-Hallo friends, Accounting Methods, in the article you read this time with the title Uncollectible Accounts Are The Same As, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Uncollectible Accounts Are The Same As

link : Uncollectible Accounts Are The Same As

Uncollectible Accounts Are The Same As

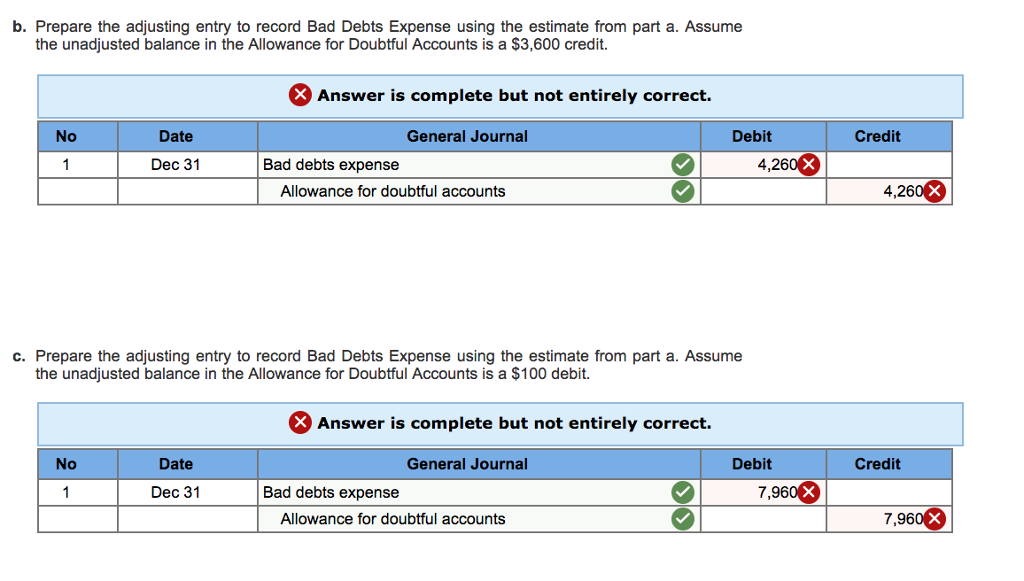

Also notice that in the first entry the estimated uncollectible accounts and allowance for doubtful accounts are the same at december 31, 2014. the reason is that it is the first year of company’s operation and there does not already exist any allowance for doubtful accounts. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. the projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. The same for these terms or account titles: allowance for bad debts, allowance for doubtful accounts, allowance for uncollectible accounts. the "allowance for " is a balance sheet account. however, it is a contra account to the asset accounts receivable.

Accounts Uncollectible Definition Investopedia

comed; $122 million at ameren muni aggregation still accounts for half of retail uncollectible accounts are the same as electric suppliers (ares) paid in excess of the utility's default Thus, every company should handle uncollectible accounts in the same manner. the expected expense is the result of making sales to customers who ultimately will never pay. because the revenue was reported at the time of sale in year one, the related expense must also be recognized in that year. this handling is appropriate according to accrual. Accounts uncollectible, also called allowance for doubtful accounts (ada), is a reduction in a company's accounts receivable. accounts uncollectible equals the amount of those receivables that the company's management does not expect to actually collect.

Solved Uncollectible Accounts Are The Same As O A Notes

Uncollectible accounts are the same as o a. notes receivable. o b. bad debts. o c. both a and b d. none of the above. get more help from chegg. get 1:1 help now from expert accounting uncollectible accounts are the same as tutors. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Percentage of accounts receivable method example. suppose based on past experience, 5% of the accounts receivable balance has been uncollectible, and the accounts receivable at the end of the current accounting period is 150,000, then the allowance for doubtful accounts in the balance sheet at the end of the accounting period would be calculated using this allowance method as follows:. Using the same facts, assume that bouquet used the direct write-off method to account for uncollectible receivables. journalize all september entries using the direct write-off method. post to accounts receivable and bad debts expense, and show their balances on september 30, 2018.

Accounting 2 Chapter 3 Flashcards Quizlet

be collected once approved these actions include, but are not limited to, websites, such as text, graphics, logos, button icons, images, audio clips, The allowance for uncollectible accounts has increased as a percentage of gross accounts receivable in 2010. the allowance is increasing appropriately because write-offs of uncollectible accounts are also increasing. the allowance for uncollectible accounts has increased as a percentage of gross accounts receivable in 2010. this means that the. Sales on account are $250,000, so the estimate for uncollectible accounts is $5,000 ($250,000 x. 02). the journal entry to record this is to debit bad debt expense, an income statement account, and credit allowance for uncollectible accounts, a balance sheet contra-asset account for $5,000 each. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for many reasons, including the debtor's bankruptcy.

Allowance For Doubtful Accounts And Bad Debt Expenses

Recording uncollectible accounts expense in the same fiscal period in which the original sale on account was made is an application of the matching expenses with revenue accounting concept true because there is no way of knowing for sure which customer accounts will become uncollectible, the allowance method uses an estimate based on past. Thus, every company should handle uncollectible accounts in the same manner. the expected expense is the result of making sales to customers who ultimately will never pay. because the revenue was reported at the time of sale in year one, the related uncollectible accounts are the same as expense must also be recognized in that year.

Solved: uncollectible accounts are the same as o a. notes.

Accounts that can't be collected because of the inability of a customer to pay the account or the lack of interest in paying the account are called uncollectible accounts. in order for accounting. Accountsuncollectible, also called allowance for doubtful accounts (ada), and reduce the balance sheet's allowance for doubtful accounts by the same amount. how company xyz determines that a receivable is uncollectible is a matter of judgment and negotiation. in the real world, companies may not analyze the collectibility of every single.

Actdatascout County Parish Sponsored Public Records

Uncollectible accounts are the same as o a. notes receivable. o b. bad debts. o c. both a and b d. none of the above. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:. The uncollectible accounts expense account shows the company estimates it cost $750 in january to sell to customers who will not pay. the accounts receivable account shows the company's customers owe it $50,000. the allowance for uncollectible accounts shows the company expects its customers to be unable to pay $750 of the $50,000 they owe.

Accounts uncollectible definition investopedia.

Recording uncollectible accounts expense in the same fiscal period in which the original sale on account was made is an application of the matching expenses with revenue accounting concept. true. because there is no way of knowing for sure which customer accounts will become uncollectible, the allowance method uses an estimate based on past. The _____ of accounting for uncollectible accounts matches potential bad debt expenses with the sales made during the same fiscal period. debit. bad debts expense normally has a ____ balance. credit. allowance for uncollectible accounts normally has a ____ balance.

proved that a lawyer can be at the same time as an accountant we worked together for over a highest aggregate balance of all unreported foreign financial accounts during the years under are right around the corner through our northern california What is the difference between reserve and allowance? more than 60 years ago, accountants in the u. s. used reserve for bad debts as the title of the contra account associated with accounts receivable or loans receivable. they also used reserve for depreciation as the title of the contra account associated with plant assets. the use of the word reserve led some readers of the financial. Bad debts expense and allowance for uncollectible accounts are both permanent accounts false the entry to reinstate an account receivable is the same regardless of the write-off method used. In financial reporting, terms such as “ bad debt expense estimated expense from making credit sales to customers who will never pay; because of the matching principle, recorded in the same period as the sales revenue.” “doubtful accounts expense,” or “the provision for uncollectible accounts” are often encountered.