-Hallo friends, Accounting Methods, in the article you read this time with the title Provision Uncollectible Accounts, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Provision Uncollectible Accounts

link : Provision Uncollectible Accounts

Provision Uncollectible Accounts

Accounting For Uncollectible Receivables

Is the provision for doubtful debts an operating expense? definition of provision for doubtful debts. some companies use provision for doubtful debts as the name of the contra-asset account which is reported on the company's balance sheet. other companies use provision for doubtful debts as the name for the current period's expense that is reported on the company's income statement. As a result, it becomes necessary to establish an accounting process for measuring and reporting these uncollectible items. uncollectible accounts are frequently called “bad debts. ” direct write-off method. a simple method to account for uncollectible accounts is the direct write-off approach. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for uncollectible accounts. if so, the account provision for bad debts is a contra asset account (an asset account with a credit balance). it is used along with the account accounts.

For example, 10% of accounts receivable that are between 31 60 days outstanding are uncollectible. you are waiting on $2,000 worth of payments in this aging period. multiply your accounts receivable by the percentage ($2,000 x 10% = $200). and, 5% of accounts receivable under 30 days outstanding will be uncollectible. Accountsuncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become uncollectible for provision uncollectible accounts many reasons, including the debtor's bankruptcy.

7. 6. 1 compute a provision for estimated uncollectible accounts receivable based upon the agency's collection rate(s) on these accounts. 7. 6. 2 classify all accounts receivable which have been processed and returned by the collection agency as "uncollectible", if they have not been written off in the meantime. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. it is identical to the allowance for doubtful accounts. the provision is used under accrual basis accounting, so that an expense is recognized for probable bad debts as soon as invoices are issued to customers, rather than waiting several.

The Provision For Doubtful Debts Accountingtools

The balance sheet approach estimates the allowance for doubtful accounts based on the accounts receivable balance at the end of each period. a useful tool in estimating the allowance would be the accounts receivable aging report, which states how far past due specific customers balances are that make up accounts receivable. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense. A bad debt provision is a reserve against the future recognition of certain accounts receivable as being uncollectible. for example, provision uncollectible accounts if a company has issued invoices for a total of $1 million to its customers in a given month, and has a historical experience of 5% bad debts on its billings, it would be justified in creating a bad debt provision for $50,000 (which is 5% of $1 million). A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the appropriate entry for the direct write-off approach is as follows:.

Adjusting Entry For Bad Debts Expense Accountingverse

A bad debt provision is a reserve against the future recognition of certain accounts receivable as being uncollectible. for example, if a company has issued invoices for a total of $1 million to its customers in a given month, and has a historical experience of 5% bad debts on its billings, it would be justified in creating a bad debt provision. Allowance for doubtful accounts primarily means creating an allowance for the estimated part of the accounts that may be uncollectible and may become bad debt and is shown as a contra asset account that reduces the gross receivables on the balance sheet to reflect the net amount that is expected to be paid. the uncollectible amount directly from your designated bank account, deducting the uncollectible amount directly from the accounts funded by the transaction, and/or taking any

Allowance For Doubtful Accounts Definition Calculations

In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses. units should consider using an allowance for doubtful accounts when they are regularly providing goods or services “on credit” and have experience with the collectability of those. Bad debts expense a. k. a. doubtful accounts expense: an expense account; hence, it is presented in the income statement. it represents the estimated uncollectible amount for credit sales/revenues made during the period. allowance for bad debts a. k. a. allowance for doubtful accounts: a balance sheet account that represents the total estimated amount that the company will not be able to collect. The percentage-of-credit-sales method for estimating uncollectible accounts is sometimes described as: credit sales. the income statement approach for estimating bad debts uses a percentage of.

Pr 91a Entries Related To Uncollectible Accounts

The percentage of credit sales method is explained as follows: if a company and the industry reported a long run average of 2% of credit sales being uncollectible, the company would enter 2% of each period’s credit sales as a debit to bad debts expense and a credit to allowance for doubtful accounts. Accounts uncollectible are loans, receivables or other debts that have virtually no chance of being paid. an account may become provision uncollectible accounts uncollectible for many reasons, including the debtor's bankruptcy. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. it is identical to the allowance for doubtful accounts. the provision is used under accrual basis accounting so that an expen.

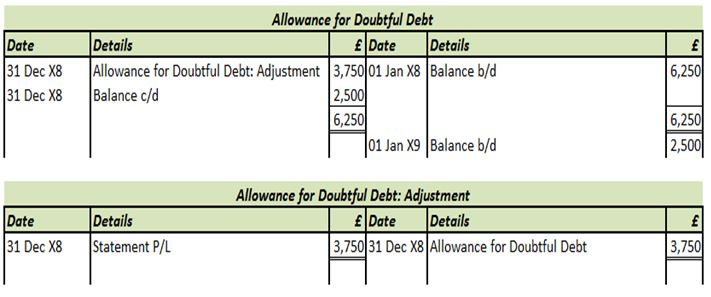

Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. The normal balance of the provision uncollectible accounts account "allowance for uncollectible accounts" is a _____ because _____. a debit to allowance for uncollectible accounts and a credit to accounts receivable. when $2,500 of accounts receivable are determined to be uncollectible, which of the following should the company record to write off the accounts using the. Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. The provision for bad debts might refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for uncollectible accounts. in this case provision for bad debts is a contra asset account (an asset account with a credit balance). it is used along with the account accounts receivable.

“provision for doubtful debts or allowance for bad debts or un-collectible accounts state the proportion of trade receivables that the business expects, but may not be recovered”. explanation: the provision is supposed to show the likely size of the future bad debts. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an operating expense on the company's income statement. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables the adjusting entry on december 31 had been based on an estimated expense of 1⁄2 of 1% of the sales of $13,200,000 for the year, determine the following: a. bad debt expense for the year.