-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Medical, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Medical

link : Uncollectible Accounts Medical

Uncollectible Accounts Medical

Uncollectibleaccount Financial Definition Of

Learn medical insurance chapter 14 with free interactive flashcards. choose from 500 different sets of medical insurance chapter 14 flashcards on quizlet. The amount of uncollectible accounts, and will accrue this estimation within its financial statements on a regular basis. this method may include scrutinizing of the aging, analysis of collection histories, and consideration of other factors that may lead an account balance to be uncollectible. accounts receivable. retrieved 01/13/2017.

Study 27 Terms Medical Insurancechapter 14 Flashcards

Dear tkl, when a medical debt is sold to collections, the collection agency that purchased the debt may report the account to experian. an unpaid medical collection account will almost certainly have a negative impact on your credit scores, even if you are sending in monthly payments.. contact the creditor as soon as you receive a bill. Based on the historical trends of cash collections from actual patients, abc hospital estimates that 20% of such outstanding a/r to be uncollectible. this estimate of $1,000 ($5,000 x 20%) represents a bad debt allowance.

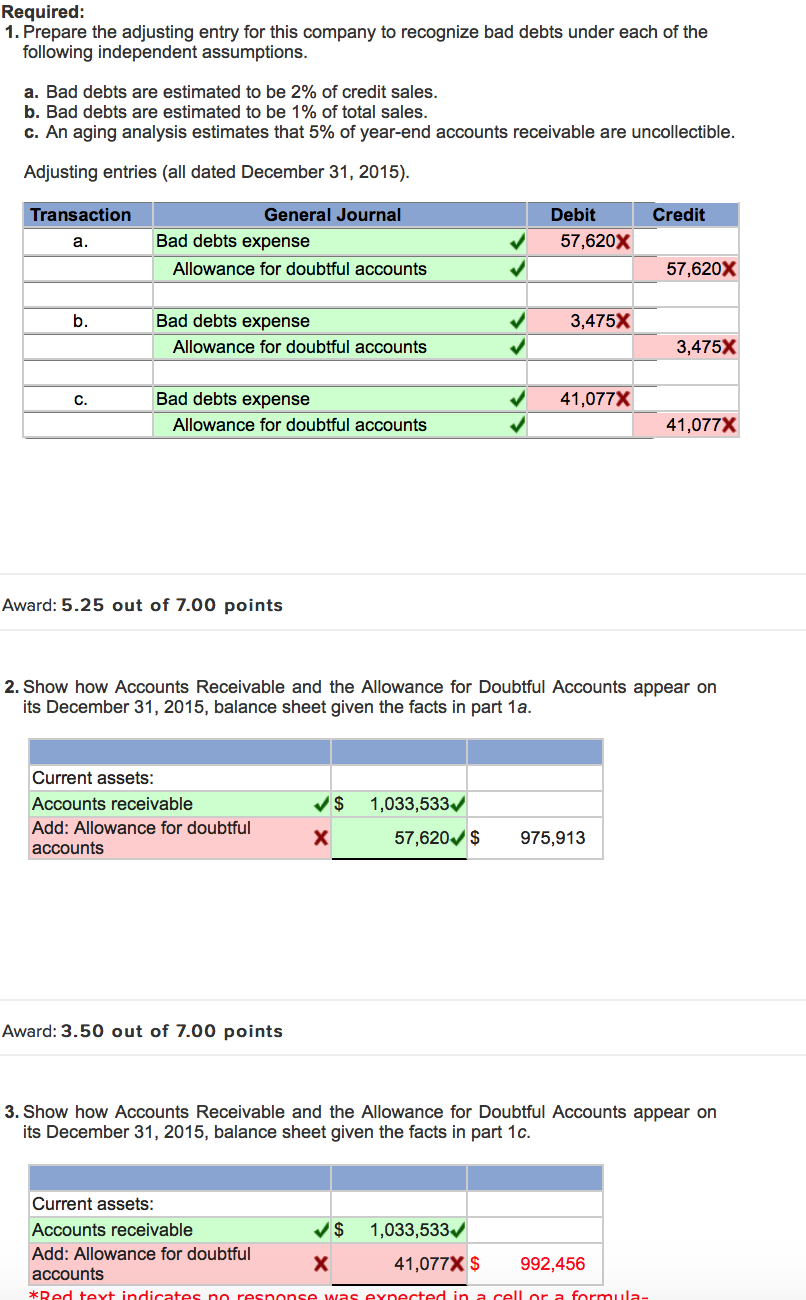

After an account is determined to be uncollectible, it is removed from the practice's expected accounts receivable and classified as bad debt. after the collections process for an overdue payment is finished without success, the practice writes off the amount as:. Ex 8-3 entries for uncollectible accounts, using direct write-off method. journalize the following transactions in the accounts of pro medical co. a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: jan. 30. sold merchandise on account to dr. cindy mott, $85,000. Open the allowance for uncollectible accounts t-account, and post entries affecting that account. keep a running balance. 3. show how mountain terrace medical center should report net accounts receivable on its december 31, 2012 balance sheet. use the three line reporting format. Accounts receivable $ 287,258 credit balances $ (63,212) average days in a/r 43. 18 35. 48 beginning bank account balance $15,477 current month deposits $134,808 current month uncollectible accounts medical checks written $138,438 ending balance $11,847 charges collections encounters days in office doctor bush jr $53,483 $29,581 412 21.

Solved Journalize The Following Transtutors

After an account is determined to be uncollectible, it is removed from the practice's expected accounts receivable and classified as bad debt. the type of patient billing that spreads out the workload of mailing statements is called:. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. Related to accounts uncollectible: allowance for doubtful accounts, uncollectible debt bad debt any bill submitted for payment by a third-party payer or patient which is not paid in full, and unlikely to be paid for various reasons. Go through your uncollectible accounts from the past three years and tell me how many of those accounts passed the gut check. eight things you can do right now to avoid past due accounts 1. 166-1(e. thus, for cash-basis taxpayers, a bad debt deduction is generally not allowed for uncollectible accounts receivable since these items are normally.

