-Hallo friends, Accounting Methods, in the article you read this time with the title Principle Of Accounting, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : Principle Of Accounting

link : Principle Of Accounting

Principle Of Accounting

Home principlesofaccounting. com.

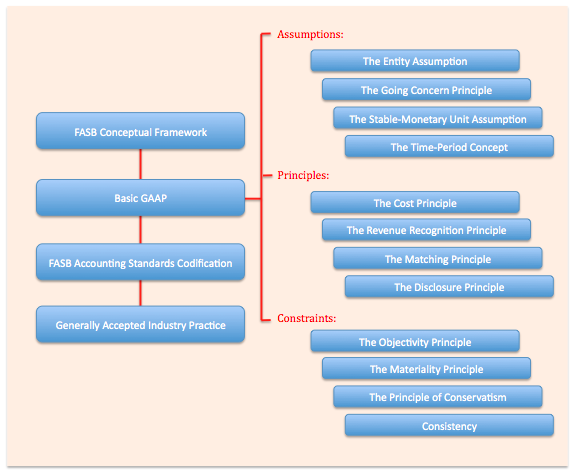

A number of basic accounting principles have been developed through common usage. they form the basis upon which the complete suite of accounting standards have been built. the best-known of these principles are as follows: accrual principle. this is the concept that accounting transaction. What are accounting principles? definition: accounting principles are the building blocks for gaap. all of the concepts and standards in gaap can be traced back to the underlying accounting principles. some principle of accounting accounting principles come from long-used accounting practices where as others come from ruling making bodies like the fasb. it’s important to have a basic understanding of these main.

Vaisala A Global Leader In Environmental And Industrial Measurement

The accounting equation: assets = liabilities + owners’ equity. how transactions impact the accounting equation. the four core financial statements. chapter 1 introduces the study of accounting. accounting is defined as a set of concepts and techniques that are used to measure and report financial information about an economic entity. If a company distributes its financial statements to the public, it is required to follow generally accepted accounting principles in the preparation of those statements. further, if a company's stock is publicly traded, federal law requires the company's financial statements be audited by independent public accountants. both the company's management and the independent accountants must certify that the financial statements and the related notes to the financial statements have been principle of accounting prepared in accordance with gaap. The continuity assumption states that accounting systems assume that a business will continue to operate. the importance of the continuity assumption becomes most clear if you consider the ramifications of assuming that a business won’t continue. if a business won’t continue, it becomes very unclear how one should value assets if the assets have no resale value. if a business won’t continue operations, no assurance exists that any of the inventory can be sold. if the inventory can’t be sold,

The expense principle states that an expense occurs when the business uses goods or receives services. in other words, the expense principle is the flip side of the revenue principle. as is the case with the revenue principle, if you receive some goods, simply receiving the goods means that you’ve incurred the expense of the goods. similarly, if you received some service, you have incurred the expense. it doesn’t matter that it takes a few days or a few weeks to get the bill. you incur an exp Principlesofaccounting. com is a high-quality, comprehensive, free, financial and managerial accounting textbook online and more. Gaap is exceedingly useful because it attempts to standardize and regulate accounting definitions, assumptions, and methods. because of generally accepted accounting principles we are able to assume that there is consistency from year to year in the methods used to prepare a company's financial statements. and although variations may exist, we can make reasonably confident conclusions when comparing one company to another, or comparing one company's financial statistics to the statistics for its industry. over the years the generally accepted accounting principles have become more complex because financial transactions have become more complex. since gaap is founded on the basic accounting principles and guidelines, we can better understand gaap if we understand those accounting principles. the following is a list of the ten main accounting principles and guidelines together with a highly condensed explanation of each. Principlesof accounting; deifition; identify; record; communicate; organization, interested users; financial statements; stakeholders; internal users; exter.

Because of this basic accounting principle, it is assumed that the dollar's purchasing power has not changed over time. as a result accountants ignore the effect of principle of accounting inflation on recorded amounts. for example, dollars from a 1960 transaction are combined (or shown) with dollars from a 2018 transaction. Accountingprinciples serve as a doctrine for accountants theory and procedures, in doing their accounting systems. accounting principles ensure that companies follow certain standards of recording how economic events should be recognised, recorded, and presented. online resources to learn the basic concepts and principles of accounting bookkeeping financial accounting managerial accounting, business and finance learn the detailed and comprehensive concepts, terms and principles of accounting it is recommended to accounting students, accounting professionals,

The accountant keeps all of the business transactions of a sole proprietorship separate from the business owner's personal transactions. for legal purposes, a sole proprietorship and its owner are considered to be one entity, but for accounting purposes they are considered to be two separate entities. Accounting principle of accounting principles are the rules and guidelines followed by the different entities to record, to prepare and to present the financial statements of the company for presenting true and fair picture of those financial statements. See full list on accountingcoach. com.

The revenue principle, also known as the realization principle, states that revenue is earned when the sale is made, which is typically when goods or services are provided. a key component of the revenue principle, when it comes to the sale of goods, is that revenue is earned when legal ownership of the goods passes from seller to buyer. note that revenue isn’t earned when you collect cash for something. See full list on dummies. com. From an accountant's point of view, the term \\"cost\\" refers to the amount spent (cash or the cash equivalent) when an item was originally obtained, whether that purchase happened last year or thirty years ago. for this reason, the amounts shown on financial statements are referred to as historical cost amounts. There are general rules and concepts that govern the field of accounting. these general rulesreferred to as basic accounting principles and guidelinesform the groundwork on which more detailed, complicated, and legalistic accounting rules are based. for example, the financial accounting standards board (fasb) uses the basic accounting principles and guidelines as a basis for their own detailed and comprehensive set of accounting rules and standards.

Accounting Principles Meaning Top 6 Basic Accounting

Basic accounting principles and guidelines. since gaap is founded on the basic accounting principles and principle of accounting guidelines, we can better understand gaap if we understand those accounting principles. the following is a list of the ten main accounting principles and guidelines together with a highly condensed explanation of each. 1. economic entity. See more videos for principle of accounting.