-Hallo friends, Accounting Methods, in the article you read this time with the title Gaap Uncollectible Accounts, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Gaap Uncollectible Accounts

link : Gaap Uncollectible Accounts

Gaap Uncollectible Accounts

How To Use The Gaap Allowance Method Bizfluent

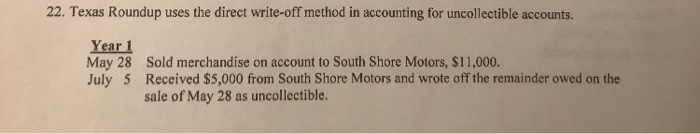

U. s. gaap requires the accrual of losses from uncollectible receivables if a loss is probable and the amount of the loss can be reasonable estimated (fasb asc 450-20-25-2). methods to calculate an allowance. A simple method to account for uncollectible accounts is the direct write-off approach. under this technique, a specific account receivable is removed from the accounting records at the time it is finally determined to be uncollectible. the gaap uncollectible accounts appropriate entry for the direct write-off approach is as follows:.

The allowance method follows gaap matching principle since we estimate uncollectible accounts at the end of the year. we use this estimate to record bad debt expense and to setup a reserve account called allowance for doubtful accounts (also called allowance for uncollectible accounts) based on previous experience with past due accounts. Uncollectibleaccounts expense is the charge made to the books when a customer defaults on a payment. this expense can be recognized when it is certain that a customer will not pay. a more conservative approach is to charge an estimated amount to expense when a sale is made; doing so matches the expense to the related sale within the same reporting period. The gaap uncollectible accounts percentage of credit sales method is explained as follows: if a company and the industry reported a long run average of 2% of credit sales being uncollectible, the company would enter 2% of each period’s credit sales as a debit to bad debts expense and a credit to allowance for doubtful accounts.

Accounting For Uncollectible Receivables

Fasb allowance for bad debt conditions your business.

Allowance for doubtful accounts. paired with the accounts receivable in a typical company's books is a special account called the "allowance for doubtful accounts" or "allowance for uncollectible. Accounts written off as uncollectible during gaap uncollectible accounts 2017 500 bad expense is estimated by the aging-of-receivables method. management estimates that $2,850 of accounts receivable will be uncollectible. calculate the amount of net accounts receivable after the adjustment for bad debts. a. $19,150 b. $20,150 c. $18,150 d. $17,650.

Gaap Rules For Writing Off Accounts Receivable Your Business

Uncollectibleaccounts Expense Accountingtools

Allowance for doubtful accounts: an allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. Because it is impossible to know precisely which accounts will turn bad, there are three gaap procedures for estimating (forecasting) the allowance for bad debt: the percentage of credit sales method, the aging of accounts receivable method (a variation of the preceding) and the percentage of ending accounts receivable method.

Gaap Rules For Bad Debt Small Business Chron Com

Generally accepted accounting principles (gaap) as reported in the comprehensive annual financial report (cafr) require that an estimation of uncollectible accounts receivable be made and gaap uncollectible accounts recorded as an allowance for doubtful accounts under the modified accrual and accrual bases of accounting. waiting. Gaap rules for writing off accounts receivable. at some point during the life of your business, you'll likely have to write off an invoice for a customer who never makes payment. if you maintain the business's books and records in accordance with generally accepted accounting principles, or gaap, there are two. Thus, it cannot be used to record the write-offs of uncollectible accounts in financial statements prepared for the public in accordance with fasb and gaap regulations. in the direct charge-off method, once the company determines that a certain amount due to the company will not be collected at all, the company writes it off in that fiscal period. For accounts that are 31-60 days past due with current accounts receivables = $40,000 and the historical average for uncollectible debt for this period is 5 percent, then the amount of uncollectible debt for this period would be $2,000: $40,000 x 5% = $2,000.

Uncollectible accounts/write-offs page 2 of 6 for gaap reporting, an allowance for doubtful accounts, a contra asset account, should be used under the modified accrual and accrual bases of accounting to recognize the portion of receivables that is not expected to be collected, regardless of the eligibility to be legally written off. Gaap requires receivables be reported on the balance sheet net of uncollectible amounts (bad debt). this means the allowance method must be used to record uncollectible accounts. the allowance method includes making an adjusting entry. explain this procedure to a new accounting student. address these topics: the two accounts used in the. Gaap requires that businesses extending credit to customers use the allowance method, which means they estimate uncollectible accounts. companies use a few different types of methods, usually based on their past experience with bad debt.

One way to record the affects of uncollectible accounts is the direct charge-off method. this method is simple. but it violates the matching principle and does not conform to gaap standards and procedures. thus, it cannot be used to record the write-offs of uncollectible accounts in financial statements prepared for the public in accordance. The financial accounting standards board, or fasb, is the authority on the generally accepted accounting principles, or gaap, that companies use to maintain their books and records. fasb establishes the conditions that must exist before a company can set up an allowance account for bad debts. Generally accepted accounting principles (“u. s. gaap”). the allowance for doubtful accounts is one example of an important estimate made by management and there are several methods to use in determining the estimate. u. s. gaap requires the accrual of losses from uncollectible receivables if a loss is probable and the amount of the loss.

A second account (often called the allowance for doubtful accounts a contra asset account reflecting the estimated amount of accounts receivable that will gaap uncollectible accounts eventually fail to be collected and, thus, written off as uncollectible. or the allowance for uncollectible accounts) reflects the estimated amount that will eventually have to be written off. Generally accepted accounting principles (gaap) require companies with a large amount of receivables to use. the allowance method. under the allowance method for uncollectible accounts, the journal entry to record the estimate of uncollectible accounts would include a credit to. A account receivable that has previously been written off may subsequently be recovered in full or in part. it is known as recovery of uncollectible accounts or recovery of bad debts. this article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from the related receivable. The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i. e. it recognizes uncollectible accounts expense in the period in which the related sales are made. under this method, the uncollectible accounts expense is recognized on the basis of estimates. there are two general approaches to estimate uncollectible accounts expense.