-Hallo friends, Accounting Methods, in the article you read this time with the title Under The Direct Write-off Method Of Accounting For Uncollectible Accounts, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, article posts Accounts, article posts Direct, article posts Method, article posts Uncollectible, article posts Under, article posts Under The Direct Write-off Method Of Accounting For Uncollectible Accounts, article posts Write-off, which we write this you can understand. Alright, happy reading.

Title : Under The Direct Write-off Method Of Accounting For Uncollectible Accounts

link : Under The Direct Write-off Method Of Accounting For Uncollectible Accounts

Under The Direct Write-off Method Of Accounting For Uncollectible Accounts

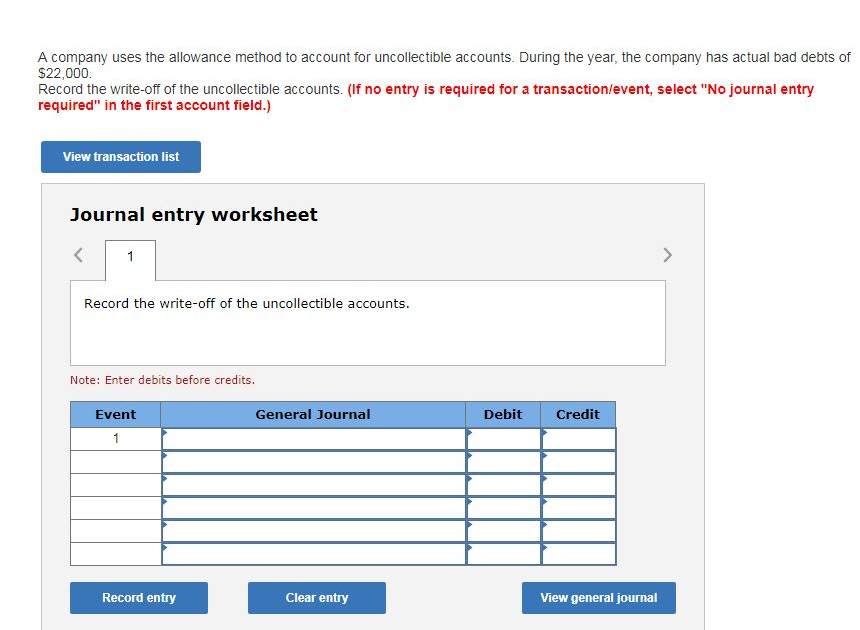

Direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. Under direct write-off method the uncollectible accounts expense is recognized when a receivable is actually determined to be uncollectible. unlike allowance method, no valuation allowance is used and accounts receivables are reported in the balance sheet at gross amount. this method does not follow the matching principle of accounting because no attempt is made to Under the direct write-off method of accounting for uncollectible accounts, bad debt expense is debited a. at the end of each accounting period. b. when a credit sale is past due. c. when an account is determined to be uncollectible & is written-off. d. whenever a pre-determined amount of credit sales have been made.

The directwrite-offmethod recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. Directwrite-offmethod. a simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income tax purposes. the allowance method provides in advance for uncollectible accounts think of as setting aside money in a reserve account. The directwrite offmethod involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used under the direct write-off method of accounting for uncollectible accounts to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating the credit memo creates a debit to a bad debt.

Test bank for accounting principles, eleventh edition 87. under the direct write-off method of accounting for uncollectible accounts a. the allowance account is increased for the actual amount of bad debt at the time of write-off. b. a specific account receivable is decreased for the actual amount of bad debt at the time of write-off. c. balance sheet relationships are emphasized. The direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. the specific action used to write off an account receivable under this method with accounting software is to create a credit memo for the customer in question, which offsets the amount of the bad debt. creating.

The directwrite offmethod. underthe directwrite offmethod, when a small business determines an invoice is uncollectible they can debit the bad debts expense account and credit accounts receivable immediately. this eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. Under the direct write-off method of accounting for uncollectible accounts, bad debt expense is debited? when a credit sale is past due. when an account is determined to be uncollectible. at the end of each accounting period. whenever a pre-determined amount of credit sales have been made. The direct write off method. under the direct write off method, when a small business determines an invoice is uncollectible they can debit the bad debts expense account and credit accounts receivable immediately. this eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. Direct write off method refers to the technique of accounting for the uncollectible accounts by businesses. under the direct write off method, once accounts are identified as uncollectible, the bad debts expense account is debited and the accounts receivable account is credited directly.

The directwrite-offmethod is one of the two methods normally associated with reporting accounts receivable and bad debts expense. (the other method is the allowance method. ) under the direct write-off method, bad debts expense is first reported on a company's income statement when a customer's account is actually written off. Underdirectwrite-offmethod the uncollectible accounts expense is recognized when a receivable is actually determined to be uncollectible. unlike allowance method, no valuation allowance is used and accounts receivables are reported in the balance sheet at gross amount.. this method does not follow the matching principle under the direct write-off method of accounting for uncollectible accounts of accounting because no attempt is made to match sales revenue with.

Chapter 8 Accounting Youll Remember Quizlet

Solution for entries for bad debt expense under the direct write-off and allowance methods the following selected transactions were taken from the records of…. Why isn't the direct write off method of uncollectible accounts receivable the preferred method? definition of direct write off method. under the direct write off method of accounting for credit losses pertaining to accounts receivable, no bad debts expense is reported on the income statement until an account receivable is actually removed from the company's receivables. Why isn't the direct write off method of uncollectible accounts receivable the preferred method? definition of direct write off method. under the direct write off method of accounting for credit losses pertaining to accounts receivable, no bad debts expense is reported on the income statement until an account receivable is actually removed from the company's receivables.

Under the direct write-off method of accounting for uncollectible accounts, bad debts under the direct write-off method of accounting for uncollectible accounts expense is debited a. at the end of each accounting period b. when a credit sale is past due c. whenever a predetermined amount of credit sales have been made d. when an account is determined to be worthless.

The Directwrite Offmethod Accountingtools

Accounting chapter 8 final flashcards quizlet.

Underthe directwrite-offmethod, a bad debt is charged to expense as soon as it is apparent that an invoice will not be paid. under the allowance method, an estimate of the future amount of bad debt is charged to a reserve account as soon as a sale is made. this results in the following differences between the two methods: timing. bad debt expense recognition is delayed under the direct write. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. Directwrite offmethod refers to the technique of accounting for the uncollectible accounts by businesses. under the direct write off method, once accounts are identified as uncollectible, the bad debts expense account is debited and the accounts receivable account is credited directly.