-Hallo friends, Accounting Methods, in the article you read this time with the title Allowance For Uncollectible Accounts Journal Entry, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Allowance For Uncollectible Accounts Journal Entry

link : Allowance For Uncollectible Accounts Journal Entry

Allowance For Uncollectible Accounts Journal Entry

Accountingfor Uncollectibleaccounts Receivable Part 2

The allowance for doubtful accounts is paired with and offsets accounts receivable. the allowance represents management’s best estimate of the amount of accounts receivable that will not be paid allowance for uncollectible accounts journal entry by customers. when the allowance is subtracted from accounts receivable, the remainder is the total amount of receivables that a business actually expects to collect. Cairo co. uses the allowance method of accounting for uncollectible accounts. cairo co. accepted a $5,000, 12%, 90-day note dated may 16, from alexandria co. as in exchange for its past-due account re. To allowance for doubtful accounts debts a/c $40,000. effect on income statement and balance sheet. the first journal entry above would affect the income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account.

The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). A journal entry was made for potential write offs: bad debt xxx. allowance for doubtful accounts xxx. the entry we are trying to post once the account is realized to be uncollectable would be: allowance for doubtful accounts xxx. account receiveable xxx. Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected.

A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. R: allowance for doubtful accounts $13,000 one of the organizations which pledged $6,000 has been determined as uncollectible. the following journal entry is recorded to write off the amount. dr: allowance for doubtful accounts $ 6,0001701 ne 104th street r: accounts receivable $ 6,000 tel 206. 525. 5170. The allowance method is one of the two common techniques of accounting for bad debts, the other being the direct write-off method. allowance method is a better alternative to the direct write-off method because it is according to the matching principle of accounting. in allowance method, the doubtful debts are estimated and bad debts expense is recognized before the debts actually become. The journal entry is to debit allowance for uncollectible accounts for $1,000 and credit a/r parmelee supplies for $1,000. about the book author maire loughran is a certified public accountant who has prepared compilation, review, and audit reports for fifteen years.

Estimating Allowance For Doubtful Accounts By Aging Method

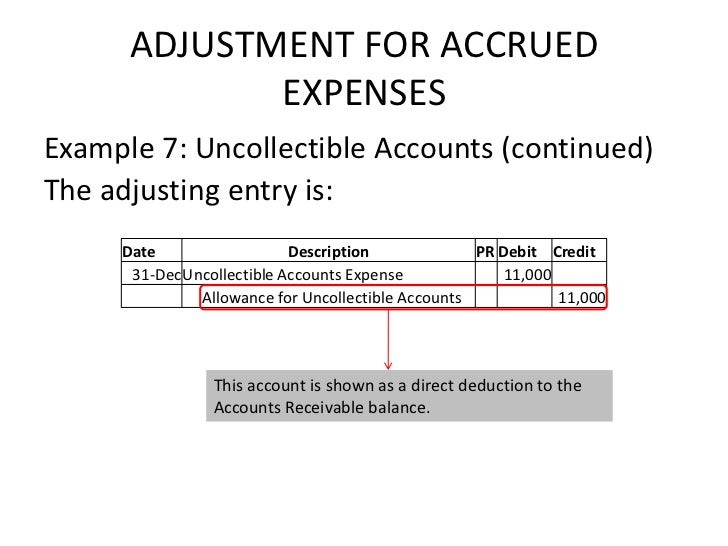

The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet allowance for uncollectible accounts journal entry as a deduction from the face value of accounts receivable. The first journal entry above would affect the income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account. and the second and third journal entries will only affect the balance sheet where we will first deduct the amount of provision from the accounts receivables and if any amount is.

Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. the offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. The journal entry also credits the accounts receivable account for $100. in combination, these two entries zero out the allowance for the uncollectible a/r account and remove the uncollectible amount from the accounts receivable account. writing off an actual, specific uncollectible receivable for invoice should be done on a case-by-case basis. The allowance for doubtful accounts on the balance sheet is increased by credit journal entry. it should be noted that the adjustment is made irrespective of the balance already on the allowance account, and for this reason the allowance account balance can build up irrespective of the level of accounts receivable.

Prepare an adjusting entry to recognize uncollectible accounts expense and adjust the balance in allowance for doubtful accounts account to the required amount. solution: (1). computation of required balance in the allowance for doubtful accounts account: (2). adjusting entry at the end of the period:. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for allowance for uncollectible accounts journal entry doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

Before this journal entry, entity a had zero balance in the allowance for doubtful accounts. prepare a journal entry to record the amount that may be uncollectible. a20. to recognize the portion of accounts receivable that may be uncollectible, bad debts expense is recorded on the debit side and the allowance for doubtful accounts is recorded. After writing off the bad account on august 24, the net realizable value of the accounts receivable is still $230,000 ($238,600 debit balance in accounts receivable and $8,600 credit balance in allowance for doubtful accounts). the bad debts expense remains at $10,000; it is not directly affected by the journal entry write-off. Under the allowance method for uncollectible accounts, the journal entry to record the write-off of an account receivable would include a. credit to accounts receivable. what is the only account used with allowance methods of accounting for uncollectible accounts receivable?. The entry will involve the operating expense account bad debts expense and the contra-asset account allowance for doubtful accounts. allowance for uncollectible accounts journal entry later, when a specific account receivable is actually written off as uncollectible, the company debits allowance for doubtful accounts and credits accounts receivable.

The allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected. once it is known that a customer will not pay and that customer's account receivable is eliminated through the above credit to accounts receivable, the balance in the. Now, add the two aging group values together ($200 + $500 = $700). your allowance for doubtful accounts estimation would be $700. allowance for doubtful accounts journal entry. to predict your company’s bad debts, you must create an allowance for doubtful accounts entry. you must also use another entry, bad debts expense, to balance your books. The journal entry to record the adjusting entry for accrued interest on a note receivable would include a credit to interest revenue. the allowance for doubtful accounts is reported as a(n) __________ on the balance sheet.

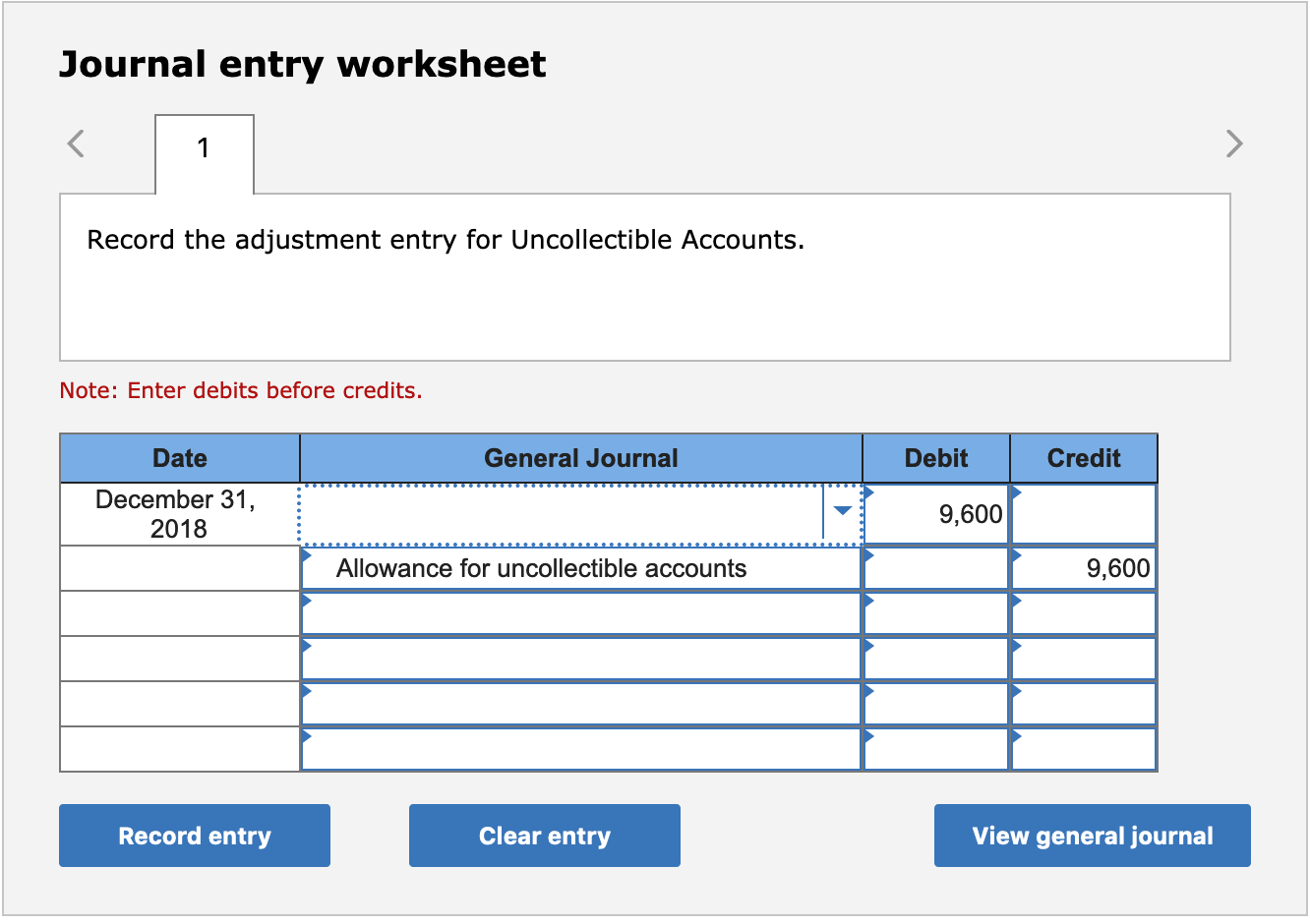

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. Once the estimated amount for the allowance account is determined, a journal entry will be needed to bring the ledger into agreement. assume that ito’s ledger revealed an allowance for uncollectible accounts credit balance of $10,000 (prior to performing the above analysis).

The journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries: following is the balance sheet presentation. Allowance for uncollectible accounts, 1/1/12 $84,000 provision for uncollectible accounts during 2012 (2% on credit sales of $3,000,000) $60,000 uncollectible accounts written off, 11/30/12 $69,000 estimated uncollectible accounts per aging, 12/31/12 $104,000 after year-end adjustment, the uncollectible accounts expense for 2012 should be.