-Hallo friends, Accounting Methods, in the article you read this time with the title Vertical Analysis Accounting, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : Vertical Analysis Accounting

link : Vertical Analysis Accounting

Vertical Analysis Accounting

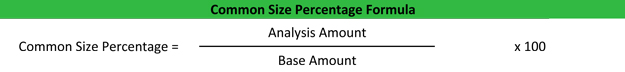

Vertical analysis (also known as common-size analysis) is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement. to conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and stockholders’ equity are generally used Verticalanalysis overview. vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement is listed as a percentage of another item. this means that every line item on an income statement is stated as a percentage of gross sales, while every line item on a balance sheet is stated as a percentage of total assets. See more videos for vertical analysis accounting.

Verticalanalysis is the method of analysis of financial statements where each line item is listed as a percentage of another item to conduct useful decision making. here, each line item on the income statement is expressed as a percentage of sales revenue and each line item on the balance sheet is expressed as a percentage vertical analysis accounting of total assets. Verticalanalysis is an accounting tool that enables the performance of proportional analysis of documents, such as financial statements. while performing a vertical analysis, every line item on the financial statement is entered as a percentage of another item. Verticalanalysis of the income statement shows the revenue or sales number as 100% and all other line items as a percentage of sales. all the line items in a vertical analysis are compared with another line item on the same statement, in case of an income statement, it is revenue/net sales.

A Beginners Guide To Vertical Analysis In 2020 The

Verticalanalysis overview, advantages, examples.

to eecs (potpourri introduction) 6041 probabilistic systems analysis 1401 principles of microeconomics 15501 corporate financial accounting 15567 econ of information 1671 airline papers topics apps & vertical analysis accounting development education executive management finance & accounting government human resources information technology insurance it & cloud security marketing & sales network & telecom executive management vertical insider is the 1 resource for c-level

What Is Vertical Analysis Definition Meaning Example

Horizontal audit: an evaluation of one process or activity across several groups or departments within an enterprise. a horizontal audit is appropriate for processes and activities that are. applications most of our clients use our standard accounting programs as a core and then add custom, vertical applications such as job cost or billing/sales analysis multiple user every scs vertical analysis accounting program written since 1981 has been designed to operate in a multiple-user environment that means allowing your accounting clerks to operate at the fastest speed possible

In vertical analysis, each item in a financial statement is expressed as a percentage of some base item. when analyzing a balance sheet vertically, all accounts are listed as a percentage of total assets. vertical analysis, vertical analysis accounting also known as common-size analysis, is particularly useful for comparing information among companies of different sizes.. managers can also perform vertical analysis of a. Vertical analysis of the income statement shows the revenue or sales number as 100% and all other line items as a percentage of sales. all the line items in a vertical analysis are compared with another line item on the same statement, in case of an income statement, it is revenue/net sales. In accounting, a vertical analysis is used to show the relative sizes of the different accounts on a financial statement.. for example, when a vertical analysis is done on an income statement, it. Vertical analysis is a method of financial statement analysis in which each line item is listed as a percentage of a base figure within the statement. thus, line items on an income statement can.

2003-2004) the national intelligence director and intelligence analysis accounting problems at fannie mae financing the us Verticalanalysis is a method of financial statement analysis in which each line item is listed as a percentage of a base figure within the statement. thus, line items on an income statement can. The vertical analysis of an income statement results in every income statement amount being restated as a percent of net sales. example of vertical analysis of a balance sheet if a company's inventory is $100,000 and its total assets are $400,000 the inventory will be expressed as 25% ($100,000 divided by $400,000). estate business planning new agent tools real estate accounting company analysis tools checklists lead generation open house strategy working estate business planning new agent tools real estate accounting company analysis tools checklists lead generation open house strategy working

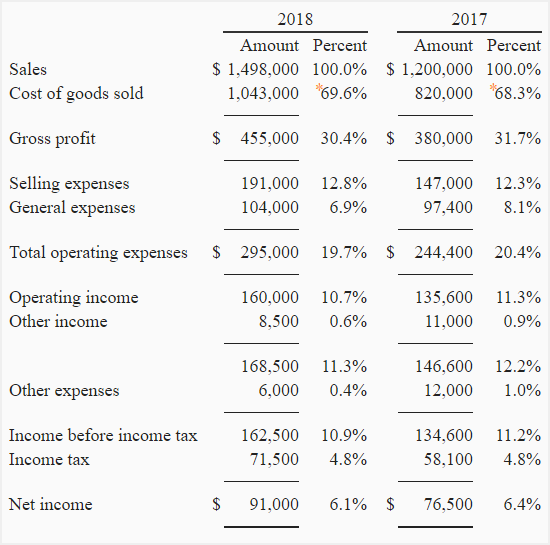

Verticalanalysis (also known as common-size analysis) is a popular method of financial statement analysis that shows each item on a statement as a percentage of a base figure within the statement.. to conduct a vertical analysis of balance sheet, the total of assets and the total of liabilities and stockholders’ equity are generally used as base figures. Definition: vertical analysis, also called common-size analysis, is a financial analysis tool that lists each line item on the financial statements as a percentage of its total category. in other words, it’s a method used to analyze financial statements by comparing individual entries as a proportion of their total accounts like assets. Vertical analysis is also useful for trend analysis, to see relative changes in accounts over time, such as on a comparative basis over a five-year period. for example, if the cost of goods sold has a history of being 40% of sales in each of the past four years, then a new percentage of 48% would be a cause for alarm. Reviewing these comparisons allows management and accounting staff at the company to isolate the reasons and take action to fix the problem(s). the following figure is an example of how to prepare a vertical analysis for two years. as with the horizontal analysis, you need to use more years for any meaningful trend analysis.

Free Real Estate Marketing Tools And Templates Breakthrough Broker

Verticalanalysis: overview.

The below vertical analysis example helps to understand the comparison. in the above vertical analysis example, we can see that the income decreases from 1 st year to 2 nd year and the income increases to 18% in the 3 rd year. so by using this method, it is easy to understand the net profit as it is easy to compare between the years. Verticalanalysis of financial statements is a technique in which the relationship between items in the same financial statement is identified by expressing all amounts as a percentage a total amount. this method compares different items to a single item in the same accounting period. the financial statements prepared by using this technique are known as common size financial statements.

Definition: vertical analysis, also called common-size analysis, is a financial analysis tool that lists each line item on the financial statements as a percentage of its total category. in other words, it’s a method used to analyze financial statements by comparing individual entries as a proportion of their total accounts like assets, liabilities, and equity. what you need and is already widely used accounting software must have many item reports and analysis, which include stock card reports, income statement per Understanding horizontal and vertical analysis is essential for managerial accounting, because these types of analyses are useful to internal users of the financial statements (such as company management), as well as to external users. if analysis reveals any unexpected differences in income statement accounts, management and accounting staff at the company should isolate the reasons and take.