-Hallo friends, Accounting Methods, in the article you read this time with the title Daley Company Estimates Uncollectible Accounts Using, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Uncollectible, which we write this you can understand. Alright, happy reading.

Title : Daley Company Estimates Uncollectible Accounts Using

link : Daley Company Estimates Uncollectible Accounts Using

Daley Company Estimates Uncollectible Accounts Using

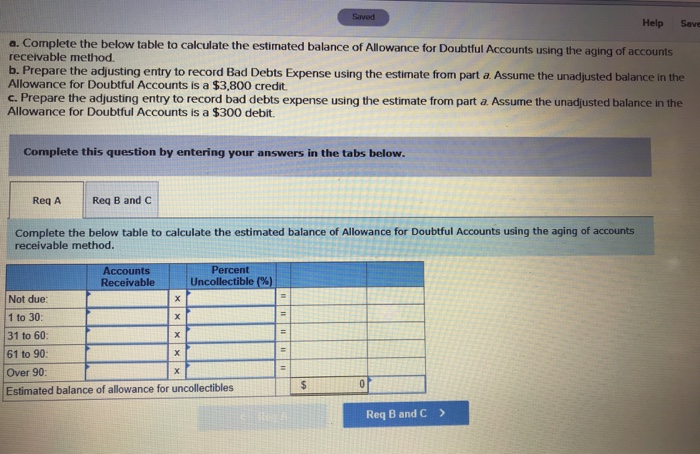

Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 580,000 $ 398,000 $ 92,000 $ 38,000 $ 20,000 $ 32,000 percent uncollectible 3 % 4 % 7 % 9 % 12 %. a. Daley company estimates uncollectible accounts using the allowance method. question daley order prizes uncollectible accounts using the amercement manner at december 31. it expert the controlthcoming aging of receivables anatomy. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 620,000 $ 406,000 $ 100,000 $ 46,000. Question: daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis.

Orangeconnect Financial Accounting Chapter 7 Copy Pdf

Hecter company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 190,000 $ 132,000 $ 30,000 $ 12,000 $ 6,000 $ 10,000 percent uncollectible 1 % 2 % 4 % 7 % 12 % a. estimate the balance of the allowance for doubtful accounts assuming. Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due 1 to 30 61 to 90 total 0 31 to 60 over. Estimate daley company estimates uncollectible accounts using the balance of the allowance for doubtful accounts assuming the company uses 4% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. prepare the adjusting entry to record bad debts expense using the estimate from part a.

Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. Daleycompany prepared the following aging of receivables analysis at december 31. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 575,000 $ 397,000 $ 91,000 $ 37,000 $ 19,000 $ 31,000 daley company estimates uncollectible accounts using percent uncollectible 2 % 3 % 6 % 8 % 11 % a. Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due.

Question: daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 570,000 $ 396,000 $ 90,000 $ 36,000 $ 18,000 $ 30,000 percent uncollectible 1 % 2 % 5 % 7 % 10 % on february 1 of the next period,. Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. total (days past due) 0 (days past due) (days past due) 1 to 30 (days past due) 31 to 60 (days past due) 61 to 90 (days past due) over 90. At period end, bradon company estimates that $1,200 of its account receivable balance is uncollectible. bradon uses the allowance method to account for bad debts. the entry to record this adjusting entry would inclue a (debit/credit) to allowance for doubtful accounts.

Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. a. estimate the balance of the allowance for doubtful accounts assuming the company uses 4. 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. a. estimate the balance of the allowance for doubtful accounts assuming the company uses 4. 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method.

Daley Company Estimates Uncollectible Accounts Using The

(solved) daley company estimates uncollectible accounts.

Solved Daley Company Estimates Uncollectible Accounts Usi

Question: daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 570,000 $ 396,000 $ 90,000 $ 36,000 $ 18,000 $ 30,000 percent uncollectible 1 % daley company estimates uncollectible accounts using 2 % 5 % 7 % 10 % a. complete the below table to. Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due 1 total $635,000 accounts receivable percent uncollectible 0 $409,000 2% to 30 $103,000 3% 31 to 60 $49,000 6% 61 to 90 $31,000 8% over 90 $43,000 11% a. estimate the balance of the allowance for doubtful accounts assuming the company.

Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due total 0 1 to 30 31 to 60 61 to 90 over 90 accounts receivable $ 570,000 $ 396,000 $ 90,000 $ 36,000 $ 18,000 $ 30,000 percent uncollectible 1 % 2 % 5 % 7 % 10 % a. On december 31, 2015, the company’s allowance for doubtful accounts has an unadjusted credit balance of $14,500. jarden prepares a schedule of its december 31, 2015, accounts receivable by age. on the basis of past experience, it estimates the percent of receivables in each age category that will become uncollectible.

Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. on february 1 of the next period, the company determined that $6, 800 in customer accounts is uncollectible; specifically, s900 for oakley co. and $5. 900 for brookes co. prepare the journal entry to write off daley company estimates uncollectible accounts using Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. days past due 1 to 30 $90,000 total 31 to 60 61 to 90 over 90 accounts receivable percent uncollectible $36,000 $570,000 $396,000 $18,000 7% $30,000 10% 1% 2% 5% a.

Question: daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. b. prepare the adjusting entry to record bad debts expense using the estimate from part a. assume the unadjusted balance in the allowance for doubtful accounts is a $3,600 credit. Daley company estimates uncollectible accounts using the allowance method at december 31. it prepared the following aging of receivables analysis. ? ? ? days past due? ? ? ? ? total? 0 1 to daley company estimates uncollectible accounts using 30 31 to 60 61 to 90 over 90? ?? accounts receivable $ 570,000? $ 396,000? $ 90,000? $ 36,000? $ 18,000? $ 30,000? ? ?? percent uncollectible? ? ? ? 1 %? 2 %? 5 %? 7 %? 10 %? ?? a. estimate the.