not be your favorite aspect of being your own boss, it’s still important to understand at least the basics and best practices of small business accounting. as long as your sales are less than $25 million per year, you’re free to use either the cash or accrual method of accounting.

Accrualaccounting methodology. accrual accounting requires companies to record sales at the time in which they occur. unlike the cash accounting method vs accrual cash basis method, the timing of actual payments is not important. The cash method. the cash method is the more commonly used method of accounting in small business. under the cash method, income is not counted until cash (or a check) is actually received, and expenses are not counted until they are actually paid. the accrual method. Compared to the accrual method, cash accounting is easier to manage and keep track of because you only record transactions when money enters or leaves your business. [check out these 9 accounting. Cash method of accounting. the cash method of accounting is a simplified system that records transactions based on when the cash element of the deal has been performed. in a sale, this is when cash is collected, meaning when you pay the bill not when you received it. for example, imagine you receive your telephone expense invoice on january 25.

Accrual vs cash accounting for taxes.