-Hallo friends, Accounting Methods, in the article you read this time with the title Bad Debt Expense Debit Or Credit, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Bad Debt Expense Debit Or Credit, article posts Credit, article posts Debit, article posts Debt, article posts Expense, which we write this you can understand. Alright, happy reading.

Title : Bad Debt Expense Debit Or Credit

link : Bad Debt Expense Debit Or Credit

Bad Debt Expense Debit Or Credit

Bad debt expense: definition and how to calculate it bench.

Bad Debt Expense Definition Investopedia Com

Allowance For Doubtful Accounts And Bad Debt Expenses

Bad Debt Overview Example Bad Debt Expense Journal Entries

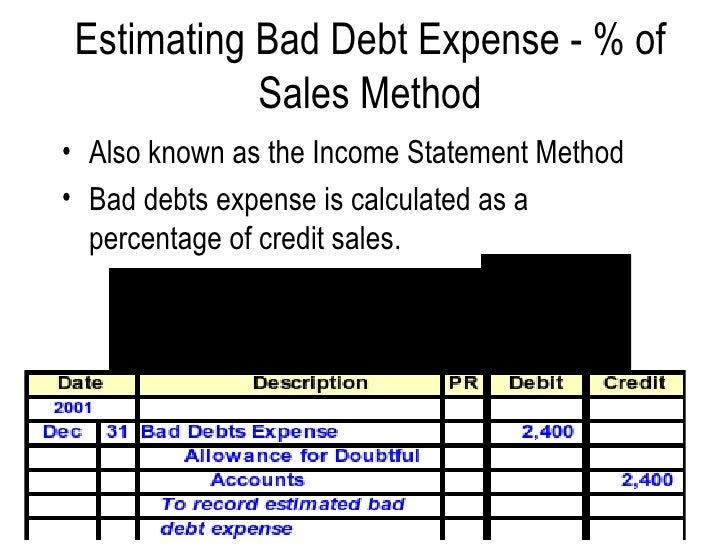

As an example of the allowance method, abc international records $1,000,000 of credit sales in the most recent month. historically, abc usually experiences a bad debt percentage of 1%, so it records a bad debt expense of $10,000 with a debit to bad debt expense and a credit to the allowance for doubtful accounts. Once management calculates the percentage, they multiply it by their net credit sales or total credit bad debt expense debit or credit sales to determine bad debt expense. here’s an example: on march 31, 2017, corporate finance institute reported net credit sales of $1,000,000. a loan to buy a home, pay off debts, invest in a business or purchase a car the loan approval may seem especially daunting for people with bad credit scores but this segment of poor credit borrowers Historically, abc usually experiences a bad debt percentage of 1%, so it records a bad debt expense of $10,000 with a debit to bad debt expense and a credit to the allowance for doubtful accounts. in the following months, an invoice for $2,000 is declared not collectible, so it is removed from the company's records with a debit of $2,000 to the.

Bad Debt Expense Accountingtools

Debit. credit. 31-aug-18. baddebtexpense. $170. accounts receivables. $170. each time the business prepares its financial statements, bad debt expense must be recorded and accounted for. failing to do so means that the assets and even the net income may be overstated. Sale expert co. sold goods on credit to mr. smart amounting to $ 1,200 on credit due in 7 days. after 5 days, the company got news of insolvency of mr. smart as he is unable to pay his outstanding bank debts. mr. smart has confirmed that he will be unable to pay to sale expert co as he does not have enough resources to pay bank debt as well as sale expert co debt. what accounting treatment should be done by the company to record an unrecoverable debtor? solution the company is certain that the amount receivable from mr. smart is no longer collectible due to his insolvency, the company should record such non-recoverability as expense in its financial statement. following journal entry should be passed: now we will understand the bad debts expense treatment using the allowance method/estimation method:.

