-Hallo friends, Accounting Methods, in the article you read this time with the title GST in Tally.ERP 9, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Artikel, which we write this you can understand. Alright, happy reading.

Title : GST in Tally.ERP 9

link : GST in Tally.ERP 9

GST in Tally.ERP 9

GST in Tally.ERP 9GST in Tally.ERP 9 - Hello Friend Accounting Methods, In the article you read this time with the title GST in Tally.ERP 9, We have prepared this article for you to read and retrieve information therein. Hopefully the contents of postings Article GST, Article tally, Article Tally.ERP 9, We write this you can understand. Alright, good read.

Title : GST in Tally.ERP 9

link : GST in Tally.ERP 9

GST in Tally.ERP 9

As per my knowledge and as per your demand, I am sharing accounting treatment and voucher entries of GST in Tally.ERP 9. Still, there is need of improvement in this content because GST is new concept and Tally Solution company is busy in developing new software. So, as I will gain new knowledge, I will update this content.

1st Step : Ledger Creation Of Input and Output GST in Tally.ERP 9

GST has divided into main two parts one is State GST ( SGST) and Central GST ( CGST). If goods will be supplied from one state to other state, IGST will apply. So, we will create Input SGST and Input CSGT and Input IGST and Output SGST and Output CGST and Output IGST.

2nd Step : Ledger Creation of Purchase, Sale, Debtors and Creditors and Cash Electronic Register in Tally.ERP 9

Purchase will be under purchase account. Sales will be under sales account. Debtor will be under Sundry debtors account and creditor will be under Sundry Creditors Account. Cash Electronic Register Account will be decided on the basis of balance of GST, if it is receivable, then this account will be under current asset, otherwise, it will be current liability.

Mr. C is Credior

Mr. B is creditor

3rd Step : Ledger Creation of Expenses

For example, internet bill expenses will be under indirect expenses.

4th Step : Create Stock Item and Unit Measurement

Just go to Inventory info and create stock item and unit measurement

We will create Note Books because it has 18% which we will show in tally through example.

Voucher Entries of Sales with GST

Expenses Payment Voucher Entries with GST

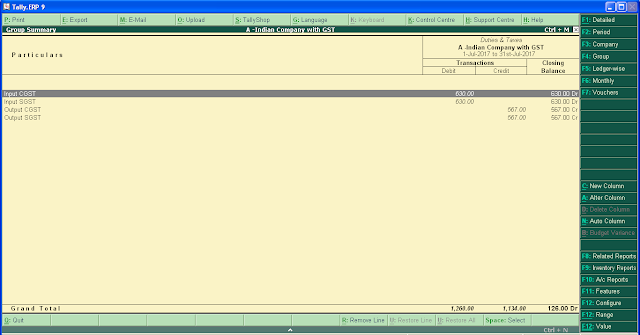

6th Step : Check Net GST Liability or Receivable Credit from GST

Just go to balance sheet, then go to duty and taxes and then go to monthly report.

Rs. 126 is our current asset because we have paid more GST on purchase goods and services and received less from our customer. So, we have to receive from GST department in our online bank account under cash electronic ledger account. So, following voucher entry will pass

Cash Electronic Register Account Dr. 126

Output CGST Account Dr. 567

Output SGST Account Dr. 567

Input CGST Account Credit 630

Input SGST Account Credit 630

In our balance sheet, Cash Electronic Register Account will show as current asset.

1st Step : Ledger Creation Of Input and Output GST in Tally.ERP 9

GST has divided into main two parts one is State GST ( SGST) and Central GST ( CGST). If goods will be supplied from one state to other state, IGST will apply. So, we will create Input SGST and Input CSGT and Input IGST and Output SGST and Output CGST and Output IGST.

2nd Step : Ledger Creation of Purchase, Sale, Debtors and Creditors and Cash Electronic Register in Tally.ERP 9

Purchase will be under purchase account. Sales will be under sales account. Debtor will be under Sundry debtors account and creditor will be under Sundry Creditors Account. Cash Electronic Register Account will be decided on the basis of balance of GST, if it is receivable, then this account will be under current asset, otherwise, it will be current liability.

Mr. C is Credior

Mr. B is creditor

3rd Step : Ledger Creation of Expenses

For example, internet bill expenses will be under indirect expenses.

4th Step : Create Stock Item and Unit Measurement

Just go to Inventory info and create stock item and unit measurement

We will create Note Books because it has 18% which we will show in tally through example.

5th Step : Pass the Voucher Entries of Purchase and Sales and Expenses with GST in Tally.ERP 9

Intra-state Transactions ( Buyer and Seller in Same State)

A - Indian Company with GST buy notebook of Rs. 2,00,000 from Mr. C

A - Indian Company with GST sold notebook to Mr. B Rs. 1,40,000

He paid Internet Bill of Rs. 2000 ( It is IT and Telecom service )

GST is 18% which is divided equal to CGST 9% and 9% SGST

A - Indian Company with GST buy notebook of Rs. 2,00,000 from Mr. C

A - Indian Company with GST sold notebook to Mr. B Rs. 1,40,000

He paid Internet Bill of Rs. 2000 ( It is IT and Telecom service )

GST is 18% which is divided equal to CGST 9% and 9% SGST

In the Books of A - Indian Company with GST

Voucher Entries of Purchase with GST

Expenses Payment Voucher Entries with GST

6th Step : Check Net GST Liability or Receivable Credit from GST

Just go to balance sheet, then go to duty and taxes and then go to monthly report.

Rs. 126 is our current asset because we have paid more GST on purchase goods and services and received less from our customer. So, we have to receive from GST department in our online bank account under cash electronic ledger account. So, following voucher entry will pass

Cash Electronic Register Account Dr. 126

Output CGST Account Dr. 567

Output SGST Account Dr. 567

Input CGST Account Credit 630

Input SGST Account Credit 630

In our balance sheet, Cash Electronic Register Account will show as current asset.

Thus Article GST in Tally.ERP 9

that's all the article GST in Tally.ERP 9 this time, hopefully can give benefits to all of you. alright, see you in posting other articles.

You now read the article GST in Tally.ERP 9 with link address http://accountingmethode.blogspot.com/2017/06/gst-in-tallyerp-9.html

[ad_2]

Source link : GST in Tally.ERP 9