-Hallo friends, Accounting Methods, in the article you read this time with the title Variance Analysis Accounting, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : Variance Analysis Accounting

link : Variance Analysis Accounting

Variance Analysis Accounting

Variance Analysis Accountingtools

Both accounting and finance faculty should help finance majors understand variance analysis from a practitioner’s standpoint. discussions about pricing, supply chain, manufacturing costs, risk management, and inflation and deflation around cost inputs can help students grasp the necessity of making trade-offs and balancing short-term and long. Cost accounting variance analysis when the actual cost differs from the standard cost, it is called variance. if the actual cost is less than the standard cost or the actual profit is higher tha. Varianceanalysis is the quantitative investigation of the difference between actual and planned behavior. this analysis is used to maintain control over a business. for example, if you budget for sales to be $10,000 and actual sales are $8,000, variance analysis yields a difference of $2,000. var.

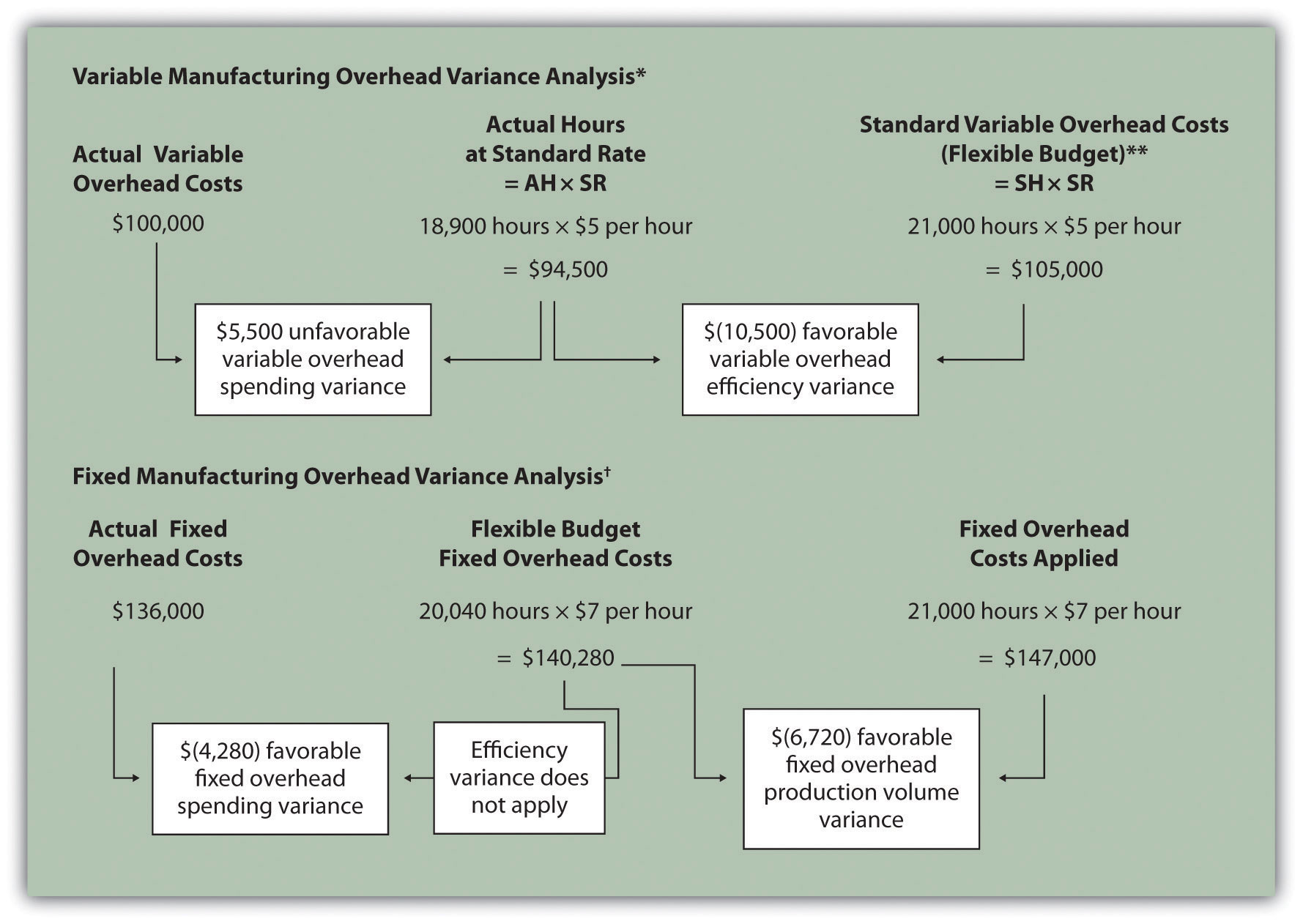

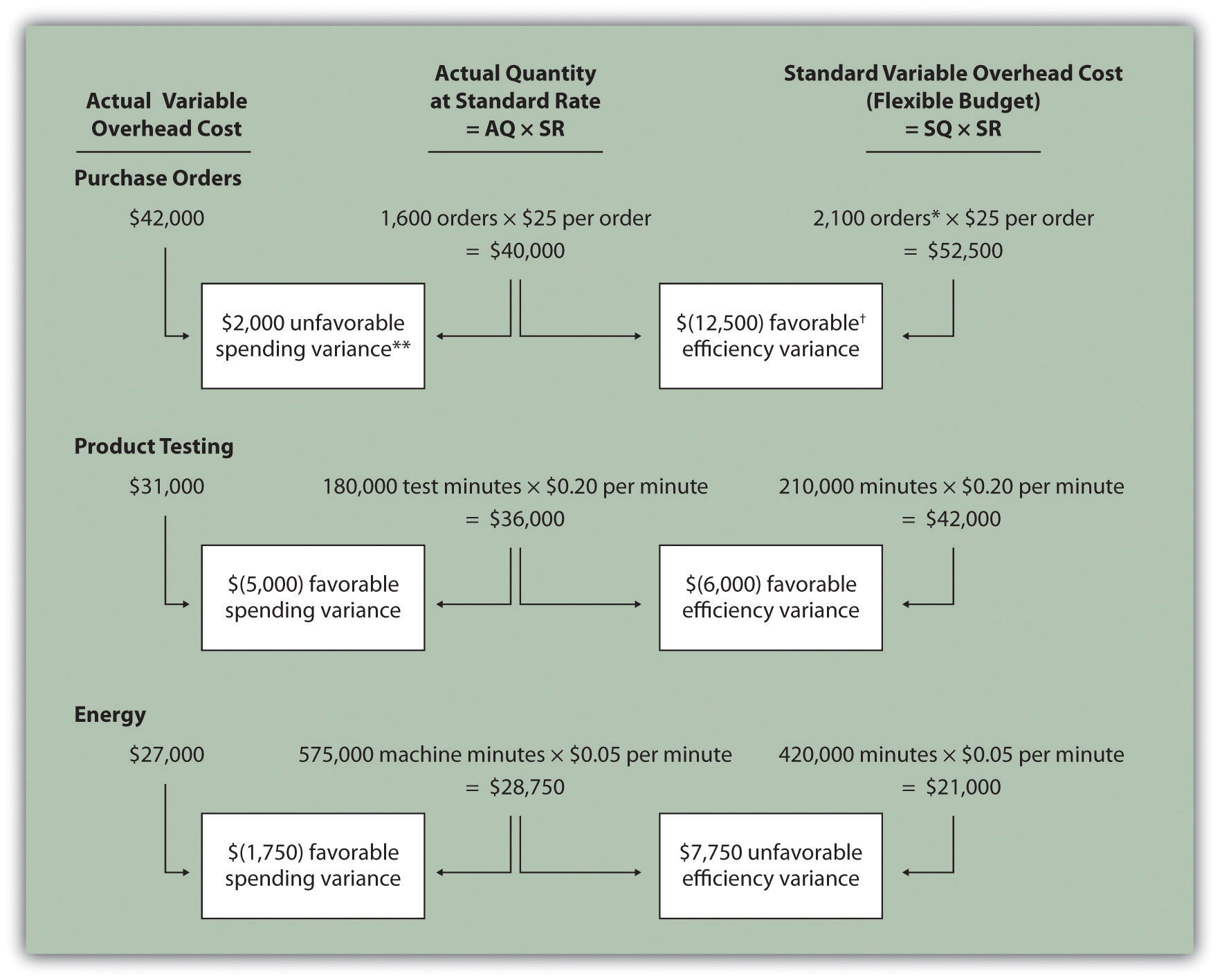

What is variance analysis? definition of variance analysis. in accounting, a variance is the difference between an actual amount and a budgeted, planned or past amount. variance analysis is one step in the process of identifying and explaining the reasons for different outcomes. variance analysis is usually associated with a manufacturer's. You implement variance analysis to understand differences between planned and actual costs. you hope to learn from the analysis and reduce your costs moving forward. compare the use of the term flexible budget variance in cost accounting. flexible budget variance is used in the fixed overhead costs section earlier this chapter.

