-Hallo friends, Accounting Methods, in the article you read this time with the title Under The Direct Write Off Method Of Accounting For Uncollectible Accounts Bad Debts, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accounts, article posts Debts, article posts Direct, article posts Method, article posts Uncollectible, article posts Under, article posts Under The Direct Write Off Method Of Accounting For Uncollectible Accounts Bad Debts, article posts Write, which we write this you can understand. Alright, happy reading.

Title : Under The Direct Write Off Method Of Accounting For Uncollectible Accounts Bad Debts

link : Under The Direct Write Off Method Of Accounting For Uncollectible Accounts Bad Debts

Under The Direct Write Off Method Of Accounting For Uncollectible Accounts Bad Debts

Chapter 8 accounting you'll remember quizlet.

Directwriteoff And Allowance Methods For Dealing With

A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. Underthe directwrite-offmethodof accountingfor uncollectibleaccounts, bad debt expense is debited a. at the end of each accounting period. b. when a credit sale is past due. c. when an account is determined to be uncollectible & is written-off. d. whenever a pre-determined amount of credit sales have been made. Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. See full list on accountingcoach. com.

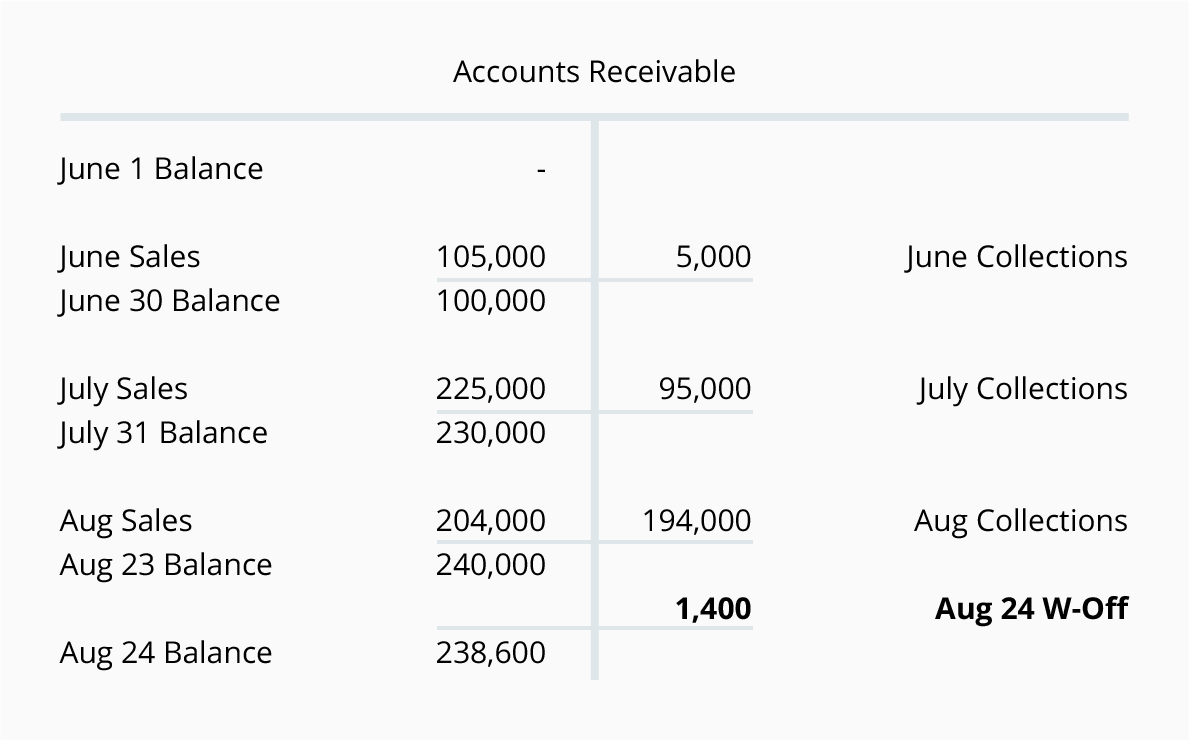

The direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. Let's illustrate the write-off with the following example. on june 3, a customer purchases $1,400 of goods on credit from gem merchandise co. on august 24, that same customer informs gem merchandise co. that it has filed for bankruptcy. the customer states that its bank has a lien on all of its assets. it also states that the liquidation value of those assets is less than the amount it owes the bank, and as a result gem will receive nothing toward its $1,400 accounts receivable. after confirming this information, gem concludes that it should remove, or write off, the customer's account balance of $1,400. under the allowance method of recording credit losses, gem's entry to write off the customer's account balance is as follows: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). after writing off the bad account on august 24, the net realizable value of the accounts receivable is still $230,000 ($238,600 debit balance in accounts receivable and $8,600 credit balance in allowance for doubtful accounts). after a seller has written off an accounts receivable, it is possible that the seller is paid part or all of the account balance that was written off. under the allowance method, if such a payment is received (whether directly from the customer or as a result of a court action) the seller will take the following two steps: for example, let's assume that a company prepares weekly financial statements. past experience indicates that 0. 3% of its sales on credit will never be collected. using the percentage of credit sales approach, this company automatically debits bad debts expense and credits allowance for doubtful accounts for 0. 3% of each week's credit sales. let's assume that in the current week this company sells $500,000 of goods on credit. it estimates its bad debts expense to be $1,500 (0. 003 x $500,000) and records the following journal entry:. Uncollectibleaccounts are frequently called “bad debts. ” direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry.