Revenue cycle and medical billing account receivables management handled by in house teams are now a thing of the past. nowadays, these services demand billing specialists with specialized skill-sets to look after accounts receivable follow ups. Preparation for adjustment of accounts receivable. kareo accounts receivable expert teams deliver an "uncollectable" report monthly in the month-end reporting packages and will conduct quarterly reviews to identify any accounts receivable for which it is responsible that meet the criteria for designation as an uncollectable account. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Preparation for adjustment of accounts receivable. kareo accounts receivable expert teams deliver an "uncollectable" report monthly in the month-end reporting packages and will conduct quarterly reviews to identify any accounts receivable for which it is responsible that meet the criteria for designation as an uncollectable uncollectible accounts medical account.

Contractual Allowance Vs Bad Debt For Healthcare Providers

To review concepts related to uncollectable accounts, and other related topics, read through the brief lesson titled uncollectable accounts, the allowance method & bad debt. this lesson will help you:. Accounting q&a library ethics case: uncollectible accounts introduction the purpose of this discussion forum is to give you an opportunity to apply your critical-thinking ability to the knowledge you’ve gained. uncollectible accounts medical the assignment provides you with an opportunity to develop your research, analysis, judgment, and communication skills. you also will work with other students, integrate what you’ve.

Accounts Uncollectible Definition Of Medical Dictionary

The exposure draft, which introduces a five-step performance obligation model, proposes significant changes to the measurement, classification, and potentially, the timing of recognition of revenue and related transactions, such as warranty costs, returns and allowances, provisions for uncollectible accounts, and multiple deliverables. files to decrease amount for uncollectible accounts medical partially bypassable generation uncollectibles rider advertisement retailenergyx : firstenergy solutions: "expectation" nuclear subsidy

Allowances for bad debts are not deductible for tax purposes until the related accounts receivable are written off the taxpayer’s books and records as uncollectible after exhausting collection efforts (both internally and through third-party collection agencies). as a result, the irs wants bad debt allowances clearly separated in tax returns and lumping them together with contractual. Measuring medical accounts receivable: “aging buckets” the other measure is the percent of accounts receivable in each “aging bucket”, for instance 0-30 days, 31-60 days, 61-90 days, etc. to calculate it, you will need a report showing the dollar amount of the ar in each aging bucket.

Statute of limitations medical debt collections. a statute of limitations (sol) is the length of time a party has to take legal action. when it comes to medical debt, the dentist, doctor, hospital or collection agency has a certain amount of time to file suit in order to collect the outstanding amounts. Uncollectibleaccount an account which cannot be collected by a company because the customer is not able to pay or is unwilling to pay. uncollectible account accounts receivable that a company cannot collect because the client is unable or unwilling to pay. if the client is simply unwilling to pay, the company can sue to collect what is owed; however. Accountsuncollectible are loans, receivables or other debts that have virtually no uncollectible accounts medical chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy. Then divide the total accounts receivable by the average daily charges. for instance, if you have charged $640,000 in the past 12 months, or 365 days, your average daily revenue is $1,753. then, if your total accounts receivable today are $80,000, the days in accounts receivable is 45. 6.