-Hallo friends, Accounting Methods, in the article you read this time with the title Inventory Turnover Ratio Analysis, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Analysis, article posts Inventory, article posts Inventory Turnover Ratio Analysis, article posts Ratio, article posts Turnover, which we write this you can understand. Alright, happy reading.

Title : Inventory Turnover Ratio Analysis

link : Inventory Turnover Ratio Analysis

Inventory Turnover Ratio Analysis

The inventory turnover ratio. the inventory turnover ratio is an important financial ratio for many companies. of all the asset-management ratios, it gives the business owner some of the most important financial information, by showing how many times the company turns its inventory over within the given period. Analysis. inventory turnover is a measure of how efficiently a company can control its merchandise, so it is important to have a high turn. this shows the company does not overspend by buying too much inventory and wastes resources by storing non-salable inventory. Alternatively, using the other method—cogs / average inventory—the inventory turnover is 10, or $250,000 in cogs divided by $25,000 in inventory. inventory is on hand for 36. 5 days under this. Inventory turnover ratio analysis: we know that inventory is the biggest asset that the company holds. inventory turnover ratio used to analyze the actual condition of the company, whether the company is appropriately using its resources and is it efficient for selling the stocks.

How To Calculate The Inventory Turnover Ratio

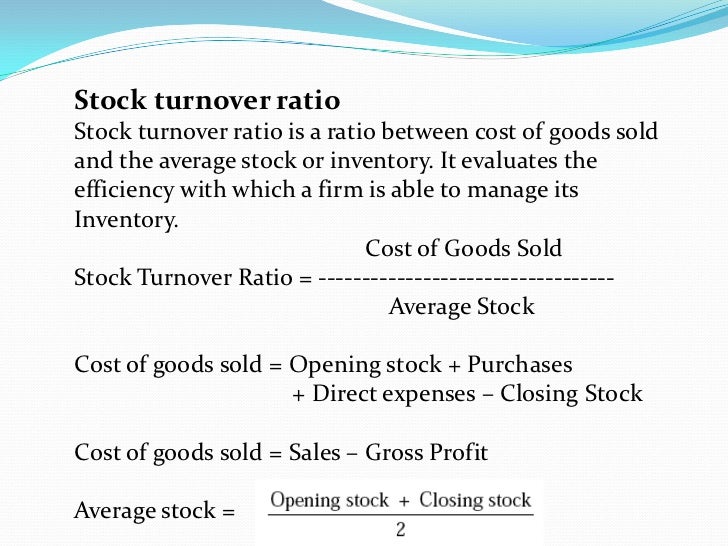

Inventoryturnoverratio (itr) is an activity ratio and is a tool to evaluate the liquidity of company’s inventory. it measures how many times a company has sold and replaced its inventory during a certain period of time. formula: inventory turnover ratio is computed by dividing the cost of goods sold by average inventory at cost. the bcg matrix ? contribution margin and contribution margin ratio what is a swot analysis ? asset turnover what is michael inventory turnover ratio analysis porter's value chain ? inventory turnover what is michael porter's diamond model ?

Inventory Turnover Ratio Explanation Formula Example And

Sep 17, 2020 · the inventory turnover ratio is a formula that makes it easy to figure out how long it takes for a business to sell through its entire inventory. a higher inventory turnover ratio usually indicates that a business has strong sales compared to a company with a lower inventory turnover ratio. growth is a positive but for context the inventory-to-sales ratio remains at 135x the highest level ex-lehman on record they just keep building inventories… even as sales remain lower yoy… urban outfitters (

Aug 27, 2019 · definition of inventory turnover ratio. inventory turnover ratio determines the number of times the inventory is purchased and sold during the entire fiscal year. this ratio is important to both the company and the investors as it clearly reflects the company’s effectiveness in converting the inventory purchases to final sales. The inventory turnover ratio is a formula that makes it easy to figure out how long it takes for a business to sell through its entire inventory. a higher inventory turnover ratio usually indicates that a business has strong sales compared to a company with a lower inventory turnover ratio. Analysis. inventoryturnover is a measure of how efficiently a company can control its merchandise, so it is important to have a high turn. this shows the company does not overspend by buying too much inventory and wastes resources by storing non-salable inventory. The inventory turnover ratio, as outlined by tracy in “ratio analysis fundamentals: how 17 financial ratios can allow you to analyse any business on the planet,” is a measure of efficiency. it tells us how efficiently management performs in handling the flow of goods through its business process.

Definition of inventory turnover ratio. inventory turnover ratio determines the number of times the inventory is purchased and sold during the entire fiscal year. this ratio is important to both the company and the investors as it clearly reflects the company’s effectiveness in converting the inventory purchases to final sales. man to an ascendant man there is significant turnover in the ranks of alpha males, which women society, particularly of women, is entirely dependent on ratio of 'aggressor' men to 'protector' men staying below as the table shows, a 1:1:1 ratio of three young ladies takes only 40 years to yield a 12:4:0 ratio of grandchildren consider, also, that we are already Inventory turnover ratio (itr) is an activity ratio and is a tool to evaluate the liquidity of company’s inventory. it measures how many times a company has sold and replaced its inventory inventory turnover ratio analysis during a certain period of time. formula: inventory turnover ratio is computed by dividing the cost of goods sold by average inventory at cost.

The inventory turnover ratio is a key measure for evaluating how effective a company is at managing inventory levels and generating sales from its inventory. See more videos for inventory turnover ratio analysis. The inventory turnover ratio is calculated by dividing the cost of goods sold for a period by the average inventory for that period. average inventory is used instead of ending inventory because many companies’ merchandise fluctuates greatly throughout the year. for inventory turnover ratio analysis instance, a company might purchase a large quantity of merchandise january 1 and sell that for the rest of the year. by december almost the entire inventory is sold and the ending balance does not accurately reflect the company’s a

Inventoryturnover (days) breakdown by inventory turnover ratio analysis industry. inventory turnover is a measure of the number of times inventory is sold or used in a given time period such as one year calculation: cost of goods sold / average inventory, or in days: 365 / inventory turnover. more about inventory turnover (days). number of u. s. listed companies included in the calculation: 2082 (year 2019). Inventory turnover ratio analysis explanation. inventory turnover ratio explanations occur very simply through an illustration of high and low turnover ratios. despite this, many businesses do not survive due to issues with inventory. a low inventory turnover ratio shows that a company may be overstocking or deficiencies in the product line or. Jul 21, 2020 · the inventory turnover ratio is a key measure for evaluating how effective a company is at managing inventory levels and generating sales from its inventory. Inventoryturnoveranalysis. a business needs to know its inventory turnover because this measures how efficiently the company controls its merchandise. if a business purchases a large inventory of stock at the beginning of the year, this would imply that it has to sell it over the year if it wants to improve its inventory turnover ratio.

See full list on myaccountingcourse. com. Analysis. inventoryturnoverratio is used to assess how efficiently a business is managing its inventories. in general, a high inventory turnover indicates efficient operations. a low inventory turnover inventory turnover ratio analysis compared to the industry average and competitors means poor inventories management. it may be an indication of either a slow-down in demand or.