-Hallo friends, Accounting Methods, in the article you read this time with the title Estimated Uncollectible Accounts Journal Entry, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Estimated Uncollectible Accounts Journal Entry

link : Estimated Uncollectible Accounts Journal Entry

Estimated Uncollectible Accounts Journal Entry

Allowance Method For Uncollectible Accounts Double Entry

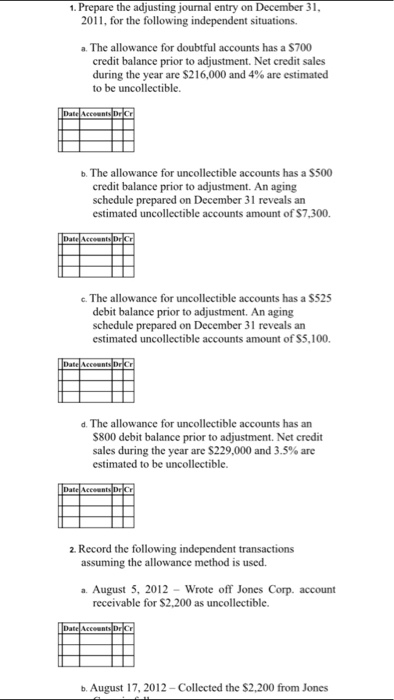

In the accounting cycle, the process of recording uncollectible accounts is called the allowance method. several accounts are used to separate the unpaid accounts receivables from the paying accounts, and specific journal entries are included on the financial statements. If a company has $500,000 in credit sales during an accounting period and company records indicate that, on average, 1% of credit sales become uncollectible, the adjusting entry at the end of the accounting period debits bad debts expense for $5,000 and credits allowance for bad debts for $5,000.

Allowance For Doubtful Accounts Definition Calculations

Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Notice that the preceding entry reduces the receivables balance for the item that is uncollectible. the offsetting debit is to an expense account: uncollectible accounts expense. while the direct write-off method is simple, it is only acceptable in those cases where bad debts are immaterial in amount. This is different from the last journal entry, where bad estimated uncollectible accounts journal entry debt was estimated at $58,097. that journal entry assumed a zero balance in allowance for doubtful accounts from the prior period. this journal entry takes into account a debit balance of $20,000 and adds the prior period’s balance to the estimated balance of $58,097 in the current period.

Accounts receivable was credited in the above journal entry because accounts receivable are assets and assets decrease with credits. the allowance for uncollectible accounts was debited in the above journal entry because this estimated uncollectible accounts journal entry account represents an estimate of accounts receivable that will not be collected. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. when you decide to write off an account, debit allowance for doubtful accounts allowance for doubtful accounts the allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the.

Estimating Bad Debts Financial Accounting

Accounting Principles I Cliffsnotes

How To Estimate Uncollectible Accounts Dummies

Notice that the estimated uncollectible accounts on december 31, 2015 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. the reason is that there is already a credit balance of $3,300 ($4,500 $1,200) in the allowance for doubtful accounts. If the allowance account has a $5,000 credit balance before adjustment, the adjustment would be for $19,400 calculated as $24,400 estimated amount uncollectible from exhibit 1 5,000 existing credit balance in the allowance account. the entry would be:.

The two accounts affected by this estimated uncollectible accounts journal entry entry contain this information: note that prior to the august 24 entry of $1,400 to write off the uncollectible amount, the net realizable value of the accounts receivables was $230,000 ($240,000 debit balance in accounts receivable and $10,000 credit balance in allowance for doubtful accounts). Regardless of which percentage is used, either percentage would probably result in a reasonable estimate of uncollectible accounts receivable. using the 1. 70% estimate, the nicholas corporation would prepare the following journal entry to record uncollectible accounts expense in january. 3. adjusting journal entry for bad debt expense an aging schedule is a balance sheet approach to bad debt estimation, meaning that the schedule tells management what should be in the allowance account on the balance sheet. the adjusting entry brings the allowance account in line with the estimated bad debt reserve. Allowance method entries. once you finalize the allowance estimate, you need a debit entry to “bad debts expense” so that the revenue reported on the income statement reflects the uncollectible amount. a corresponding credit entry to the allowance account is also necessary.

To allowance for doubtful accounts debts a/c $40,000. effect on income statement and balance sheet. the first journal entry above would affect the income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account. Allowance for doubtful accounts has a credit balance of $500 at the end of the year (before adjustment) and uncollectible accounts expense is estimated at 3% of net sales. if net sales are $600,000, the amount of the adjusting entry to record the provision for doubtful accounts is. It would involve the following entry: how to estimate accounts receivables. as mentioned earlier in our article, the amount of receivables that is uncollectible is usually estimated. why? this is because it is hard, almost impossible, to estimate a specific value of bad debt expense. companies cannot control how or when people pay. Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:.

Before recording any adjustments, dhaliwal has a debit balance of $67,500 in its allowance for uncollectible accounts. required: 1. estimate the appropriate 12/31/2021 balance for dhaliwal’s allowance for uncollectible accounts. 2. what journal entry should dhaliwal record to adjust its allowance for uncollectible accounts?. Journal entry to record the estimated amount of accounts receivable estimated uncollectible accounts journal entry that may be uncollectible. accta february 9, 2018 journal entry examples. post navigation.

Journalentry to record the estimated amount of accounts receivable that may be uncollectible. accta february 9, 2018 journal entry examples. post navigation. previous. next [q1] the entity estimates that $2,000 of its accounts receivable may be uncollectible. There are two general approaches to estimate uncollectible accounts expense. the first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement estimated uncollectible accounts journal entry approach. journal entry to recognize uncollectible accounts expense:. Allowance for doubtful accounts journal entry. to predict your company’s bad debts, you must create an allowance for doubtful accounts entry. you must also use another entry, bad debts expense, to balance your books. increase your bad debts expense by debiting the account, and decrease your ada account by crediting it.

Journal entry to record the estimated amount of accounts.

Under the allowance method for uncollectible accounts, the journal entry to record the estimate of uncollectible accounts would include a credit to what? allowance for doubtful accounts under the allowance method for uncollectible accounts, the journal entry to record the write-off of an account receivable would include a. Compute the total amount of estimated uncollectibles (the required balance in the allowance for doubtful accounts account) on the basis of above information. prepare an adjusting entry to recognize uncollectible accounts expense and adjust the balance in allowance for doubtful accounts account to the required amount. solution: (1).