-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Receivable Journal Entry, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Receivable Journal Entry

link : Uncollectible Accounts Receivable Journal Entry

Uncollectible Accounts Receivable Journal Entry

Accounting Chapter 8 And 9 2019 Flashcards Quizlet

The two accounts affected by this entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. journal.

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. For example, the estimate of uncollectible accounts receivable less than 30 days old is 0. 5% and equals $12,500 (i. e. $2,5000,000 x 0. 5%). you can see that the estimated uncollectible percentage increases with the accounts receivable age.

How To Estimate Uncollectible Accounts Dummies

Bad Debt Expense Journal Entry Corporate Finance Institute

The accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable. in each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected. Accountsreceivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this account represents an estimate of accounts receivable that will not be collected.

Writing Off An Account Under The Allowance Method

The accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable.. in each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. Accounts receivable journal entry account receivable is the amount which the company owes from the customer for selling its goods or services and the journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the sales account. Credit: accounts receivable/notes receivable received cash in full payment of sanderson company's account, previously written off as uncollectible (first entry) journal: uncollectible accounts expense. It is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. journal entries: the accounting treatment of recovered amount requires two journal entries.

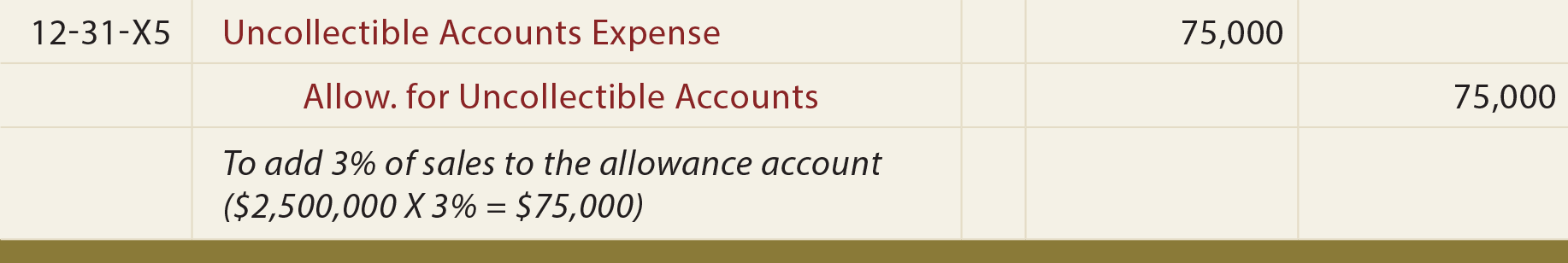

Accounting For Uncollectible Receivables

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. here are the journal entries:. Estimating uncollectible accounts receivable. as illustrated in the previous section, the estimation of uncollectible accounts receivable results in a journal entry in which uncollectible accounts expense is debited and the allowance for uncollectible accounts receivable journal entry uncollectible accounts is credited. this entry reduces stockholders' equity and assets. The allowance account is established and adjusted with the following journal entry: debit bad debts expense, and; credit allowance for doubtful accounts. when a specific customer's account is identified as uncollectible, the journal entry to write off the account is: a credit to accounts receivable (to remove the amount that will not be.

The journal entry also credits the accounts receivable account for $100. in combination, these two entries zero out the allowance for the uncollectible a/r account and remove the uncollectible amount from the accounts receivable account. writing off an actual, specific uncollectible receivable for invoice should be done on a case-by-case basis. Accountsreceivable is known as a control account. this means the total of all individual accounts found in the subsidiary ledger must equal the total balance in accounts receivable. the allowance method uses an estimate of uncollectible expense, also known as bad debts expense, and does not predict which individual accounts will be written off. Journalentry to record the estimated amount of accounts receivable that may be uncollectible. accta february 9, 2018 journal entry examples. post navigation. previous. next [q1] the entity estimates that $2,000 of its accounts receivable may be uncollectible. prepare a journal entry to record this transaction. [journal entry] debit: credit. The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable.

The journal entry is to debit allowance for uncollectible accounts uncollectible accounts receivable journal entry for $1,000 and credit a/r parmelee supplies for $1,000. about the book author maire loughran is a certified public accountant who has prepared compilation, review, and audit reports for fifteen years. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

The journal entry to uncollectible accounts receivable journal entry record the adjusting entry for accrued interest on a note receivable would include a credit to interest revenue. the allowance for doubtful accounts is reported as a(n) __________ on the balance sheet. Accountreceivable is the amount which the company owes from the customer for selling its goods or services and the journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the sales account.

Accounting for uncollectible receivables.

Determining account balances and preparing journal entries: percent of revenue allowance method of accounting for uncollectible accounts lo 7-1 during the first year of operation, 2016, direct service co. recognized $290,000 of service revenue on account. at the end of 2016, the accounts receivable balance was $46,000. In this entry, we are debiting allowance for doubtful debts because by this amount the counter-asset has been reduced and we’re crediting accounts receivables to reduce the outstanding accounts receivables by $120,000. journal entries 3. now let’s say that the company has asked a collection agency to try out to recover the bad debts.