Print Item Under The Direct Writeoff Method Of Ac

Direct write off method refers to the technique of accounting for the uncollectible accounts by businesses. under the direct write off method, once accounts are identified as uncollectible, the bad debts expense account is debited and the accounts receivable account is credited directly. The direct write-off method for bad debt the direct write-off method allows a business to record bad debt expense only when a specific account has been deemed uncollectible. the account is removed from the accounts receivable balance and bad debt expense is increased. Directwriteoffmethod refers to the technique of accounting for the uncollectible accounts by businesses. under the direct write off method, once accounts are identified as uncollectible, the bad debts expense account is debited and the accounts receivable account is credited directly. The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides under the direct write off method of accounting for uncollectible accounts bad debts in advance for uncollectible accounts think of as setting aside money in a reserve account.

Bad Debt Expense Definition Investopedia Com

Why Isnt The Direct Write Off Method Of Uncollectible

To calculate bad debt expense select either the direct write-off method the invoice amount is charged directly to bad debt expense and removed from the account accounts receivableor the allowance method the bad debts are anticipated even before they occur and an allowance is set. The directwriteoffmethod involves under the direct write off method of accounting for uncollectible accounts bad debts charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating the credit memo creates a debit to a bad debt. The bad debts expense remains at $10,000; it is not directly affected by the journal entry write-off. the bad debts expense recorded on june 30 and july 31 had anticipated a credit loss such as this. it would be double counting for gem to record both an anticipated estimate of a credit loss and the actual credit loss. Under the direct write-off method of accounting for uncollectible accounts, bad debt expense is debited a. at the end of each accounting period. b. when a credit sale is past due. c. when an account is determined to be uncollectible & is written-off. d. whenever a pre-determined amount of credit sales have been made.

The seller's accounting records now show that the account receivable was paid, making it more likely that the seller might do future business with this customer. The directwriteoffmethod is a way businesses account for debt can’t be collected from clients, where the bad debts expense account is debited and accounts under the direct write off method of accounting for uncollectible accounts bad debts receivable is credited. for example, a graphic designer makes a new logo for a client and sends the files with an invoice for $500, but the client never pays and the designer decides the client won’t ever pay, so she debits bad debts.

The direct write off method. under the direct write off method, when a small business determines an invoice is uncollectible they can debit under the direct write off method of accounting for uncollectible accounts bad debts the bad debts expense account and credit accounts receivable immediately. this eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. Under the direct write-off method of accounting for uncollectible accounts, bad debts expense is debited when an account is determined to be worthless if the allowance method of accounting for uncollectible receivables is used, what general ledger account is debited to write off a customer's account as uncollectible?. Under the direct write-off method of accounting for uncollectible accounts, bad debts expense is debited a. at the end of each accounting period b. when a credit sale is past due c. whenever a predetermined amount of credit sales have been made d. when an account is determined to be worthless.

Another way sellers apply the allowance method of recording bad debts expense is by using the percentage of credit sales approach. this approach under the direct write off method of accounting for uncollectible accounts bad debts automatically expenses a percentage of its credit sales based on past history. Uncollectible accounts are frequently called “bad debts. ” direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry. The directwrite-offmethodof accountingfor uncollectibleaccounts is not generally accepted as a basis for estimating bad debts. under the direct write-off method of accounting for uncollectible accounts, bad debts expense is debited. Under both the allowance method and the direct-write off method of accounting for uncollectible accounts, the amount of bad debts expense is to be estimated at the end of each accounting period. true false. ordinary repairs to plant assets are referred to as revenue expenditures. true. false.

Test 3 flashcards quizlet.

Under the allowance method, if a specific customer's accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. the entry to write off a bad account affects only balance sheet accounts: a debit to allowance for doubtful accounts and a credit to accounts receivable. no expense or loss is reported on the income statement because this write-off is \\"covered\\" under the earlier adjusting entries for estimated bad debts expense. Under the bad debts direct write-off method, one entry is required to record credit loss in the general journal. if it is known that a specific customer is not able to pay a specific amount, the accounts receivable should be reduced for that amount.