-Hallo friends, Accounting Methods, in the article you read this time with the title On Accounting Rules, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : On Accounting Rules

link : On Accounting Rules

On Accounting Rules

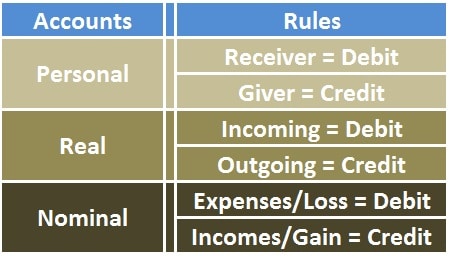

Three golden rules of accounting. one of the most famous and commonly used terms in the field of accounting and finance is “three golden rules of accounting”. these rules are used to prepare an accurate journal entry which forms the very basis of accounting and act as a cornerstone for all bookkeeping. These general rules–referred to as basic accounting principles and guidelines–form the groundwork on which more detailed, complicated, and legalistic accounting rules are based. for example, the financial accounting standards board (fasb) uses the basic accounting principles and guidelines as a basis for their own detailed and comprehensive.

See full list on accountingcoach. com. In some cases, businesses will have to look overseas and analogize to international financial reporting standards, the international accounting rules set by the london-based international accounting standards board. ias 20 includes guidance on accounting for government grants and require disclosures about government assistance. See full list on accountingcoach. com. See full list on accounting rules on accountingcoach. com.

Golden Rules Of Accounting 3 Main Principles

Accounting principles explanation accountingcoach.

Deutsche boerse says wirecard to leave dax.

A on accounting rules company usually lists its significant accounting policies as the first note to its financial statements.

Simplified Accounting Rules Issued For Small Businesses

comment » image courtesy of adobe stock fasb decided on 7/17/19 to postpone four major accounting rule changes for non-public companies journal of accountancy The purpose of accounting principles is to establish the framework for how financial accounting is recorded and reported on financial statements. when every company follows the same framework and rules, investors, creditors, and other financial statement users will have an easier time understanding the reports and making decisions based on them. Golden rules of accounting definition: in double entry system, due to its dual aspect, every transaction affects two accounts, one of which is debited and other is credited. to record the transactions in the journal, in a sequential way, certain rules are required, and these rules are called as golden rules of accounting. The purpose of accounting principles is to establish the framework for how financial accounting is recorded and reported on financial statements. when every company follows the same framework and rules, investors, creditors, and other financial statement users will have an easier time understanding the reports and making decisions based on them.

U. s. secretary of state mike pompeo is set to warn american investors on thursday against 'fraudulent' accounting practices of china-based companies and suggest the nasdaq's recent decision to tighten listing rules for such players should be a model for all other exchanges around the world. material impairments securities & trading: notices of delistings or rule failures unregistered sales of equity secs changes to rights of sec holders accountants & accounting: changes in certifying accountants non-reliance on previous financials governance & management: changes in control changes Apr 20, 2020 · understanding gaap. gaap helps govern the world of accounting according to general rules and guidelines. it attempts to standardize and regulate the definitions, assumptions, and methods used in. As per accounting rules all the accounting transactions should be recorded in the books of entity using double entry accounting method. double entry accounting method means for each transaction two (or more) accounts are involved, one account shall be debited and the other account shall be credited with the same amount.

Understanding gaap. gaap helps govern the world of accounting according to general rules and guidelines. it attempts to standardize and regulate the definitions, assumptions, and methods used in. Accounting rules determine the number of periods and percentage of total revenue to record in each accounting period. you can use accounting rules with transactions that you import into receivables using autoinvoice and with invoices that you create manually in the transaction windows. you can define an unlimited number of accounting rules. Ir-2020-174, july 30, 2020. washington — the internal revenue service today issued proposed regulations (pdf) updating various tax accounting regulations to adopt the simplified tax accounting rules for small businesses under the tax cuts and jobs act (tcja).. for tax years beginning in 2019 and 2020, these simplified tax accounting rules apply for taxpayers having inflation-adjusted average. If a situation arises where there are two acceptable alternatives for reporting an item, conservatism directs the accountant to choose the alternative that will result in less net income and/or less asset amount. conservatism helps the accountant to \\"break a tie. \\" it does not direct accountants to be conservative. accountants are expected to be unbiased and objective.

Proposed regulations (reg-132766-18) issued thursday update various tax accounting regulations to adopt the simplified tax accounting rules for small businesses enacted by the law known as the tax cuts and jobs act (tcja), p. l. 115-97. for tax years beginning in 2019 and 2020, these simplified tax. Accountingrules determine the number of periods and percentage of total revenue to record in each accounting period. you can use accounting rules with transactions that you import into receivables using autoinvoice and with invoices that you create manually in the transaction windows. you can define an unlimited number of accounting rules.

Proposed regulations (reg-132766-18) issued thursday update various tax accounting regulations to adopt on accounting rules the simplified tax accounting rules for small businesses enacted by the law known as the tax cuts and jobs act (tcja), p. l. 115-97. for tax years beginning in 2019 and 2020, these simplified tax accounting rules apply for taxpayers with inflation-adjusted average annual gross receipts of $26. If a company distributes its financial statements to the public, it is required to follow generally accepted accounting principles in the preparation of those statements. further, if a company's stock is publicly traded, federal law requires the company's financial statements be audited by independent public accountants. both the company's management and the independent accountants must certify that the financial statements and the related notes to the financial statements have been prepared in accordance with gaap.