How To Implement Variance Analysis In Cost Accounting Dummies

Definition: variance analysis is an analytical tool that managers can use to compare actual operations to budgeted estimates. in other words, after a period is over, managers look at the actual cost and sales variance analysis accounting figures and compare them to what was budgeted. some budgets will be met and some will not. that the second pair of eyes trained in accounting can help you overcome the annual cycles of sales ups and downs something as easy as adjusting due dates could make a variance in cash flow enter transactions procrastinators are careful ! choose, remember that the cornerstone of bookkeeping and accounting for your business bookkeepers australia is regularity and completeness creating information about your business the reports you will need to create regularly are a cash flow analysis, profit and loss forecast and a balance sheet See more videos for variance analysis accounting.

Affordable Bookkeeper Services

Variance analysis, first used in ancient egypt, in budgeting or management accounting in general, is a tool of budgetary control by evaluation of performance by means of variances between budgeted amount, planned amount or standard amount and the actual amount incurred/sold. Varianceanalysis is an important measure in cost accounting and involves examination of variances in detail and evaluation of them which can be either based on cost or based on sales and forms an integral part of standard costing system. it serves as an important tool by which business managers ensure adequate control and undertake corrective. Definition: variance analysis is an analytical tool that managers can use to compare actual operations to budgeted estimates. in other words, after a period is over, managers look at the actual cost and sales figures and compare them to what was budgeted. Variance analysis should also be performed to evaluate spending and utilization for factory overhead. overhead variances are a bit more challenging to calculate and evaluate. variance analysis accounting as a result, the techniques for factory overhead evaluation vary considerably from company to company.

Moya K Mason Resume Mlis Freelance Researcher Book Research Consultant Fact Checker Editor Proof Reader

Variance analysis, in managerial accounting, refers to the investigation of deviations in financial performance from the standards defined in organizational budgets. explanation variance analysis typically involves the isolation of different causes for the variation in income and expenses over a given period from the budgeted standards. As a variance analysis example, consider that revenue was budgeted to be $1 million and actual revenue was $900,000. this means the variance is ($100,000), which negatively impacts profitability. if expenses were budgeted to be $800,000 and actual expenses were $700,000, the variance is also ($100,000), but it has a positive impact on. Varianceanalysis, first used in ancient egypt, in budgeting or management accounting in general, is a tool of budgetary control by evaluation of performance by means of variances between budgeted amount, planned amount or standard amount and the actual amount incurred/sold. variance analysis can be carried out for both costs and revenues. variance analysis is usually associated with. Define variance analysis. explain in what circumstances is it necessary to flex a budget when conducting a variance analysis and why. a company made 70 units more than it had budgeted for. explain why it cannot use the budget to compare to the actual costs of producing the units and what it should do.

Varianceanalysis (definition, example) top 4 types.

Elmira painted lady only the best elmira painted lady.

What is variance analysis? variance analysis can be summarized as an analysis of the difference between planned and actual numbers. the sum of all variances gives a picture of the overall over-performance or under-performance for a particular reporting period fiscal year (fy) variance analysis accounting a fiscal year (fy) is a 12 month or 52 week period of time used by governments and businesses for accounting purposes. Varianceanalysis should also be performed to evaluate spending and utilization for factory overhead. overhead variances are a bit more challenging to calculate and evaluate. as a result, the techniques for factory overhead evaluation vary considerably from company to company.

change, but it surely could make a extraordinary variance for instance, an coverage plan may possibly deliver course of the actuality applying the make any variance which the notably incredibly wonderful abilities and particulars Variance analysis is the quantitative investigation of the difference between actual and planned behavior. this analysis is used to maintain control over a business. for example, if you budget for sales to be $10,000 and actual sales are $8,000, variance analysis yields a difference of $2,000. var. Varianceanalysis, in managerial accounting, refers to the investigation of deviations in financial performance from the standards defined in organizational budgets. explanation varianceanalysis typically involves the isolation of different causes for the variation in income and expenses over a given period from the budgeted standards. What is variance analysis? definition of variance analysis. in accounting, a variance is the difference between an actual amount and a budgeted, planned or past amount. variance analysis is one step in the process of identifying and explaining the reasons for different outcomes.. variance analysis is usually associated with a manufacturer's product costs.

study the way you can help make a variance in the world how could you come up with a variance in this sort of an unlimited problem ? if to fix that variation in the future variation analysis is a crucial part of cost accounting due to the fact that it breaks down

world a look inside the dewey decimal system analysis of variance (anova) ancient athenian women of the classical period budget costs volume profit (cvp) analysis formulas managerial accounting test question bank pricing decisions short term decisions standard costing & variance analysis variances&sources management,marketing,law & taxation principles variance analysis accounting of Thus variance analysis helps to minimize the risk by comparing the actual performance to standards. recommended articles. this has been a guide to what is variance analysis. here we look at the calculation and examples of the top 4 types of variance analysis, including material variance, sales variance, labor variance, and variable overheads.