-Hallo friends, Accounting Methods, in the article you read this time with the title Example Of Calculating Variable Cost With Smallest Quadratic Method, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Calculating, article posts Cost, article posts Example, article posts Example Of Calculating Variable Cost With Smallest Quadratic Method, article posts Method, article posts Quadratic, article posts Smallest, article posts Variable, article posts With, which we write this you can understand. Alright, happy reading.

Title : Example Of Calculating Variable Cost With Smallest Quadratic Method

link : Example Of Calculating Variable Cost With Smallest Quadratic Method

Example Of Calculating Variable Cost With Smallest Quadratic Method

Solve: −200p 2 + 92,000p − 8,400,000 = 0. step 1 divide all terms by -200. p 2 460p + 42000 = 0. step 2 move the number term to the right side of the equation: p 2 460p = -42000. step 3 complete the square on the left side of the equation and balance this by adding the same number to the right side of the equation:. A key aspect of business accounting is cost of goods sold. this formula makes this calculation simple to understand: beginning inventory + inventory purchases end inventory = cost of goods sold. jupiterimages/comstock/getty images a key.

29 cost function: properties 5. if f(z 1,z 2) is concave then c(r 1,r 2,q) is convex in q. hence mc(q) increases in q. concavity implies decreasing returns. For example, if the fixed costs per unit is $0. 10 and the variable cost per unit is $0. 40 (for a $0. 50 total cost per unit), then 80 percent of the unit cost is variable cost ($ / $ =). as an outside investor, you can use this information to predict potential profit risk. The formula to calculate variable cost is: same period's production volume will provide us with the variable cost per spark plug. for example, if the spark plug business made 500,000 units. When you understand your insurance costs, you can make better decisions about the type of policy that's right for you and the kind of coverage you need. while this is true of all insurance, this guide highlights health insurance costs to il.

Fixed cost = lowest activity cost (variable cost per units * lowest activity units) fixed cost = $3,210($23. 125 * 78) fixed cost = $1,406. 25. so basically total cost equation is given by = 23. 125x + 1406. 25. where x is the number of burgers sold in a particular month. since you have the total cost equation now, you can use this to. If pierre’s recipe makes 6 dozen cakes (72 cakes), the variable cost per unit would be $1. variable cost/total quantity of output = x variable cost per unit of output. variable cost per unit = = $72/72 = $1. when pierre puts his cakes in the shop window for sale, he knows he must mark up the cost per cake starting at $1. Office of the assistant secretary for planning and evaluation office of the assistant secretary for planning and evaluation 08/01/2001 this section describes the creation of variables used in the analysis of this report. we group the variab.

Variability is the degree to which a data series deviates from its mean (or in the accounting world, how much a budgeted value differs from an actual value). variability is the degree to which a data series deviates from its mean (or in the. High-low method does not account for the effect of inflation on a portion of financial data which could result in overestimation of the variable cost element of a mixed cost. the limitation can be overcome by adjusting the financial data for the effect of inflation before applying the high low method as explained in the example below.

9 2 8 Quadratic Discriminant Analysis Qda Stat 508

High Low Method Accounting Simplified

Variable cost examples & meaning investinganswers.

Algorithms with quadratic or cubic running times are less practical, but algorithms with exponential running times are infeasible for all but the smallest sized inputs. let's draw the growth rates for the above functions and take a look at the following table. focusing on the worst case: think about the example of a linear search on an array. Quadratic discriminant function: this quadratic discriminant function is very much like the linear discriminant function except that because Σ k, the covariance matrix, is not identical, you cannot throw away the quadratic terms. this discriminant function is a quadratic function and will contain second order terms.

The high-low method is a method of accounting used to calculate variable and fixed costs from a mixed cost. this method is often used as an uncomplicated way to estimate future costs and to analyze prior costs. however, if the data points. In cost accounting, the high-low method is a technique used to split mixed costs into fixed and variable costs. fixed and variable costs cost is something that can be classified in several ways depending on its nature. one of the most popular methods is classification according. although the high-low method is easy to apply, it is seldom used. Example of example of calculating variable cost with smallest quadratic method variable costs. let us consider a bakery that produces cakes. it costs $5 in raw materials and $20 in direct labor to bake one cake. in addition, there are fixed costs of $500 (the equipment used). to illustrate the concept, see the table below: note how the costs change as more cakes are produced. Cost accounting by jawarhalal free book download, texas instruments t1-82 calculator, example of worded problems of quadratic equations, simplify multiplication expressions with exponents, adding fractions w/ algebra, real life examples of the quadratic equation.

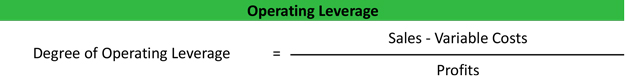

Here's how to calculate marginal cost, total cost, fixed cost, total variable cost, average total cost, average fixed cost, and average variable cost. there are many definitions relating to cost, including the following seven terms: the dat. Contribution margin reporting shares useful information with company managers. company managers use this information to calculate the breakeven point, or the level of sales required to pay all expenses. managers also use this information to. Review a brief explanation of how depreciation is calculated using the straight-line and basic-accelerated depreciation methods. when your business buys an asset (a physical property owned by your company), you can deduct the cost of that a.

If you have several costs that are in the future, you can find the present value of these costs. the present value of the costs are how much the costs are worth today. present value of costs takes into example of calculating variable cost with smallest quadratic method account a concept known as time value. Variable costs of a business increase when it manufactures products more than normal and decrease when it goes downsizing. raw material cost is the best example for variable costs. for instance, when a bakery produces more bread than normally does, it will spend more flour and for this reason its variable cost will increase. In other words, diminishing returns to the variable factor would not be observed. such a function would exist for the cricket bat factory only if the relevant range of output under consideration was very small. type 2. quadratic cost function: if there is diminishing return to the variable factor the cost function becomes quadratic.

A semi-variable cost has characteristics of both fixed costs and variable costs once a specific level of output is surpassed. a semi-variable cost has characteristics of both fixed costs and example of calculating variable cost with smallest quadratic method variable costs once a specific level of output is. Approximating the cost]! turns out this retains a term in the back-up equation which is discarded in the iterative lqr approach! [it’s a quadratic term in the dynamics model though, so even if cost is convex, resulting lq problem could be non-convex] [reference: jacobson and mayne, “differential dynamic programming,” 1970].

Total = $305,000 / 1,000,000 units produced = $0. 305 variable cost per case. cost to produce special order of 1,000,000 phone cases = $0. 305 x 1,000,000 = $305,000. therefore, there is a contribution margin of $400,000 $305,000 = $95,000. based on our variable costing method, the special order should be accepted. An ill-conditioned quadratic function: on a exactly quadratic function, bfgs is not as fast as newton’s method, but still very fast. an ill-conditioned non-quadratic function: here bfgs does better than newton, as its empirical estimate of the curvature is better than that given by the hessian. an ill-conditioned very non-quadratic function:.