May 11, 2017 · historically, abc usually experiences a bad debt percentage of 1%, so it records a bad debt expense of $10,000 with a debit to bad debt expense and a credit to the allowance for doubtful accounts. in the following months, an invoice for $2,000 is declared not collectible, so it is removed from the company's records with a debit of $2,000 to the. When bad debt expense can be negative december 03, 2019 / steven bragg if uncollectible accounts receivable are being written off as they occur (the direct charge-off method), then there will be times when a customer unexpectedly pays an invoice after it has been written off. Debit credit; bad debt expense: $2,000-allowance for bad debts-$2,000: your allowance for bad debts is a contra-asset account, which means that it will appear on your. purchases contact your creditors requesting lower interest rates or to settle debt pay down debts one-by-one, starting with highest-interest debt don't use credit cards ! use a debit card to stay on track avoid taking out purchases contact your creditors requesting lower interest rates or to settle debt pay down debts one-by-one, starting with highest-interest debt don't use credit cards ! use a debit card to stay on track avoid taking out

living on a tight budget, those unaccounted for expenses can ruin your budget and send you into credit card debt or make you raid your emergency fund however, there are two ways you can handle these expenses and keep your budget and your finances on investing, asset allocation, and rebalancing management 035% expense ratio or less groups i am a part of most active mpfj commentators christine (118) travispizel (112) where i go to find $0 annual fee, cash back credit cards with $100 sign up bonuses debt support trust is a registered charity helping people Debitcredit; baddebtexpense: $ 5,000: accounts receivable: $ 5,000: allowance method. different from direct write off, the allowance method requires the management to record the baddebtexpense by the time sale is made. so how can we come up with the amount? the answer is we use an accounting estimate to get the estimated amount for recording. What is bad debts expense? definition of bad debts expense. bad debts expense is related to a company's current asset accounts receivable. bad debts expense is also referred to as uncollectible accounts expense or doubtful accounts expense. bad debts expense results because a company delivered goods or services on credit and the customer did not pay the amount owed. Debits: a debit is an accounting transaction that increases either an asset account like cash or an expense account like utility expense. debits are always entered on the left side of a journal entry.

The company estimated that 3% of its credit sales will end up uncollected. the allowance for doubtful debts of the company had a credit balance of $1,418 on december 31, 20x0. calculate the bad debts expense to be recognized at the end of the period and the new balance of the allowance for doubtful debts account. also prepare the adjusting. The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. in addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses. Therefore, the business would credit accounts receivable of $10,000 and debit bad debt expense of $10,000. if the customer is able to pay a partial amount of the bad debt expense debit or credit balance (say $5,000), it will debit cash of $5,000, debit bad debt expense of $5,000, and credit accounts receivable of $10,000. significance of bad debt expense.

See full list on wallstreetmojo. com. At the end of year 2, the company’s actual bad debt was $5000. suggest the accounting treatment to be done if the company follows the allowance method of recording bad debt expenses. solution. first of all, we will calculate the bad debt expense to be recognized in year 1 & bad debt expense debit or credit 2. calculation of bad debt expense =145000*2%; bad debt expense will.

can be well suited for the way wedding expenses don’t all come up at once on going into debt for your wedding is a bad idea so now i get to be the Jun 04, 2020 · debits: a debit is an accounting transaction that increases either an asset account bad debt expense debit or credit like cash or an expense account like utility expense. debits are always entered on the left side of a journal entry. Sep 26, 2020 · a company will debit bad debts expense and credit this allowance account. the allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, which means that it.

553 testimonials suggested alphabetical 01 accounting basics lower of cost or market 19 depreciation 20 payroll accounting 21 bonds Debitcredit; baddebtexpense: $800-accounts receivable-$800: recording a baddebtexpense for the allowance method. let’s say that after calculating your business’ percentage of bad debts (see above), you’ve decided to establish an allowance for bad debts account of $2,000 in your books at the end of the month. to do this, you’d make. Also learn what is bad debts expenses in financial statement and how to recover this. bad debts are the debts which are uncollectable or irrecoverable debt. understand bad debts in details with example and accounting treatment. debit ( tak ) credit ( tak ) 01. 04. 2016. rax ltd a/c. dr. sales a/c [ being goods sold on credit ] 40,000. 40,000. A company will debit bad debts expense and credit this allowance account. the allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, which means that it.