-Hallo friends, Accounting Methods, in the article you read this time with the title GST in Tally.ERP 9 Release 6, we have prepared this article well for you to read and retrieve the information therein.

Hopefully the content of article posts Artikel, which we write this you can understand. Alright, happy reading.

Title : GST in Tally.ERP 9 Release 6

link : GST in Tally.ERP 9 Release 6

GST in Tally.ERP 9 Release 6

GST in Tally.ERP 9 Release 6GST in Tally.ERP 9 Release 6 - Hello Friend Accounting Methods, In the article you read this time with the title GST in Tally.ERP 9 Release 6, We have prepared this article for you to read and retrieve information therein. Hopefully the contents of postings Article GST, Article tally, Article Tally.ERP 9, We write this you can understand. Alright, good read.

Title : GST in Tally.ERP 9 Release 6

link : GST in Tally.ERP 9 Release 6

GST in Tally.ERP 9 Release 6

As per Official Blog of Tally Solution Company, soon, company is updating release 6 of Tally.ERP 9 which is all facility relating to adding GST rates, passing voucher entries with GST, getting GST Invoice and also exporting data for e-return of GST. If you still could not understand, we are here teaching you about how can manage your GST in Tally.ERP 9 release 6. This conversion will be automatically who will have Tally.ERP 9 license. You have to accept it. ( If you don't want to do conversion of release 6 of Tally, you can still manage GST in Tally.ERP 9 in older versions)

Here you have to see your all added stock groups. Just click detail, you will see stock item in each stock group. Right side you see the button set rate and start to set GST rate. Add the supply detail and its HSN or SAC number correctly and add integrated rate of tax it may 5% , 12%, 18%, 28% and tally will automatically divide into central tax and state tax 1/2 and 1/2 of this.

1st Step Set up of GST Rate in Tally.ERP 9

After conversion your Tally.ERP 9 release 6 in your current tally.erp 9 software, it will ask your GST detail, you have to fill your GSTIN number and accept. For set up GST rates, just go to Gateway of tally, then go to display, then go statutory reports and then click GST Rate setup.

Here you have to see your all added stock groups. Just click detail, you will see stock item in each stock group. Right side you see the button set rate and start to set GST rate. Add the supply detail and its HSN or SAC number correctly and add integrated rate of tax it may 5% , 12%, 18%, 28% and tally will automatically divide into central tax and state tax 1/2 and 1/2 of this.

After set up GST, you can just go to GST in statutory reports and add the detail of GSTIN of each party. Update party GSTIN

2nd Sep : Apply GST in Sales voucher, purchase voucher, debit note, credit note and payment voucher

GST will apply in sales voucher, purchase voucher, debit note, credit note and payment voucher

by following way

Central Tax ( CGST)

State Tax ( SGST)

Integrate Tax (IGST )

First of all, you need to create ledger of Central Tax, State Tax and Integrate Tax under duties and taxation and type of duties, you have to select GST.

Now, you have to pass the voucher entries of purchase, sale, debit note and credit note. If you will select central tax, state tax and integrated tax, it will show automatically figure because we already set up rate in first step and it will record gst in books of accounts in tally.

Now, you can also get GST invoice by print of this voucher entry and its format will following which you can give to your customer.

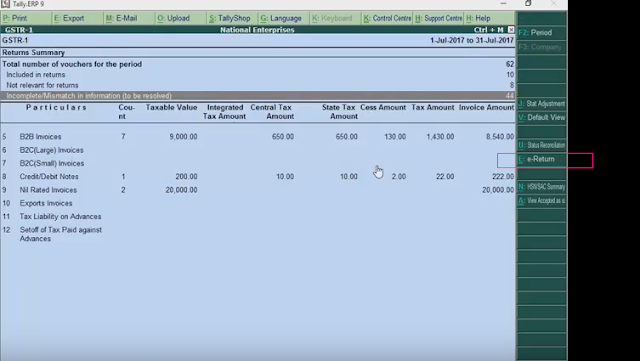

3rd Step : Data for e-return of GST and its Reconcilation

For GSTR 1 and GSTR 2 online return, tally will provide you the data. Just go to the statutory report and choose GSTR1

Thus Article GST in Tally.ERP 9 Release 6

that's all the article GST in Tally.ERP 9 Release 6 this time, hopefully can give benefits to all of you. alright, see you in posting other articles.

You now read the article GST in Tally.ERP 9 Release 6 with link address http://accountingmethode.blogspot.com/2017/06/gst-in-tallyerp-9-release-6.html

[ad_2]

Source link : GST in Tally.ERP 9 Release 6