-Hallo friends, Accounting Methods, in the article you read this time with the title 1040 Schedule C Accounting Method, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts accounting, which we write this you can understand. Alright, happy reading.

Title : 1040 Schedule C Accounting Method

link : 1040 Schedule C Accounting Method

1040 Schedule C Accounting Method

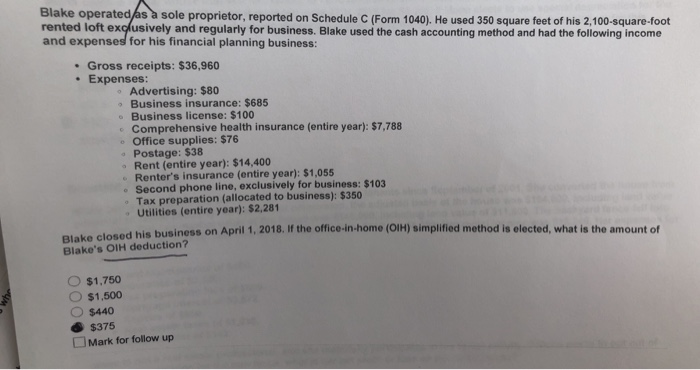

strongly recommended: to cpas, eas, tax professionals and even staff members of cpa & accounting firms. many self-employed or sole proprietors, find themselves having to navigate schedule c in reporting business income. while this attachment to form 1040 seems straightforward on the surface, there are. To find your taxable income on your corporate or individual form 1040, schedule c, you follow an accounting method. tax law recognizes and often allows the most common accounting methods for computing your business’s taxable income. Zero is not correct, you need to input the correct inventory and it should be place on schedule c not on our 1040. you should seek the assistance of an accountant. putting zero may increase your chances of an audit as it is not a true reflection of your inventory. Remember: each schedule c is for the profit or loss from just one business, so if you had more than one business, use a screen for each. income the heart of schedule c. now we get into the real meat of the schedule c. part i income starts by asking if your business had any income.

Instructions For Schedule C Form 1040 Profit Or Loss From

hit the market in 1998, to the newer accounting cs, which launched on may 1, 2010 read more Schedule c accounting method an accounting method is the method used to determine when you report income and expenses on your return. an accounting method is chosen when you file your first 1040 schedule c accounting method tax return. The centerpoint of doing your taxes when you have your own business is schedule c. this is where you enter most of your business ’ s income and deductions. let ’ s take a step-by-step look at filling out the form.. on the your business screen on your 1040. com return, you’ll first provide some identifying information about your business. the title doesn’t have to be anything formal, and.

Schedulec Profit Or Loss From Business 2019

Generally, you can use the cash method, an accrual method, or any other method permitted by the internal revenue code. in all cases, the method used must clearly reflect income. unless you are a small business taxpayer (defined later in part iii), you must use an accrual method for sales and purchases of inventory items. special rules apply to. If you have less than $5,000 of business expenses, you might be eligible to submit a simpler version—schedule c-ez. (yes, that’s a 1040 schedule c accounting method genuine irs pun). schedule c-ez is less complicated, relying only on total business receipts and expenses, but you can’t use schedule c-ez to claim vehicle expenses. you might be able to file schedule c-ez if:. A cash accounting approach is straightforward. you recognize revenue as earned when you actually receive payment for it. similarly, you recognize expenses when you make payments. in addition to its simplicity, a key benefit of the cash method is that you might have the option of using schedule c-ez.

Under an accrual method of accounting, you generally report income in the year earned and deduct or capitalize expenses in the year incurred. *the cash method of accounting is focused on the inflows and outflows of cash. much like your personal finances, organizations have revenue when we make a deposit and incur an expense when we cut a check. The irs schedule c form is the most common business income tax form for small business owners. the form is used as part of your personal tax return. for 2019 and beyond, you may file your income taxes on form 1040. the 1040-sr is available for seniors (over 65) with large print and a standard deduction chart. (form 1040-ez and form 1040-a are no longer available. ). Use schedule c (form 1040 or 1040-sr) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. an activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

Schedule c profit or loss from business 2019.

How To Fill Out The Schedule C Payable

Schedulec (form 1040) line b how do i find the "principal business code" on the 1099-misc form? you won't find a principle business code on form 1099-misc, itself. unfortunately, it's up to you to figure out what the code is. Accountingmethod. if you have been using the accrual accountingmethod, you may be able to switch to cash accounting, beginning in 2018, file schedulec with your form 1040 after entering your net business income from line 31 of your schedule c on schedule 1, line 12, "business income or loss. ". What does accounting method mean on a schedule c? there are two accounting methods, cash and accrual. most small businesses use the cash method. cash. under the cash method, include in your gross income all items of income you actually or constructively received during the tax year. items of income include money received as well as property or. Zero is not correct, you need to input the correct inventory and it should be place on schedule c not on our 1040. you should seek the assistance of an accountant. putting zero may increase your chances of an audit as it is not a true reflection of your inventory. "use the cash method of accounting even if they produce, purchase, or sell.

We will discuss different accounting methods and periods including the cash method and the accrual method and when the tax code may require one method versus another as well as when the tax code requires a deviation from the accounting method used. the course will discuss what is included in business income and the types of business income. Cost of goods sold (cogs) is the method the irs uses to define the cost you invested to produce your new inventory for sale, during the tax year.. this has been discussed in (2) previous posts. see the 1040: the schedule c: part i income for the schedule c, line 4 description of cogs. see also the blog post the 1040: the schedule c: part ii expenses for the line 22 description of. Similar to the 1040-ez, which is the simplified version of the 1040 form, the schedule c-ez is the simplified version of the schedule c. self-employed workers and contractors should fill out the schedule c-ez if they: f. accounting method. in this section, input the kind of accounting method used — either a cash or accrual basis. many.

2019 Instructions For Schedule C 2019 Internal Revenue

Schedulecaccountingmethods sapling.

Schedule C Profit Or Loss From Business 2019

What is schedule c? schedule c is part of form 1040. it’s used by sole proprietors to let the irs know how much their business made or lost in the last year. the irs uses the information in schedule c to calculate how much taxable profit you made—and assess any taxes or refunds owing. When you operate a small business as a sole proprietor, you must complete schedule c of the irs form 1040. this form outlines your profit and expenses for operations. selecting between a cash accounting and accrual accounting approach for your business impacts your results. Method worksheet in the instructions to figure the amount to enter on line 30. 30. 31 net profit or (loss). subtract line 30 from line 29. • if a profit, enter on both. schedule 1 (form 1040 or 1040-sr), line 3 (or. form 1040-nr, line 13) and on. schedule se, line 2. (if you checked the box on line 1, see instructions. Generally, you can use the cash method, an accrual method, or any other method permitted by the internal revenue code. in all cases, the method used must clearly reflect income. unless you are a qualifying taxpayer or a qualifying small business taxpayer (see the part iii instructions), you must use an accrual method for sales and purchases of.

Because accounting methods entail extensive details, make sure you're sure you want to change to the cash method before you fill out form 3115 so you won't have to make another change later. irs publication 538 offers extensive information about the cash, accrual and "other" accounting method choices. To change your accounting method, you generally must 1040 schedule c accounting method file form 3115. you also may have to make an adjustment to prevent amounts of income or expense from being duplicated or omitted. this is called a section 481(a) adjustment. Schedulec accounting method an accounting method is the method used to determine when you report income and expenses on your return. an accounting method is chosen when you file your first tax return.

error the irs posted updated instructions for 2018 schedule d (form 1040), capital gains and losses, that include a corrected